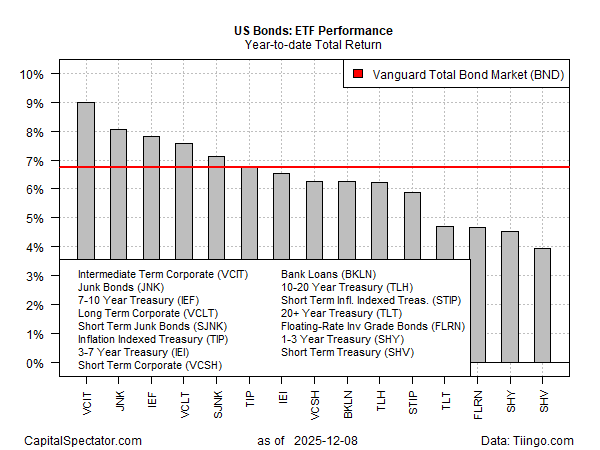

The rear-view mirror paints a rosy picture. All the primary sectors of the US bond market are posting solid year-to-date gains, based on a set of ETFs through Monday’s close (Dec. 8). Expectations for another rate cut at tomorrow’s policy meeting could extend the rally. But beneath the surface are hints that 2026 could be a more challenging environment for fixed income amid swirling cross currents for policy and macro factors.

If new headwinds are brewing, it’s not obvious in 2025’s results to date. All the key slices of the bond market are reporting gains, in nominal and inflation-adjusted terms, relative to the 3.0% year-over-year change in the headline Consumer Price Index through September (the latest update available).

The top performer this year: intermediate-term corporates (VCIT), which is up 9.0% year to date. At the back end of performances is a cash proxy via short-term Treasuries (SHV), rising 3.9% so far in 2025, which is moderately ahead of inflation.

Although 2025 has been a wild ride for markets, thanks to shifting trade policy, political disarray in Washington, and other factors, bonds have been able to march higher. Several factors are behind the gains, including: softer-than-expected inflation blowback from tariffs, a dovish pivot by the Federal Reserve that has cut interest rates two times so far, and expectations that monetary-policy stimulus will continue. As bond investors look ahead to 2026, debate is focused on whether those factors will remain tailwinds in the months ahead?

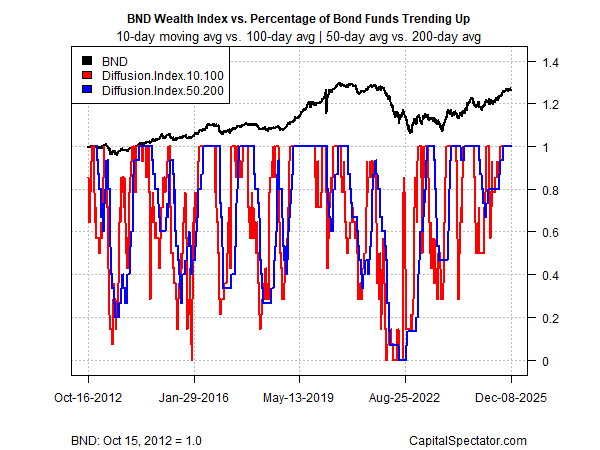

After a year of gains, the market looks vulnerable if the news flow turns negative. An estimate of sentiment for the investment-grade fixed-income benchmark (BND) is currently pinned to maximum optimism. The market, in other words, is priced for perfection.

A key test of what may lie ahead is how the 30-year Treasury yield fares. This proxy for long-term inflation expectations has traded in a range this year, but traders are wondering if the latest rise is a sign of heightened anxiety about pricing pressure, turbulence in Fed policy, or some other risk factor.

Another rate cut by the Fed tomorrow may ease concerns, but the potential for unease in the bond market on the other side of the policy meeting is lurking. One reason is the central bank appears set for a rare degree of dissent on the question of rate cuts. The Fed’s rate-setting committee is reportedly sharply divided on the merits of easing policy further.

“It’s just a really tricky time. Perfectly sensible people can reach different answers,” said William English, an economist at the Yale School of Management and a former top Fed staff member. “And the committee kind of likes to work by consensus, but this is a situation where that consensus is hard to reach.”

“You might see the least ‘groupthink’ you’ve seen … in a long time,” Fed Governor Christopher Waller said last month.

Complicating the policy path is the lingering fog for macro analysis due to the lingering effects from delayed economic data.

Another factor is Fed Chairman Powell’s tenure is drawing to close – his term ends in May. “The next chair also will inherit a committee that has been overly dependent on backward-looking data in making policy decisions,” writes Mohamed El-Erian, chief economic adviser at Allianz and chair of Gramercy Funds Management. “That makes it harder to deal with some tricky questions such as what is behind the weakening of the labor market. Furthermore, the new leader must navigate a committee with members who are sensitive to any allegation of succumbing to political pressure and may resist even a determined new chair.”

Markets will be closely watching how Powell fields questions and spins the central bank’s policy decision at tomorrow’s press conference. Hanging in the balance is a crucial question for 2026: Will the Fed hawks prevail or take a back seat to the doves?

Incoming data will play a crucial role. Unfortunately for the Fed, several key updates are still missing.

The most-immediate factor is how sentiment in the bond market reacts on the other side of the Fed meeting. Using the 30-year yield as a guide, the crowd is a bit more anxious these days. If yields continue to rise after a third-straight rate cut, that could be an early sign that the bond market’s set for a rougher ride next year.