Implementing Momentum: What Have We Learned?

Adrienne Ross (AQR Capital Management), et al.

December 2017

An abundance of academic evidence and theory exists on the efficacy and intuition behind momentum investing, yet a limited number of studies discuss the feasibility of running momentum portfolios in practice. And no study to date has directly analyzed implementation costs for a live momentum portfolio. As a result, many are still quick to dismiss momentum as difficult or costly to implement because of its high turnover. In this paper, we use seven years of live data to evaluate the implementability of momentum investing. We show that live momentum portfolios are capable of capturing the momentum premium, even after accounting for expenses, estimated trading costs, taxes, and other frictions associated with real-life portfolios.

Continue reading

Macro Briefing: 8 December 2017

UK and EU announce breakthrough in Brexit negotiations: Reuters

Congress sends bill to Trump to avert gov’t shutdown: Bloomberg

China’s export growth beats expectations in November: RTT

IMF: rising bank debt poses “large risks” to China’s economy: BBC

Jobless claims in US fall for third week: Reuters

US job cuts jump 30% in Nov vs. year-earlier level: CG&C

Consumer credit for US rises in Oct by most in 11 months: MarketWatch

Wildfires rage across Southern California: Bloomberg

Momentum Leaves Other Factor Strategies In The Dust This Year

No one will confuse it with Bitcoin, but momentum is certainly red hot among US equity factor strategies, based on a set of ETFs. Stocks exhibiting relatively strong and persistent performance have outperformed for much of the year so far and the gap has widened in recent weeks.

