This morning’s monthly release on manufacturing activity in the New York Fed region offers an early peek at the macro profile for August. Unfortunately, the numbers are unusually ugly. Is this an early warning sign for the US business cycle? Maybe, but it’s too soon to know for sure. That won’t stop the usual suspects from jumping to defnitive conclusions. But in the wake of a recovery that’s now in its sixth year, an obvious question arises: could macro’s pessimists, after being wrong for so long, finally be right this time?

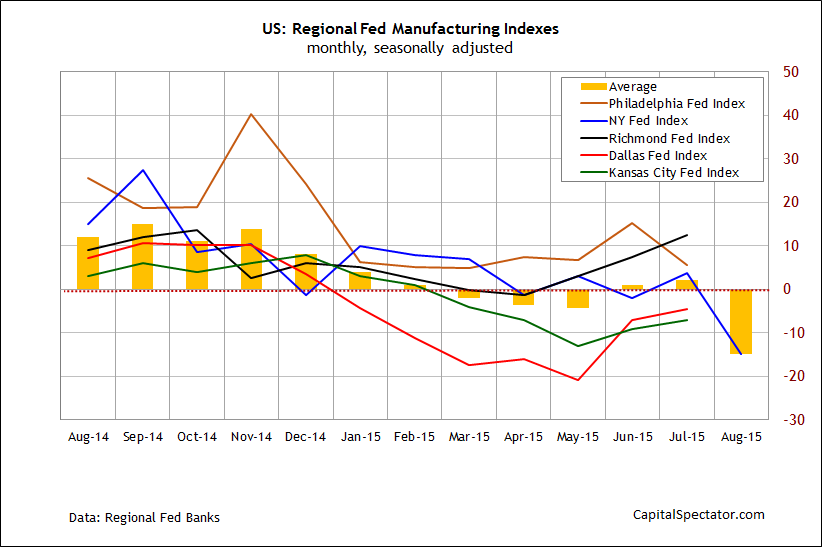

Let’s consider that question, but first: a quick look at the NY Fed numbers. The headline index for the Empire State Manufacturing Survey in August tumbled to its lowest level since the Great Recession (blue line in chart below). The general business conditions benchmark sank to -14.9 for this month, a level last seen in 2009, at the tail end of the recession.

If we use this data in isolation, the outlook is quite grim. But there are good reasons to reserve judgment, starting with the obvious: the NY Fed index, as valuable as it is, reflects only a small piece of the US manufacturing sector overall. Even if today’s update turns out to be an accurate clue for manufacturing generally, it’s not obvious that the rest of the economy would follow in due course.

Yes, manufacturing is among the more cyclically sensitive slices of the economy, which is why it’s so closely followed–and rightly so. But history reminds that using manufacturing data in isolation dispenses a fair amount of false signals when it comes to assessing the state of US macro in real time.

The caveat applies to the NY Fed release as well. During the six month through January 2013, for instance, the headline index from the NY Fed fell deeply into negative territory, albeit not quite as far as today’s slide. Nonetheless, the previous tumble was quite worrisome, in part because it persisted for half a year. The outlook was even darker via the Q1:2013 GDP update that followed–a report that surprised the market by dipping into negative territory. Nonetheless, analyzing a broad set of indicators in search of recession risk at the time suggested that the macro trend, while somewhat battered in certain corners, wasn’t heading into the ditch (for instance, see my Feb. 18, 2013 review of the business cycle).

Could it be different this time? Yes, of course, although assuming as much today, based on one indicator for a small slice of the US manufacturing sector, is premature. The question is whether today’s unusually weak data in the New York Fed region will have company for profiling the macro trend through August in the days and weeks ahead?

The upbeat numbers overall through July suggest otherwise. If that outlook is headed for downgrade, we’ll see the evidence within a few weeks. But for the moment, there’s still a case for assuming that the surprisingly weak data from the New York Fed is noise in terms of evaluating the broad trend for the US. When and if the hard data tells us otherwise, you’ll read about it here.