Broadly defined commodities posted the strongest performance last week among the major asset classes, based on a set of exchange-traded products. The gain follows renewed expectations that inflationary momentum may be firming up in the US and around the world.

Continue reading

Macro Briefing: 26 February 2018

China lays groundwork for Xi Jinping to hold presidency indefinitely: WaPo

Mexico’s president cancels White House visit after call with Trump: LA Times

Treasury yields dip ahead of new Fed chief’s first congressional testimony: MW

Peter Navarro, a trade skeptic in the White House, is promoted: NY Times

Buffett: patience is required in a world of high-priced equities: Bloomberg

Firmer pricing for transport costs point to another inflation factor: Reuters

Data breaches reach an all-time high in 2017: Thales

US flu season is the worst since 2009-2010: FiveThirtyEight

Is factor allocation superior to conventional asset allocation? Alpha Architect

Relative strength in junk bonds may be positive sign for stocks: FMD Capital

Bridgewater’s short on European equities goes into overdrive: Barron’s

US financial stress level ticks lower for first time in five weeks: St. Louis Fed

Book Bits | 24 February 2018

● It’s Better Than It Looks: Reasons for Optimism in an Age of Fear

By Gregg Easterbrook

Summary via publisher (Public Affairs)

Is civilization teetering on the edge of a cliff? Or are we just climbing higher than ever? Most people who read the news would tell you that 2017 is one of the worst years in recent memory. We’re facing a series of deeply troubling, even existential problems: fascism, terrorism, environmental collapse, racial and economic inequality, and more. Yet this narrative misses something important: by almost every meaningful measure, the modern world is better than it ever has been. In the United States, disease, crime, discrimination, and most forms of pollution are in long-term decline, while longevity and education keep rising and economic indicators are better than in any past generation. Worldwide, malnutrition and extreme poverty are at historic lows, and the risk of dying by war or violence is the lowest in human history. It’s not a coincidence that we’re confused–our perspectives on the world are blurred by the rise of social media, the machinations of politicians, and our own biases.

Continue reading

Tech Sector Momentum Still Dominates After Market Turbulence

The surge in market volatility earlier this month took a toll far and wide, but tech’s leadership endures, based on a set of sector ETFs. A fund that holds a diversified mix of technology shares is trading below its recent highs, but the sector has largely bounced back from the early February correction and continues to dominate in the year-over-year column vs. the rest of the field.

Continue reading

Macro Briefing: 23 February 2018

US set to impose more sanctions on N. Korea: Reuters

Blackrock says it will talk with gunmakers about Florida shooting: Reuters

FCC officially publishes regs that will repeal net neutrality rules in April: Engadget

US jobless claims last week fell to 2nd lowest level since the recession: MW

Leading Economic Index for US rose in Jan, signaling “robust” growth: Conf. Board

US inflation trend probably ticked up in Feb, according to alt-data estimate: WSJ

Private data suggests China’s economic growth is slowing: Asia Times

Avg college endowment fund lagged stock/bond mix over last decade: NY Times

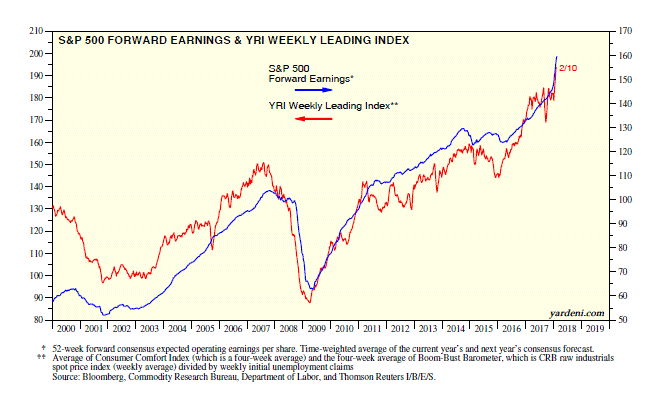

S&P 500 forward earnings estimates surging in 2018: Yardeni Research

Tough Times For Large-Cap Value Stocks

The long-run historical return premium linked to value stocks remains intact if you’re measuring performance across decades, but the strategy of favoring inexpensively priced shares has had a rough run lately.

Continue reading

Macro Briefing: 22 February 2018

Trump favors arming teachers to prevent school shootings: Reuters

Air strikes by Syrian regime and Russian allies kill more than 300 since Sun: WaPo

Fed minutes: officials say growth, inflation make case for more rate hikes: The Hill

Fed’s Quarles: US economy in “best shape” since financial crisis: Bloomberg

US existing home sales post biggest year-over-year drop in 3 years in Jan: Reuters

Signs of slower US growth are on the horizon: MainStay Investments

Larry Swedroe: research shows that combining factors can outperform: ETF.com

Small-biz sentiment indicators are no silver bullet for investors: Barry Ritholtz

Southern Poverty Law Center: hate groups in US are proliferating: Reuters

Composite PMI: US output in Jan rises at fastest rate since Nov 2015: IHS Markit

Trend Behavior: Comparing US vs. Emerging Markets Stocks

Standard finance theory tells us to select weights for stocks and other asset classes based on market value. By that standard, emerging markets deserve a relatively light touch in portfolios. But this strikes some investors are misguided. As Frontera, a research shop, noted last year, “Emerging Markets Account for 80% of Global GDP Growth But Only 10% of World Equity Market Cap.”

Continue reading

Macro Briefing: 21 February 2018

Supreme Court rejects challenge to waiting period for gun purchases: Reuters

Shocking new corruption charges leveled at Israel’s Netanyahu: LA Times

Obama’s chief economist: Trump’s economic projections are “absurd”: Vox

Weak sales growth for Wal-Mart rattled investors on Tuesday: USA Today

How will the US safety net for workers fare in the next recession? NY Times

Venezuela launches crypto currency; reports raising $735 million: Reuters

Study projects world’s oceans rising 3 feet by 2300: Nature Communications

Treasury auction sees 3- and 6-mo bills sell at rates unseen since 2008: Bloomberg

2-year Treasury rate continues rising, setting another 10yr high on Tues: 2.25%

There Are (Still) No Shortcuts For Estimating Recession Risk

The St. Louis Fed last week pondered the question: “Is the U.S. Due for a Recession?” In a blog post the bank advised that after a long expansion “there is a concern that, even though the economy looks good right now, the next recession may be lurking just around the corner.” On the short list for possible smoking guns, the post continued, is the low unemployment rate, which is currently at 4.1%, which is near a two-decade low.

Continue reading