● When Things Don’t Fall Apart: Global Financial Governance and Developmental Finance in an Age of Productive Incoherence

By Ilene Grabel

Author quote via Bloomberg

If countries coordinate their economic policies too closely, their business cycles could become overly synchronized, leading to booms—and busts—that are global in scale. And if there’s just one unified world financial architecture, mistakes could propagate through it more quickly and destructively than if there are multiple, competing systems.

The analogy is to a forest that has only one species of tree: A single insect or fungus could spread rapidly and wipe out the whole thing. Diversity in governance can make the financial system safer, argues Ilene Grabel, a professor at the University of Denver’s Josef Korbel School of International Studies and author of a new book, When Things Don’t Fall Apart: Global Financial Governance and Developmental Finance in an Age of Productive Incoherence.

Continue reading

US GDP Growth Trails Estimates In Q4 But 1-Year Trend Picks Up

Economists were looking for a 2.9% rise for GDP in today’s fourth-quarter report, according to Econoday.com’s consensus forecast. The actual number, the Bureau of Economic Analysis advised, was softer than expected, decelerating to 2.6% — the slowest since the weak 1.2% gain in 2017’s Q1. The latest rise is still a decent number, although no one’s popping champagne corks over the results. On the other hand, looking through the quarterly figures suggests that the recent improvement in economic output still has upside momentum.

Continue reading

Technology Continues To Lead US Sectors As Healthcare Heats Up

Shares of technology stocks remain the trend leader but healthcare’s recent strength suggests a changing of the guard may be near, based on a set of sector ETFs ranked by one-year return. Meanwhile, telecom is the only US sector nursing a loss for the year-over-year change, although real estate stocks are close to dipping into negative terrain.

Continue reading

Macro Briefing: 26 January 2018

Trump denies that he tried to fire special counsel for Russia probe: LA Times

Demand surge for risk assets triggers “tactical pullback” warning: Bloomberg

US economy expected to post brisk growth in today’s Q4 GDP report: Reuters

US Leading Index up in Dec, predicting “strong economic growth” for 1H 2018: CB

US jobless claims rose last week to 233,000, but remain low: WSJ

New home sales in US fell more than forecast in Dec: Bloomberg

Manufacturing growth picked up in Kansas City Fed region: Bond Buyer

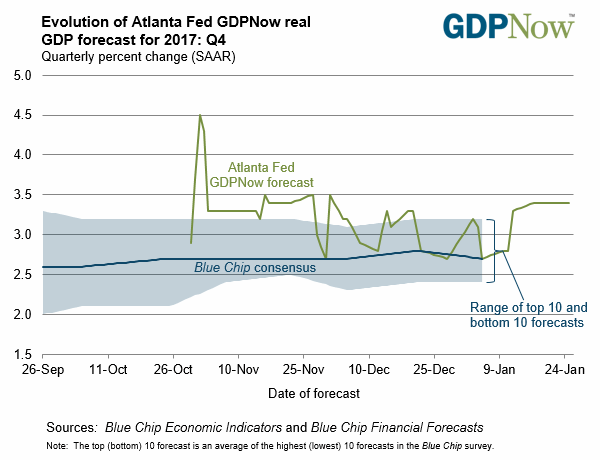

Atlanta Fed’s revised Q4 GDP nowcast holds steady at 3.4%: Atlanta Fed

US Q4 GDP Growth Expected To Hold Steady Near 3%

Tomorrow’s preliminary GDP report for the fourth quarter is on track to post a growth rate at or near the roughly 3% pace that’s prevailed in the previous two quarters, according to several estimates. If the projection is accurate, the US economy will log another healthy gain in quarterly output, reaffirming recent evidence that the macro trend picked up speed in 2017.

Continue reading

Macro Briefing: 25 January 2018

Trump says he’s willing to testify under oath in Russia probe: Reuters

Trump urges Turkey to scale back Kurdish offensive in Syria: The Hill

Will a strong euro delay a rate hike at the European Central Bank? Reuters

Oil jumps to three-year high: MarketWatch

US PMI: strong mfg start for 2018 as services sector growth eases: IHS Markit

Eurozone PMI: survey data for Jan reflects strongest growth in 12 years: IHS Markit

Japan Mfg PMI rises to three-year high in December: IHS Markit

US dollar falls to 3-year low against foreign currencies: CNBC

FHFA Home Price Index rose 0.4% (s.a.) in Nov, up 6.5% y-o-y: MND

Is A Weaker Dollar A Plus For US Economic Growth?

Treasury Secretary Steven Mnuchin says that a softer dollar will juice US economic growth. Speaking at the World Economic Forum in Davos, Switzerland, he advises that “obviously a weaker dollar is good for us as it relates to trade and opportunities.” Does that mean that tracking the dollar’s value in foreign exchange markets offers insight into projecting US GDP in the near term? Alas, no. A preliminary look at the numbers suggests the relationship between a broad measure of the US dollar and GDP growth is mostly noise.

Continue reading

Macro Briefing: 24 January 2018

Senate approves Powell as Fed chairman: Bloomberg

CIA Director says N. Korea may use nukes for “coercive” purposes: CNN

Montana implements net neutrality rules following FCC repeal: The Hill

Economists expect global growth to reach 8-year high in 2018: Reuters

US Treasury Secretary says a weaker dollar benefits US economy: Bloomberg

Is positive sentiment at Davos meeting a contrarian indicator? Guggenheim

One-sixth of millennials have saved $100,000 or more: USA Today

Richmond Fed Mfg Index: growth slows to 3-mo low in Jan: Richmond Fed

Employment up in half of US states in 2017; no change in other half: Labor Dept

US Business Cycle Risk Report | 23 January 2018

US economic output remained strong in December, according to a review of key indicators. Echoing the profile in recent history, the numbers continue to reflect a virtually nil probability that a recession has started.

Continue reading

Macro Briefing: 23 January 2018

Government shutdown ends as Trump signs funding bill into law: USA Today

Chasm between Dems and GOP widens after shutdown drama: Bloomberg

Trump announces 30% tariff on imported solar technology: The Hill

China has options for responding to Trump’s import tariffs: Bloomberg

IMF report advises that “global economic activity continues to firm up”: IMF

PA court decision on state’s congressional map gives Dems an edge: Politco

VP Pence announces accelerated US embassy move to Jersusalem: LA Times

Chicago Fed Nat’t Activity Index reflects faster US growth in Dec: Chicago Fed

10-year Treasury yield ticks up to 2.66%, highest since 2014: CNBC