The exuberance in the US stock market of late may or may not be irrational, but the party atmosphere in the value corner of equities (companies that are inexpensively priced) is subdued vs. the celebratory surge for growth shares (firms expected to grow at above market rates). Although both measures of US companies in the large-cap space are posting solid gains, the gap in favor of growth has become conspicuously wide lately.

Continue reading

Macro Briefing: 16 January 2018

Risk of US government shutdown looms as Jan. 19 deadline approaches: CNN

Turkey’s president warns of attack against US-backed rebels in Syria: Reuters

Oil rises three-year high, supported by global growth and production cuts: Reuters

Wall Street eyes higher inflation in 2018: Bloomberg

Research claims “single actor” lifted Bitcoin to $1000 from $150: TechCrunch

China’s crackdown on Bitcoin accelerates: CNBC

Boeing unveils supersonic plane design for speeds up to Mach 5: Fox

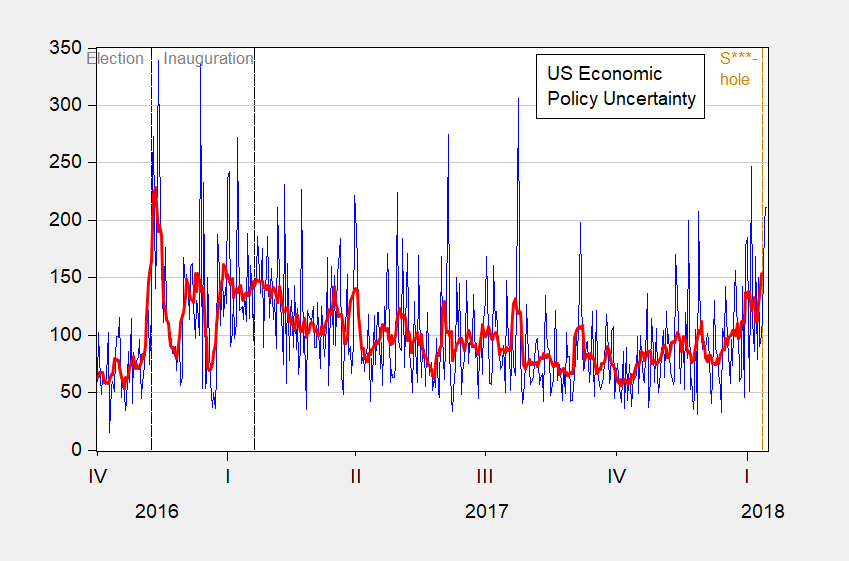

US policy uncertainty is rising: Econobrowser

US Stocks Top Weekly Performance List As REITs Sink

US equities led most markets higher last week, posting the strongest gain among the major asset classes, based on a set of exchange-traded products. Meanwhile, real estate investment trusts (REITs) in the US suffered the biggest weekly loss, extending a slide for this yield-sensitive sector in the wake of rising Treasury yields.

Continue reading

Macro Briefing: 15 January 2018

US immigration deal’s prospects fade in wake of Trump comments: Fox

Thousands flee in Philippines on warnings of imminent volcano eruption: CNN

Hawaii issues false alert about missile attack: New York

Euro reaches three-year high against US dollar: Reuters

US retail spending rises 0.4% in Dec, matching expectations: RTT

US core consumer inflation in Dec rises the most in 11 months: Reuters

Nov business inventories in US post biggest rise since Aug: Dow Jones

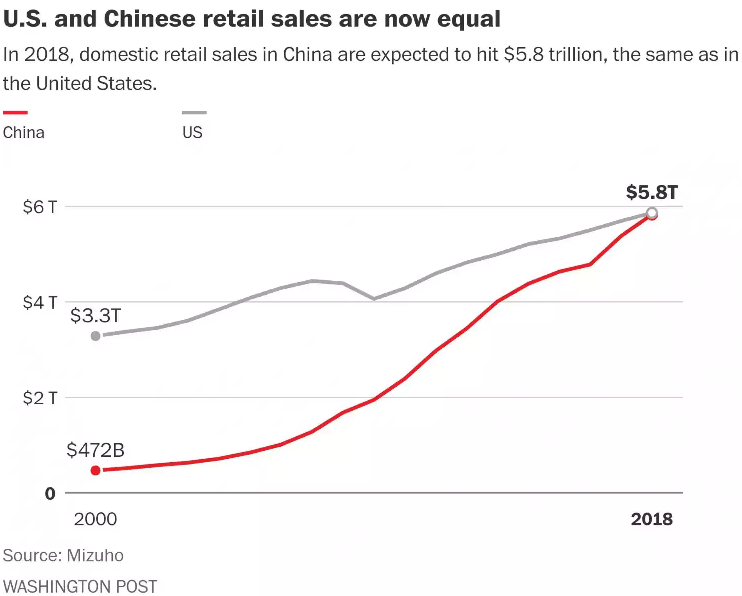

China’s retail sales expected to match US spending in 2018: WaPo

Book Bits | 13 January 2018

● When: The Scientific Secrets of Perfect Timing

By Daniel H. Pink

Summary via publisher (Riverhead Books)

Drawing on a rich trove of research from psychology, biology, and economics, Pink reveals how best to live, work, and succeed. How can we use the hidden patterns of the day to build the ideal schedule? Why do certain breaks dramatically improve student test scores? How can we turn a stumbling beginning into a fresh start? Why should we avoid going to the hospital in the afternoon? Why is singing in time with other people as good for you as exercise? And what is the ideal time to quit a job, switch careers, or get married?

