* US is world’s largest oil producer, again–leading output for sixth straight year

* JPMorgan CEO Jamie Dimon urges Fed to delay rate cuts

* Haiti’s prime minister resigns amid increasing violence

* Will China’s surging exports trigger a backlash in the West?

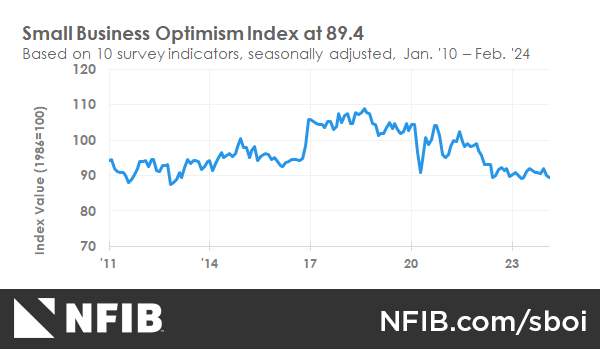

* US Small Business Optimism Index ticks down to 10-month low in February:

Is The US Labor Market As Strong As It Appears?

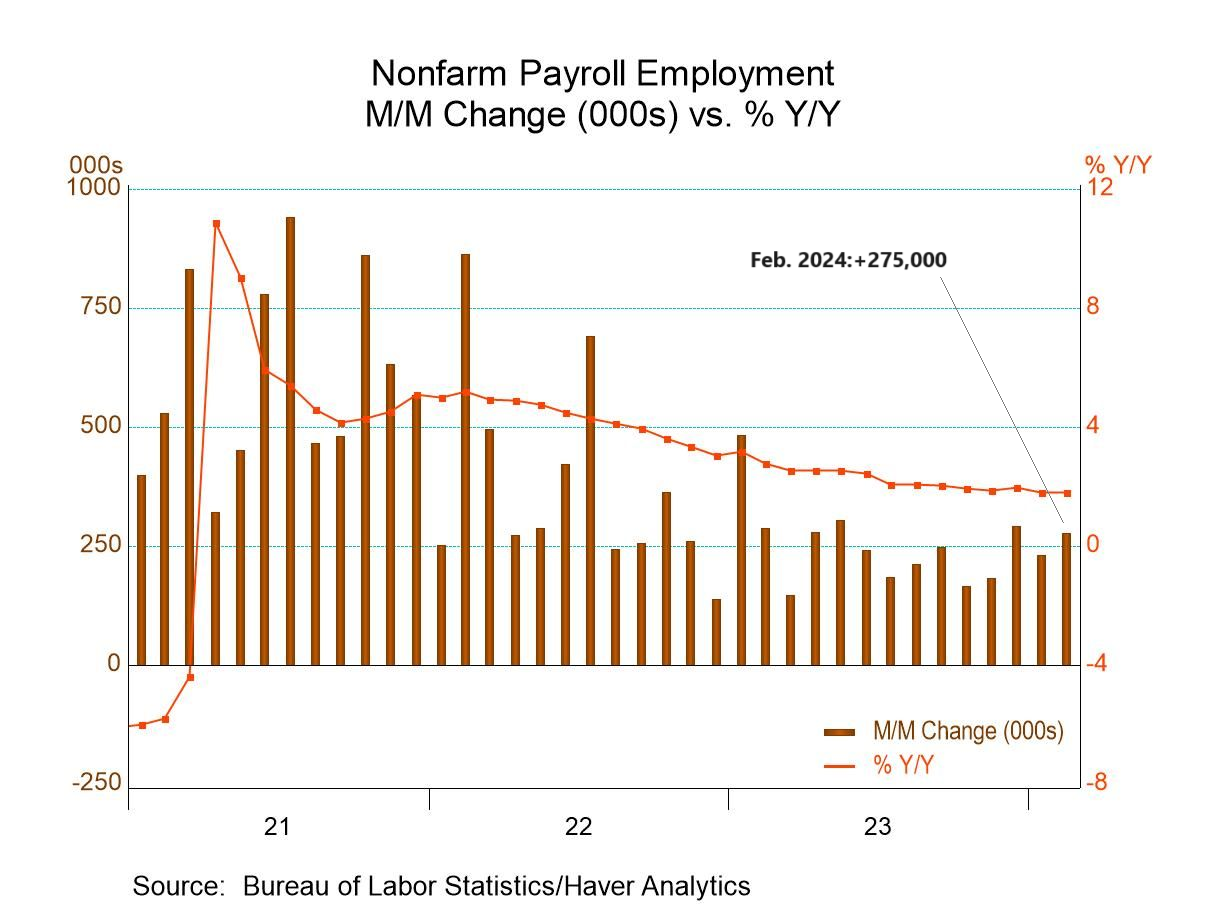

Friday’s payrolls data for February dispatched another upside surprise, reaffirming the now-consensus view that recession risk is low for the US economy. Hiring rose 275,000 last month, beating expectations — well above the consensus forecast for around 200,000.

