The third-quarter GDP report surprised most economists with a blow-out 4.9% gain. Is a downside reversal brewing for Q4?

Macro Briefing: 7 November 2023

* Israel to maintain security control in Gaza ‘indefinitely’: Netanyahu

* “Stock market’s correction is over,” advises Ed Yardeni at Yardeni Research

* Fed has more work to do to control inflation: Fed’s Kashkari

* China reports its first-ever foreign investment deficit in Q3

* South Korea bans short selling until June 2024

* US natural gas prices drops sharply on surging supply, mild weather

* Global economic activity stalls in October via global GDP proxy:

Will Revival Of The Peak-Rates Outlook Support Risk Assets?

Last week’s news that the Federal Reserve left interest rates steady, followed by a slower-than-expected rise in payrolls in October, revived animal spirits. Now comes the hard part: Was it noise, or does Friday’s broad-based rally signal a turning point in favor of the bulls?

Macro Briefing: 6 November 2023

* The price of money (natural rate of interest) is rising, and only due to Fed

* Qatar and China sign 27-year deal for liquefied natural gas

* Big Tech’s outlook for Q4 dims after strong Q3 results

* Eurozone economy contracts in October at fastest pace in almost 3 years

* Are cheap valuations for small caps signaling a buying opportunity?

* Berkshire Hathaway reports 40% rise in operating earnings

* US private payrolls decelerating faster than total payrolls (including govt):

Book Bits: 4 November 2023

● The Rise of the Global Middle Class: How the Search for the Good Life Can Change the World

Homi Kharas

Interview with author via McKinsey Global Institute podcast

Q: In your new book, you highlight the fact that we’ve now reached the point at which half the world’s population is middle class or richer. Four billion people, and by 2030, that could be five billion. So what’s driven that enormous growth, and what could continue to drive it?

A: I think the simplest answer I can give is technology. It was technology that started the emergence of the middle class in the 19th century when it became clear that literate clerks were needed to write contracts between banks and factory owners so the latter could expand. The technology of the Industrial Revolution drove the need for a healthy, educated population. And that drove a demand for teachers, doctors, nurses. Productivity started to rise, and that brought about a rise in wages.

Markets Reconsider The Peak Rates Outlook

We’ve been here before, but after Wednesday’s decision by the Federal Reserve to leave interest rates unchanged, along with comments from Fed Chairman Jerome Powell, investors are wondering anew if the policy tightening regime has peaked.

Macro Briefing: 3 November 2023

* Oil chokepoint–Strait of Hormuz–in focus as Israel-Hamas conflict persists

* Crypto king Sam Bankman-Fried found guilty of fraud in FTX collapse

* Global manufacturing activity contracts for fifth straight month in October

* Bullish stock market sentiment drops for third week to lowest level since May

* US jobless claims, while still low, rise for sixth week

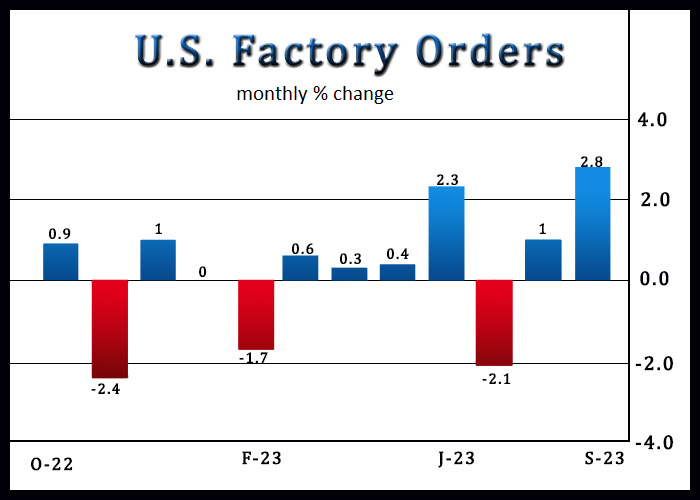

* US factory orders rose sharply in September, well ahead of expectations:

Total Return Forecasts: Major Asset Classes | 2 November 2023

The Global Market Index (GMI) continued ticked up again in October from the previous month, extending the recent upside trend. Today’s revised long-run forecast for the benchmark — a market-value-weighted portfolio that holds all the major asset classes (except cash) via a set of ETF proxies — reached an annualized 6.9% return.

Macro Briefing: 2 November 2023

* Federal Reserve leaves interest rates unchanged for a second time

* Another Fed pause helps support stocks and trim Treasury yields

* Treasury outlines plan to lift bond sales to manage growing debt load

* US private sector payrolls rose less than forecast in October: ADP

* ISM Manufacturing Index indicates 12th straight month of contraction in October

* US construction spending increases for ninth straight month in September

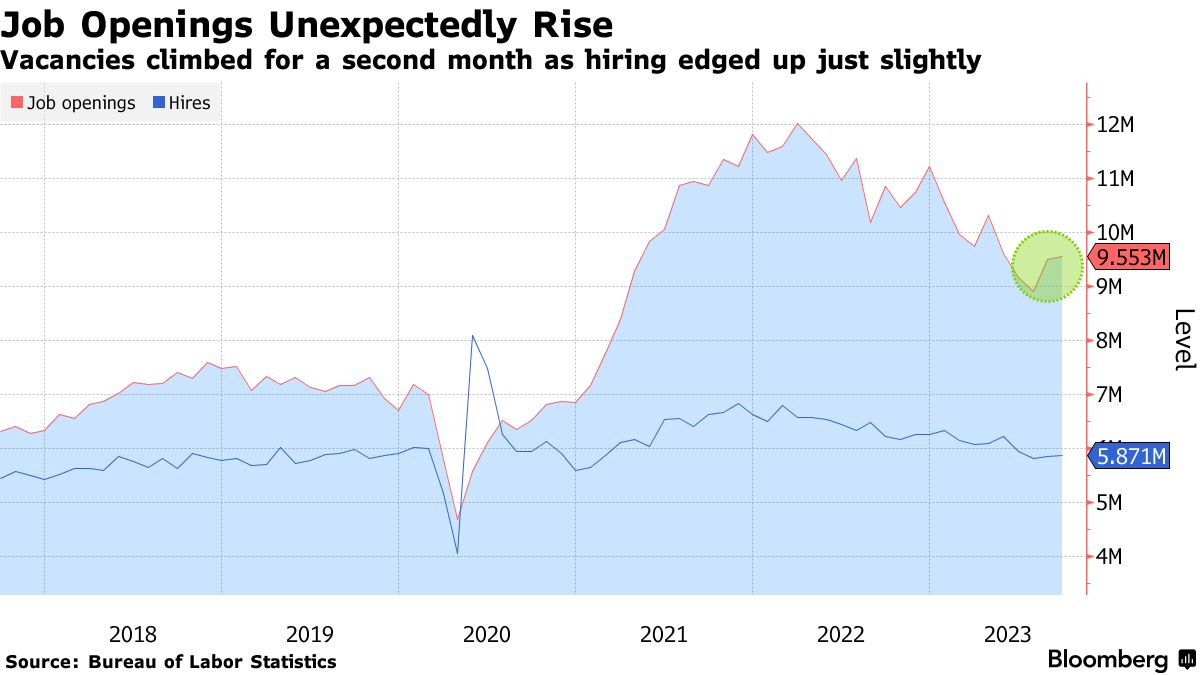

* US job openings rise more than forecast in September:

Major Asset Classes | October 2023 | Performance Review

October was another rough for global markets. With the exception of cash, all the major asset classes fell last month – the third straight month of red ink for all but a handful of markets, based on a set of ETF proxies.