The value of modeling recession risk based multiple indicators is a hardy perennial. The latest example comes by way of aggregating trends in the 50 US state economies for estimating the odds that a NBER-defined downturn has started or is imminent. As recently as February this indicator looked ominous. But as the latest updates show, the warning turned out to be noise.

Monthly Archives: April 2024

Macro Briefing: 30 April 2024

* Fed expected to show discipline in keeping rates higher for longer

* No rate cuts for US till 2025, predict economists at Macquarie

* Wall Street’s home-buying binge comes under scrutiny of lawmakers

* Is US federal borrowing a key factor that’s keeping inflation high?

* Is China’s stockpiling of commodities a prelude to economic ‘nuclear option’?

* Copper rises to 2-year high on soaring demand for green energy transition:

Momentum Retains Solid Lead For 2024 Equity Factor Returns

The momentum factor is on track to end April as it began: the strongest year-to-date performer among US equity factors, based on a set of ETFs through Friday’s close (Apr. 26).

Macro Briefing: 29 April 2024

* Weak US Q1 GDP report masks underlying strength: Wells Fargo

* US Fed meeting this week arrives as summer rate cut expectations fade

* Are wealthy older Americans fueling growth and helping delay rate cuts?

* Higher estimates of neutral rate suggests the days of low interest rates is over

* US consumer spending increased more than forecast in March:

Book Bits: 27 April 2024

● The Algebra of Wealth: A Simple Formula for Financial Security

● The Algebra of Wealth: A Simple Formula for Financial Security

Scott Galloway

Q&A with author via New York magazine

Q: Over the last ten years or so, you had the idea of crypto democratizing finance. Now you have AI democratizing talent, like there’s this hack around wealth and around work.

A: I don’t want to call them get-rich-quick schemes — but the number of people who have made money by buying crypto or buying Nvidia when it was a $10 (now it’s at $800) is small. Even among those few who have managed to do so, a lot give most of it back because they fall under the illusion of thinking it was about skill rather than luck. They double down and start making bigger bets on even riskier assets. The market reminds them in a fairly ugly way that they actually aren’t good. They just got very lucky. I find over the long term, luck is pretty symmetrical. There are people who have made a lot of money in meme stocks; most of them gave it all back because they started conflating luck with talent.

Is The Hot Inflation Data In Q1 Noise Or Signal?

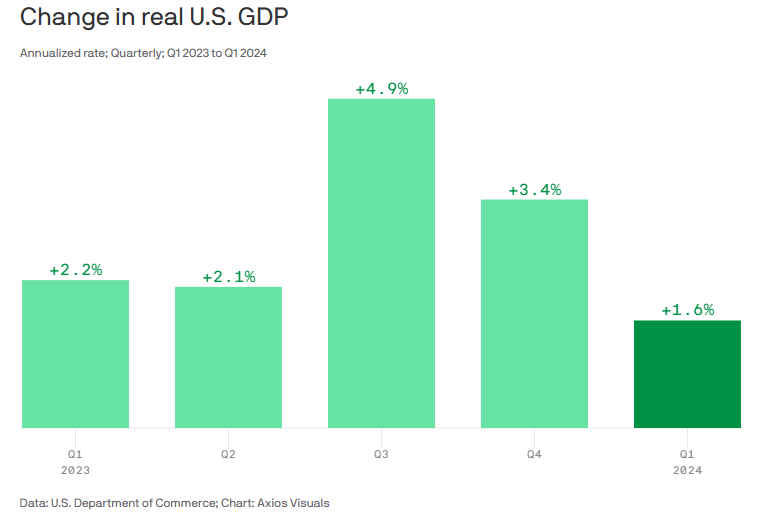

Yesterday’s first-quarter GDP report delivered a one-two punch for markets: slower-than-expected growth and hotter-than-expected inflation. In reaction, stocks fell and US Treasury yields rose. At first glance, the risk-off response looks reasonable. But a closer look at the GDP numbers still leaves room for debate.

Macro Briefing: 26 April 2024

* High commodity prices are another factor that could delay rate cuts: World Bank

* Pending US home sales rose much more than forecast in March

* Jobless claims in US fall to lowest level in 9 weeks

* US inflation picked up in the first quarter

* US GDP growth slows more than forecast in the first quarter:

Does Reflation Risk Threaten The Risk-On Signal For Stocks?

Animal spirits have come off the boil lately, but these are still early days for deciding if risk-on sentiment for equities has hit a wall or is in a holding pattern that allows markets to consolidate the gains of late. The analysis arises from a set of ETFs to gauge the risk appetite, based on prices through yesterday’s close (Apr. 24).

Macro Briefing: 25 April 2024

* Forecasts are mixed for Friday’s PCE inflation data for March

* Mining giant BHP offered to buy rival Anglo American in $39bn mega deal

* Demand for mortgages drops as mortgage rates rise to highest since November

* Solar manufacturers petition US to impose tariffs on Asian imports

* US durable goods orders rose more than expected in March:

Desperately Seeking Yield: 24 April 2024

The average 12-month trailing yield for the major asset classes has ticked up so far this year, based on a set of proxy ETFs through yesterday’s close (Apr. 23) vs. early January. Relative to Treasury yields, however, government bonds continue to offer higher payouts.