The official government third-quarter GDP report remains a mystery as the Bureau of Economic Analysis (BEA) struggles to recover its data collection and analysis efforts following the government shutdown. The best guess at this point is that output rose at a solid pace in Q3, based on several sources. Q4, by contrast, looks set for a substantially softer increase, according to various private estimates.

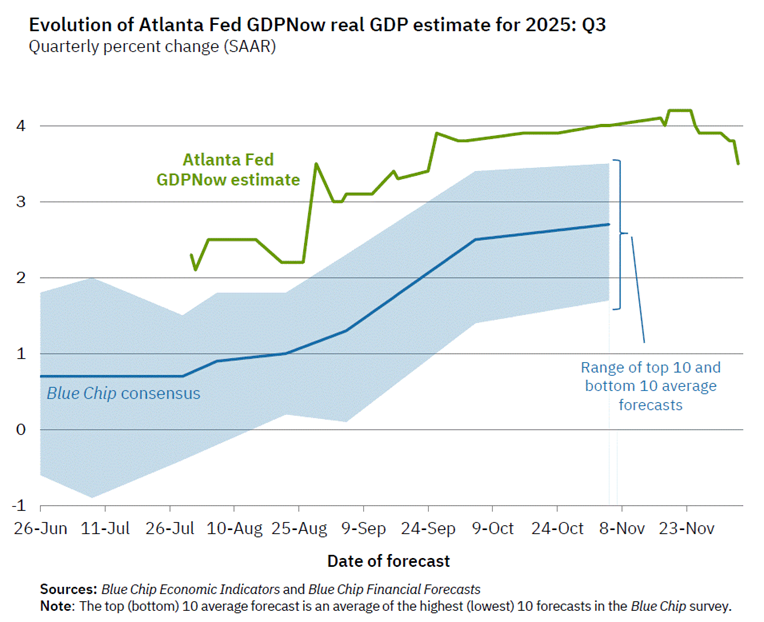

Let’s start with the current read on Q3. When the BEA updates its GDP accounting, the numbers are projected to show that economic activity rose by a strong 3.5%, according to the Atlanta Fed’s GDPNow data (as of Dec. 5). That’s only modestly below Q2’s robust 3.8% advance.

