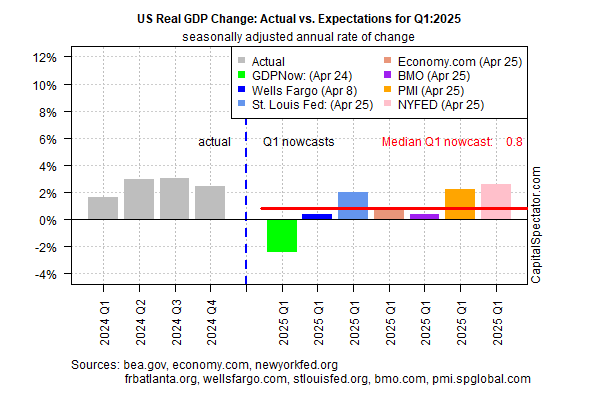

US economic activity looks set to post a sharply softer rate of growth in Wednesday’s initial estimate of first-quarter GDP, based on the median nowcast for several estimates compiled by CapitalSpectator.com.

Output is projected to downshift to an annualized real rate of 0.8% in Q1, according to the median nowcast. That marks a substantially slower rate of growth compared with Q4’s 2.4% increase.

If the median nowcast is correct, the slowdown will be especially worrisome because it doesn’t yet reflect the economic headwinds from the tariffs imposed by President Trump. The Budget Lab at Yale estimated that US real GDP growth will be 0.5 percentage point lower in calendar year 2025, based on tariffs announced as of Apr. 2. Presumably, the estimated loss has eased given some of the delays and backtracking with White House tariff policy, but it’s reasonable to assume that economic activity will still be lower in some degree due to policy changes.

There’s never a good time to start a trade war, but the US economy may be especially vulnerable vs. recent history, given the slowdown that was already in progress at the start of 2025.

The risk of recession is almost certainly higher than it would otherwise be absent the tariffs. How high? The estimates vary, depending on the assumptions and models. Among the most pessimistic forecasts: a 90% probability that a downturn is brewing, cited by Apollo’s Torsten Slok on Apr. 19.

A recent survey of economists by the National Association of Business Economics leaves more room for debate. “Half of the participants place the probability of recession in 2025 between 25% and 49%, while 37% place the odds at 50% or higher,” NABE advised on Monday. “This compares with 8% who placed the odds of recession in 2025 at 50% or higher just prior to the April 2nd tariff announcement.”

Modeling published by The US Business Cycle Risk Report, a sister publication of CapitalSpectator.com, finds that recession risk is still low in real time. But this is based on data published to date and doesn’t yet take into account the potential for stronger tariff-related headwinds in the weeks and months ahead.

“The rearview mirror is of very little help to understand what the rest of the year holds,” said Greg Daco, chief economist at EY. His current estimate of recession risk is roughly 45%, based on the assumption that some tariffs on China are reduced.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

great

Good point about a slowdown already being in progress at the beginning of the year. It’s widely unremarked that one of the longest and deepest yield curve inversions in decades ended not long before.