Equities in emerging markets bounced back in October after a mild setback at the end of the third quarter. This slice of the global stock market gained 3.5%, posting last month’s strongest performance for the major asset classes. The rest of the field was mostly higher, with losses generally contained to foreign bonds and US real estate investment trusts.

Continue reading

Macro Briefing: 1 November 2017

Terror attack with truck in New York kills eight: NY Times

Japan’s Abe re-elected as prime minister: Nikkei

Federal Reserve expected to keep rates steady today: Reuters

House Republicans delay release of tax reform legislation: Politico

US Consumer Confidence Index in Oct rises to 17-year high: Bloomberg

US employment costs rise at faster rate in Q3: US Labor Dept

House prices in US up sharply in Aug despite slower sales: USA Today

Chicago PMI rises to six-year high in Oct: ISM Chicago

Eurozone GDP growth beats expectations in Q3: RTT

Financials Still Lead But Tech Is Heating Up

Financial stocks remain the top-performing US sector for the one-year trend, based on a set of ETFs, but tech’s recent surge suggests that a leadership change may be near.

Continue reading

Macro Briefing: 31 October 2017

Former Trump campaign aides indicted in Mueller’s Russia probe: The Hill

Trump says indictments don’t prove he colluded with Russia: NY Times

House considering corporate tax cuts that phase in slowly: Bloomberg

Car sales fuel biggest rise in US consumer spending since 2009: Bloomberg

Is White House ready for Nov.’s commercial talks with China? Reuters

GDPNow’s first Q4 estimate for US growth is 2.9% vs. 3.0% in Q3: Atlanta Fed

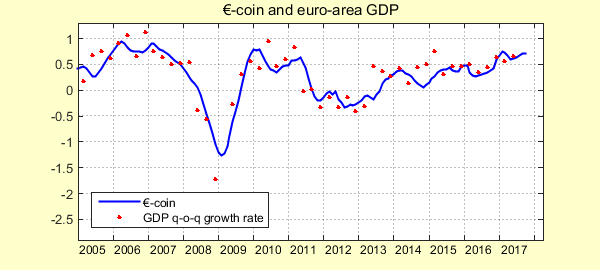

Eurozone’s Oct. 3-mo. GDP growth estimate ticks up to 0.72%: €-Coin Indicator

Commodities Popped Last Week Amid Weakness Elsewhere

Broadly defined commodities rose last week, posting the strongest advance for the major asset classes, based on a set of exchange-traded products. The increase is an outlier during a week when most markets fell.

Continue reading

Macro Briefing: 30 October 2017

Today’s expected indictments raise political risk for White House: Politico

Fed Governor Powell is the front runner for new Fed chairman: The Hill

Trump’s tax plan under scrutiny as House vote nears: Reuters

US economic growth at solid 3.0% in Q3 despite hurricanes: LA Times

Consumer Sentiment Index for US rises to 13-year high in Oct.: Bloomberg

Roughly 1/4 of Q3 GDP rise due to inventory accumulation: Econobrowser

Plans to manage China’s debt have global economic implications: Bloomberg

The US Business Cycle Risk Report: Update For Oct. 29, 2017

The Oct. 29 edition of The US Business Cycle Risk Report has been published and emailed to subscribers.

For subscription information and a sample issue, click here.

Book Bits | 28 October 2017

● Unfinished Business: The Unexplored Causes of the Financial Crisis and the Lessons Yet to be Learned

By Tamim Bayoumi

Summary via publisher (Yale University Press)

There have been numerous books examining the 2008 financial crisis from either a U.S. or European perspective. Tamim Bayoumi, deputy director in the strategy, policy, and review department at the IMF, is the first to explain how the Euro crisis and U.S. housing crash were, in fact, parasitically intertwined. Starting in the 1980s, Bayoumi outlines the cumulative policy errors that undermined the stability of both the European and U.S. financial sectors, highlighting the catalytic role played by European mega banks that exploited lax regulation to expand into the U.S. market and financed unsustainable bubbles on both continents.

Continue reading

US Q3 GDP Rises Faster Than Expected

US economic growth was surprisingly resilient in the third quarter, according to this morning’s preliminary estimate from the Bureau of Economic Analysis. Output increased 3.0%, well above the 2.5% consensus forecast via Econoday.com and only slightly below Q2’s solid 3.1% advance.

Continue reading

Replicating Indexes In R With Style Analysis (Part II): Global Macro

Imitation, Oscar Wilde famously observed, “is the sincerest form of flattery that mediocrity can pay to greatness.” The observation echoes the objective for using Professor Bill Sharpe’s style analysis to replicate investment indexes that, for one reason or another, can’t be purchased directly. If we can obtain an index’s returns, there’s a pretty good chance that we can reverse engineer the asset allocation and recreate the portfolio with publicly traded securities.

Continue reading