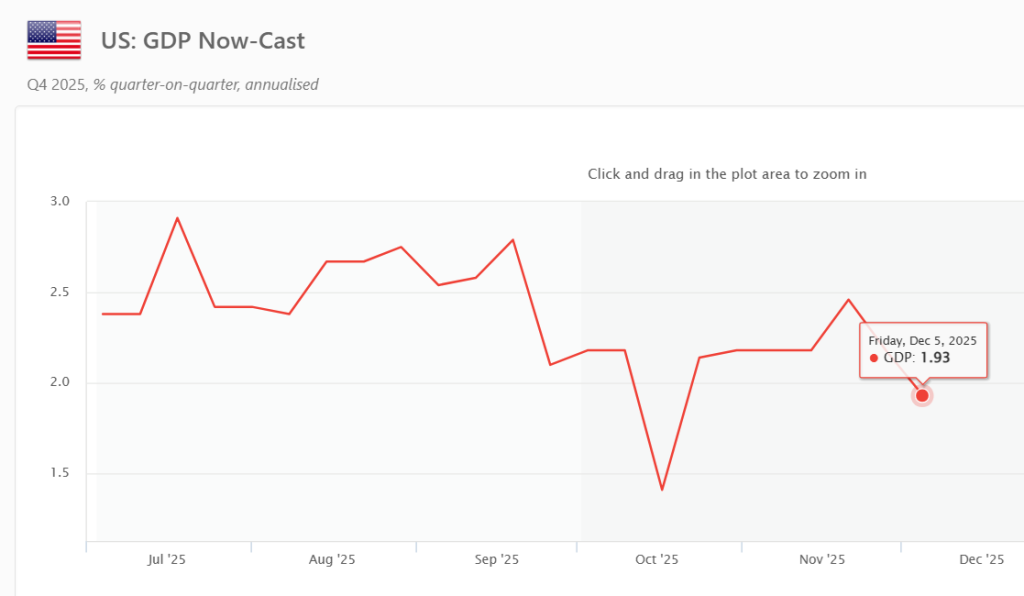

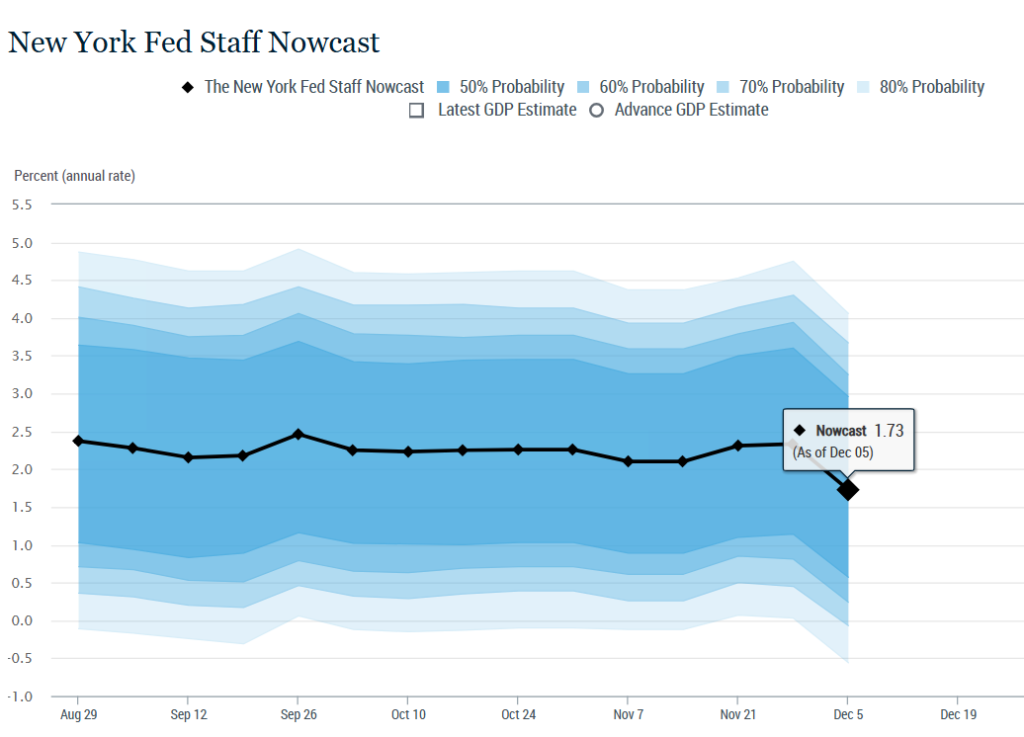

Growth in the final quarter of the year, by contrast, appears to be cooling to a degree that, if correct, will mark a significant break with the Q2-Q3 trend. Although still-missing data due to lingering effects from the government shutdown is complicating the analysis, early estimates for Q4 suggest managing expectations down relative to the previous two quarters.

The macro consultancy Now-casting.com, for example, is currently estimating US growth eased in Q4 to 1.9%.

Several economists at banks are telling a similar story. The downshift is even more severe via BMO Capital Markets’ view, which estimates growth will stumble to a stall-speed 0.4% rise (as of Dec. 5). ING Group is looking for a similarly weak comparison in Q4.

The New York Fed’s Q4 nowcast points to a stronger Q4 performance, but the estimated 1.7% GDP increase for the current quarter still marks a sharp slowdown (as of Dec. 5).

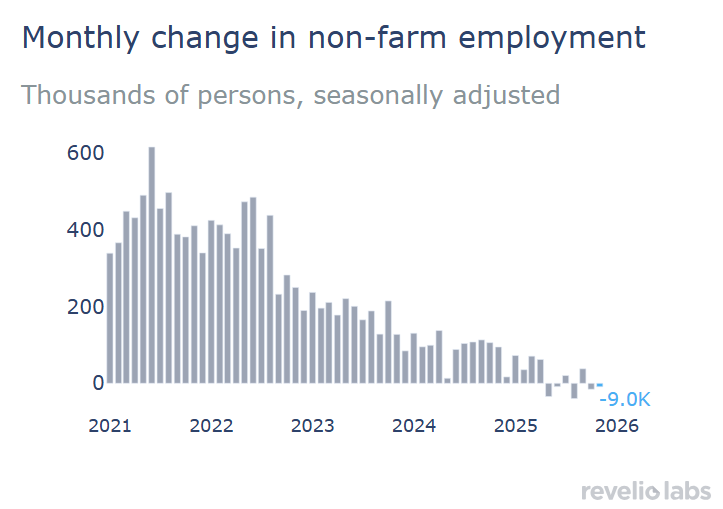

Strengthening the case for downshifting expectations: weak payrolls data for November, according to a pair of private sources. ADP and Revelio Labs calculate that the labor market contracted last month.

Enter the Federal Reserve, which is expected to cut interest rates for a third time this year, according to Fed funds futures. Some analysts predict that it will be a “hawkish cut,” meaning that the reduction is not accompanied by a clear message that another cut is forthcoming.

“The likeliest outcome is a kind of hawkish cut where they cut, but the statement and the press conference suggesting that they may be done cutting for now,” said Bill English, the Fed’s former director of monetary affairs and now a Yale professor.

Will the calculus change after today’s Fed announcement, press conference, and release of new economic projections? Tune in at 2:00pm eastern for the answer.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

The latest Atlanta Fed GDPNow estimate for Q4, of 12/5 is 3.5%.

Forest,

Q4? Atlanta Fed’s site shows Q3 in graph title for 3.5%. https://www.atlantafed.org/cqer/research/gdpnow

–JP