Macro Briefing: 11 March 2024

* Strong US growth prompts investors to buy a broader set of stocks

* China’s housing minister: troubled real-estate developers should go bankrupt

* China consumer inflation rises for first time in six months

* Japan avoids technical recession after Q4 economic data revised up

* Bank of Japan expected to scrap world’s last negative interest rate experiment

* Gold prices steady on Monday after hitting record highs last week

* US nonfarm payrolls increase 275,000 in February, beating expectations:

Book Bits: 9 March 2024

● Work, Retire, Repeat: The Uncertainty of Retirement in the New Economy

● Work, Retire, Repeat: The Uncertainty of Retirement in the New Economy

Teresa Ghilarducci

Summary via publisher (U. of Chicago Press)

Many argue that the solution to the financial straits of American retirement is simple: people need to just work longer. Yet this call to work longer is misleading in a multitude of ways, including its endangering of the health of workers and its discrimination against people who work in lower-wage occupations. In Work, Retire, Repeat, Teresa Ghilarducci tells the stories of elders locked into jobs—not because they love to work but because they must. But this doesn’t need to be the reality. Work, Retire, Repeat shows how relatively low-cost changes to how we finance and manage retirement will allow people to truly choose how they spend their golden years.

Research Review | 8 March 2024 | Combination Model Forecasting

Market Risk Premium Expectation: Combining Option Theory with Traditional Predictors

Hong Liu (Washington University in St. Louis), et al.

December 2022

In general, the slackness between the Martin lower bound (solely based on option prices) and the market risk premium depends on economic state variables. Empirically, we find that combining information from option prices and economic state variables yields forecasts of the market risk premium with greater out-of-sample performance compared to forecasts using option prices alone or economic state variables alone. Additionally, these combination-based forecasts can significantly increase investors’ utility by improving their portfolios’ Sharpe ratios. Our findings suggest the importance of combining information from option prices and economic state variables.

Macro Briefing: 8 March 2024

* Fed’s Powell says central bank “not far” from cutting rates, but…

* Powell also says “there will be bank failures” due to commercial property losses

* US consumer borrowing rose more than expected in January

* US trade deficit widens in January to largest gap in nine months

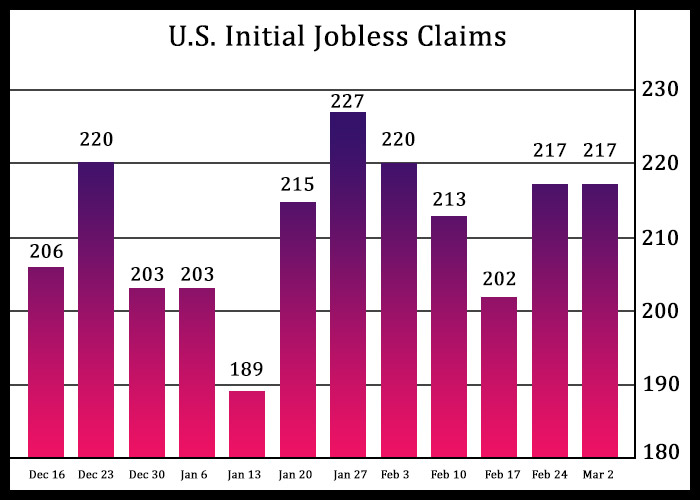

* US jobless claims were unchanged last week, holding at a low level:

US Growth Expected To Slow In Next Month’s Q1 GDP Report

Economic activity remains on a path to slow in the next month’s release of first-quarter GDP data, according to the median nowcast via a set of estimates compiled by CapitalSpectator.com.

Macro Briefing: 7 March 2024

* House approves first step to avert partial government shutdown

* Fed’s Powell says he expects rate cuts this year in House testimony, but…

* Powell also says he needs “see a little bit more data” before moving on rates

* China’s exports and imports beat estimates, suggest improving demand

* China could flood US electric-vehicle market with its cars, says Energy Secretary

* US companies hired more workers in February vs. January, ADP estimates

* US economy accelerated slightly in early 2024: Fed Beige Book

* US job openings are steady at elevated level in January:

Will Powell’s House Testimony Today Shift Rate-Cut Expectations?

Fed Chair Jerome Powell is scheduled to testify in the House today (Wed., Mar. 6) and markets will be all ears on topics that offer guidance on the outlook for interest-rate cuts.

Macro Briefing: 6 March 2024

* Red Sea cables cut, affecting data traffic flow between Asia and Europe

* Biden and Trump secure respective parties’ nominations after Tue’s vote

* Global economic growth picks up to eight-month high in February: PMI survey

* Strong US economy fuels bets that Fed will delay interest rate cuts

* US factory orders decline more than expected in January

* US ISM Services Index dips in February but still signals modest growth: