Whether its folly or prescience, markets continue to climb a wall of worry, effectively looking through tariffs and other risk factors that could threaten the bullish trend. But based on several sets of ETFs to measure the risk appetite through Monday’s close (Aug. 18), the broad trend from a global perspective remains positive.

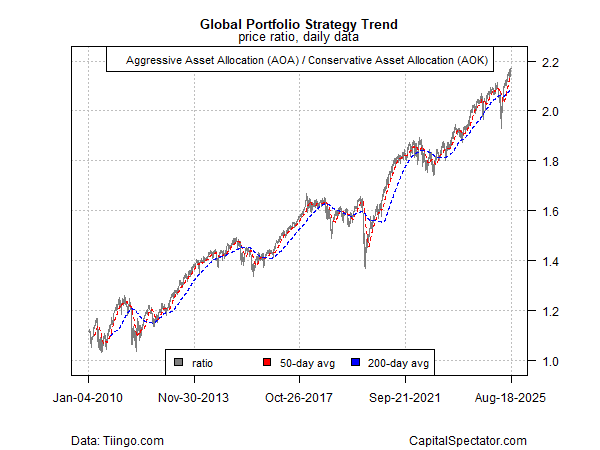

The Wall Street Journal captures the zeitgeist in its headline this week: “Global Economy Took Tariff Hike in Its Stride, But Stronger Headwinds Are Ahead.” Those headwinds have been worrying investors all year, but at the moment you would be hard pressed to find evidence of trouble in an ETF-based proxy for global asset allocation, based on the ratio for an aggressive (AOA) strategy vs. its conservative counterpart (AOK). This big-picture measure of the risk appetite continues to skew positive as it trades just below a record high.

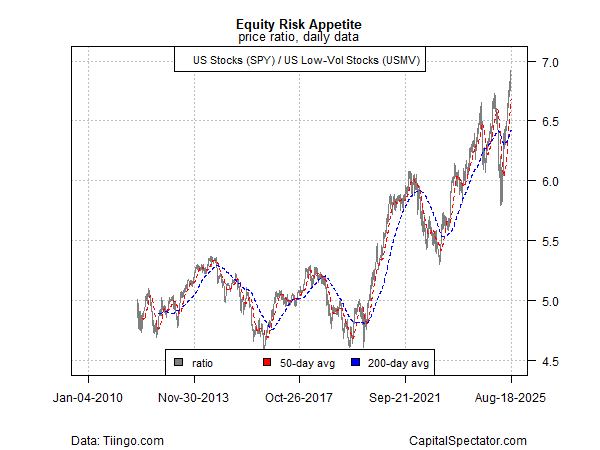

Similarly, US equity market sentiment looks no worse for wear these days, based on the ratio for a conventional measure of the US stock market (SPY) vs. a low-volatility (USMV) counterpart.

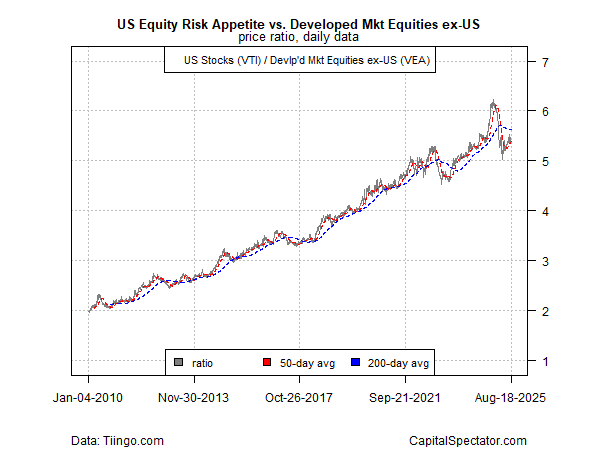

Within the global equities space, however, foreign equities in developed markets (VEA) continue to post relative strength over US stocks (VTI) this year. The debate is whether this is a normalization process after an extraordinary run of American dominance, vs. the start of an extended period of outperformance in foreign markets.

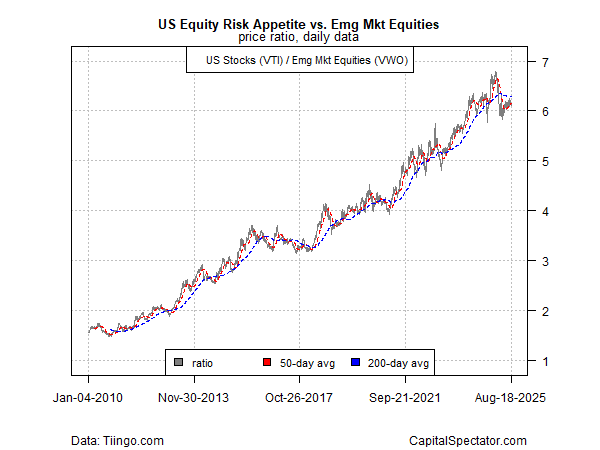

Ditto for comparing US stocks (VTI) with equities in emerging markets (VWO), which are showing renewed strength this year.

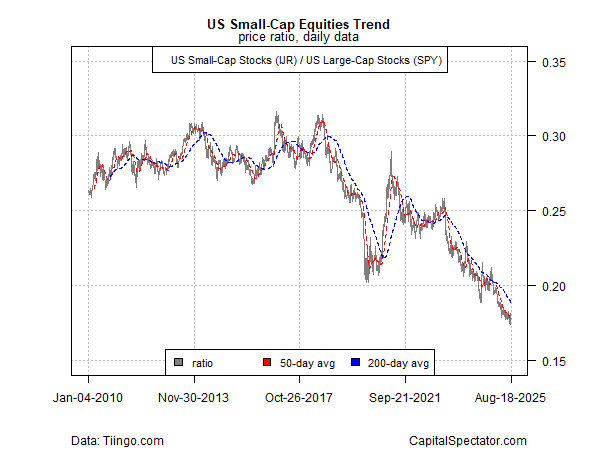

Meanwhile, there’s no debate about the ongoing weakness in US small-cap stocks (IJR) vs. large caps (SPY). Lesser-cap stocks have consistently shown an enduring ability to go from weakness to weakness in recent years, and there’s still no sign that the trend is about to run out of road.

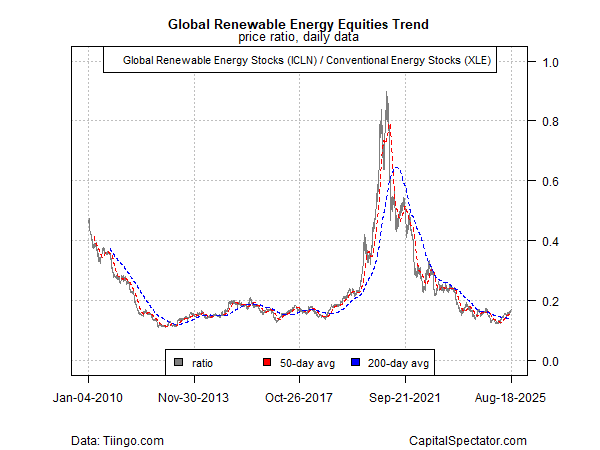

Finally, here’s an intriguing chart that may be signaling a shift back to risk-on for clean-energy stocks after an extended drought for these companies from an investment perspective. Given the current political climate in Washington, this is a bit of a surprise, assuming it endures. Nonetheless, the market seems to be repricing global alternative energy shares (ICLN) for a brighter future vs. conventional big-oil stocks (XLE). It’s too early to know if this is noise or signal, but it’s on our short list of possible trend changes to monitor.