Continue reading

Macro Briefing: 7 December 2017

Widespread condemnation follows US decision on Jersusalem: BBC

Palestinian militant group calls for new uprising against Israel: Bloomberg

US increases troops in Syria to 2000: NY Times

US government shutdown risk is still rising: Reuters

ADP: Private US employment rose a healthy 190k in Nov: CNBC

Revised Q3 data still reflect strong productivity gain for US economy: RTT

Bitcoin blows past $14k; market cap exceeds most S&P stocks: MarketWatch

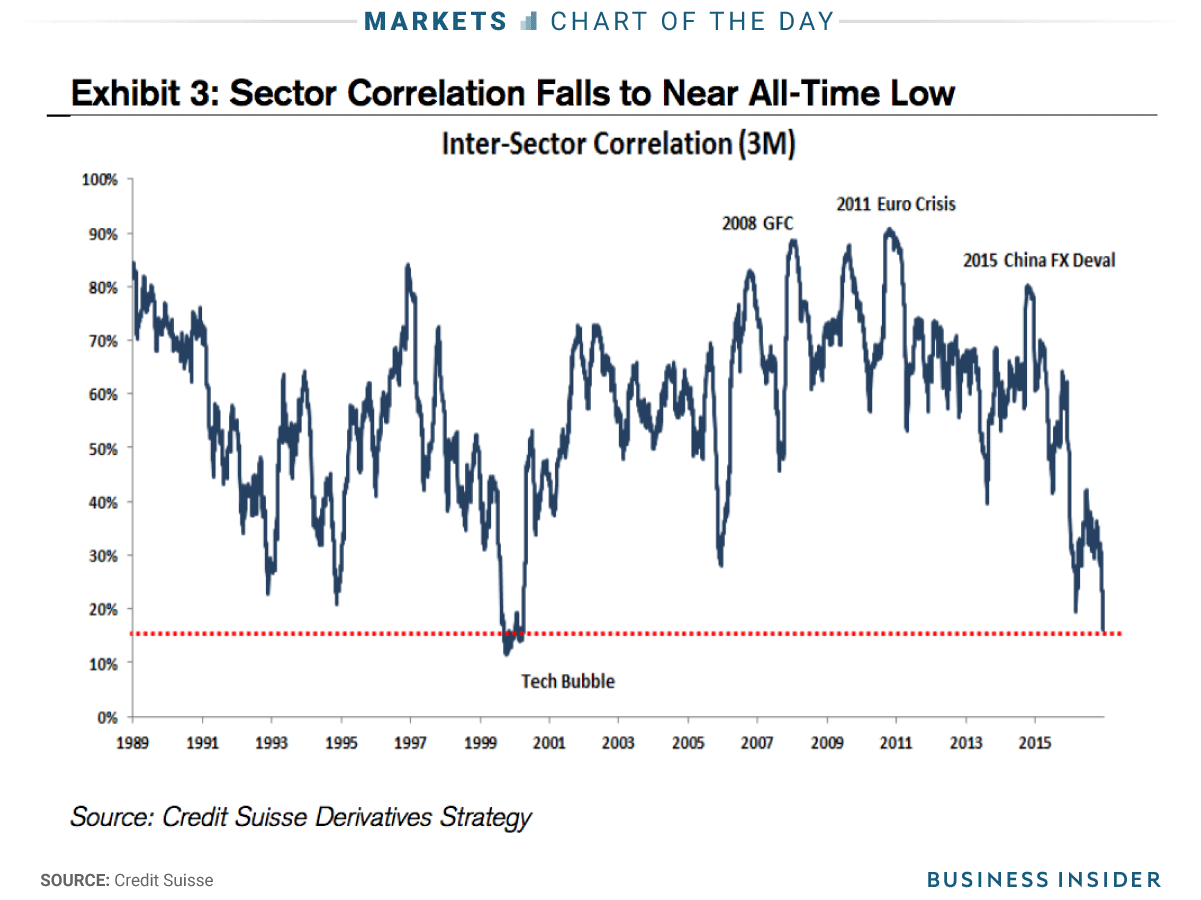

US sector correlation close to record low: Business Insider

5 Questions For Wesley Gray, AlphaArchitect.com

Momentum investing – betting on the persistence of price trends in the short to medium term — has captured the crowd’s attention in recent years. Consider, for instance, the strong growth in ETF assets in the niche. The first fund launched a bit more than five years ago; today, there are dozens of momentum ETFs, collectively holding nearly $15 billion in assets, according to etfdb.com. That’s still a small piece of the total ETF pie, but the strategy’s allure could keep growth bubbling for years to come. What should investors expect? Does the rising interest in momentum raise concerns about the strategy’s expected return? For some insight, The Capital Spectator asked Wesley Gray at Alpha Architect, a wealth manager near Philadelphia. Gray, who previously worked as a finance professor, is an obvious source for discussing momentum. In addition to managing variations of momentum-based portfolios for clients, he and his team have written extensively about the strategy at AlphaArchitect.com, a popular investing blog. Gray is also the co-author of Quantitative Momentum: A Practitioner’s Guide to Building a Momentum-Based Stock Selection System

Continue reading

Macro Briefing: 6 December 2017

Trump expected to recognize Jerusalem as Israel’s capital: Politico

Israel prepares for violence ahead of Trump’s Jerusalem decision: Haaretz

Palestinian envoy: US recognition of Jerusalem is ‘declaring war’: Jerusalem Post

US trade deficit widens in Oct, highest since Jan: USA Today

Survey data shows global growth steady at 2-1/2 year high in Nov: IHS Markit

Modest setback for US ISM Non-Mfg Index Nov after strong Oct report: CNBC

US Services PMI: Softer growth for sector in Nov: IHS Markit

Commercial real estate is the big winner with GOP’s tax cut: NY Times

10-yr/2-yr Treasury spread fell again on Tues, dipping to new decade low of 53bp:

Treasury 10yr-2yr Yield Spread Continues To Slide

The gap between the 10-year and 2-year Treasury yields fell to 57 basis points on Monday (Dec. 4), according to Treasury.gov’s daily data. The dip marks yet another post-recession low for this widely monitored spread. The flattening of the yield curve implies that the economy is facing stronger headwinds, based on the spread’s history vis-à-vis the US business cycle. But the macro trend remains solid at the moment, suggesting that the 10-year/2-year yield gap has shed its value, at least temporarily, as an early warning of US recession risk.

Continue reading

Macro Briefing: 5 December 2017

Supreme Court OKs Trump travel ban: NY Times

Killing of Yemen’s ex-president will impact Yemen’s civil war: Guardian

Brexit talks grind to a halt over Irish border standoff: Reuters

SEC’s new cyber unit halts initial coin offering scam: RTT

Factory orders dip 0.1% in Oct; business spending solid: Reuters

Eurozone economic growth strengthens in Nov, according to PMI data: IHS Markit

Average retirement account at Fidelity hits record high: Bloomberg

US Stocks Bucked The Trend With Another Solid Gain Last Week

Selling dominated trading last week for the major asset classes, based on a set of exchange-traded products. The main exception: US equities, which posted a solid advance.

Continue reading

Macro Briefing: 4 December 2017

More N. Korea saber rattling as US-S.Korea war games begin: CNN

Treacherous path for Congress for avoiding gov’t shutdown: NY Times

CVS buying Aetna, a deal that could rehsape healthcare industry: USA Today

BIS: “Frothy” markets should be addressed via monetary policy: CNBC

ISM Mfg Index for US dips in Nov but still reflects strong growth: USA Today

US construction spending up sharply in Oct, driven by gov’t spending: Reuters

PMI survey data points to slower but “robust” US mfg growth in Nov: IHS Markit

Global survey PMI data for mfg rises to 80-month high in Nov: IHS Markit