Continue reading

Momentum Continues To Dominate Factor ETF Performances

The US stock jumped to another record high yesterday, providing more fuel to keep the momentum factor sizzling. All the major factor strategies are posting solid one-year returns these days, but momentum’s trend remains a bullish outlier, based on a set of proxy ETFs.

Continue reading

Macro Briefing: 12 January 2018

Trump expected to extend sanctions relief to Iran: Reuters

German Chancellor Merkel’s party achieves breakthrough to form gov’t: Reuters

Trump’s crude comments about immigrants trigger int’l reaction: BBC

China-N. Korea trade fell sharply in 2017: CNBC

Citing tax reform, Wal-Mart boosts minimum wage to $11/hr: Bloomberg

Wal-Mart announces it’s closing dozens of its Sam’s Club stores: USA Today

US jobless claims rise to highest level since September: Dow Jones

Producer price inflation in US slips in Dec–first decline since 2016: TheSteet.com

Brent crude briefly tops $70/bbl for first time since 2014: Reuters

President Trump Attacks US Libel Laws

We interrupt our regularly scheduled review of markets and economics to consider President Trump’s latest comments on US libel laws. His remarks on Wednesday suggest that the White House will lead a new effort to revise long-standing legal standards that are directly related to the Constitution’s First Amendment rights and freedom of the press – the bedrock of US democracy. The administration doesn’t have the power to rewrite libel laws and it’s doubtful that the Supreme Court will be swayed to revisit the subject. That leaves the possibility of a constitutional amendment to effect any revision, but that’s even more unlikely, if only because introducing legislation through this channel is a long and winding road.

Continue reading

Macro Briefing: 11 January 2018

Trump may be preparing to withdraw from Nafta trade pact: Bloomberg

New York City sues big oil over climate change: AP

IRS under pressure to reduce withholding taxes ahead of election: Politico

Trump says US libel laws are a “sham” and vows to “take a strong look”: CNBC

US import prices barely budged in Dec: Dow Jones

Businesses trim year-ahead inflation expectations to 2.0%: Atlanta Fed

Policy change for bond buying by central banks worries investors: NY Times

South Korea plans to ban cryptocurrency trading: Reuters

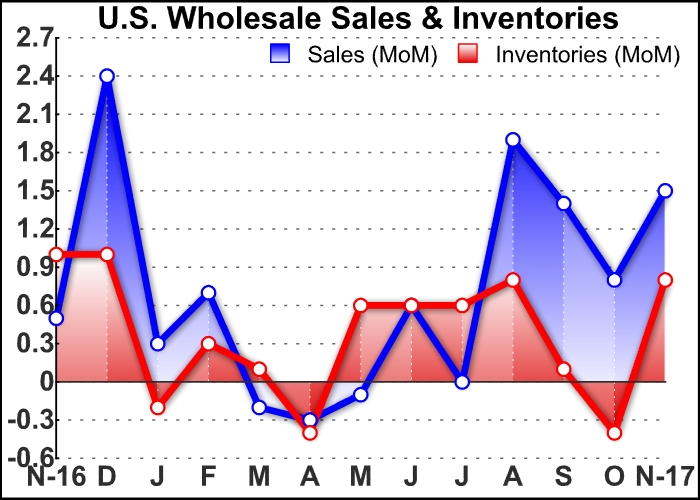

US wholesale inventories rebounded sharply in December: RTT

5 Questions For Professor Steve Keen On Debt And Financial Crises

What might trigger the next financial crisis and recession? Private debt tops the list, explains Steve Keen, an economics professor who heads the School of Economics, Politics and History at Kingston University. It’s a potent threat, in part because debt has increased since the 2008 financial crisis and interest rates appear poised to trend higher in the years ahead. Yet the risk bound up with private debt is widely underappreciated in the economics profession, Keen explains in his recent book: Can We Avoid Another Financial Crisis? “Even after the [last] crisis, mainstream economists still reject out of hand arguments that the aggregate level and rate of change of debt matters,” he writes. History suggests otherwise, Keen insists, citing the empirical record as proof. The Capital Spectator recently asked Keen for a summary of why debt matters for the business cycle and how the US and other economies currently rank on this critical risk factor.

Continue reading