Employment growth at US companies slowed in April to the weakest gain in three years, according to this morning’s update from ADP. The private sector added only 156,000 positions to payrolls last month in seasonally adjusted terms—well below expectations for a gain of nearly 200,000. Today’s data raises new questions about expectations for a second-quarter rebound in economic activity following the weak Q1 GDP report. The numbers du jour also revive the focus on a question I asked last week: Will Job Growth Kill The Bear-Market Signal For Stocks?

Despite today’s surprisingly soft report, ADP’s research head puts on a positive spin on the news. “Despite the softest overall monthly jobs added in three years, small businesses remained an engine for job growth in April,” said Ahu Yildirmaz of the ADP Research Institute. “Smaller businesses are less susceptible to global conditions, such as low commodity prices and the strong dollar, that may have caused larger businesses to ease up on hiring.”

Mark Zandi, chief economist at Moody’s Analytics, which co-produces the report with ADP, noted that “one month does not make a trend, but this bears close watching as the financial market turmoil earlier in the year may have done some damage to business hiring.”

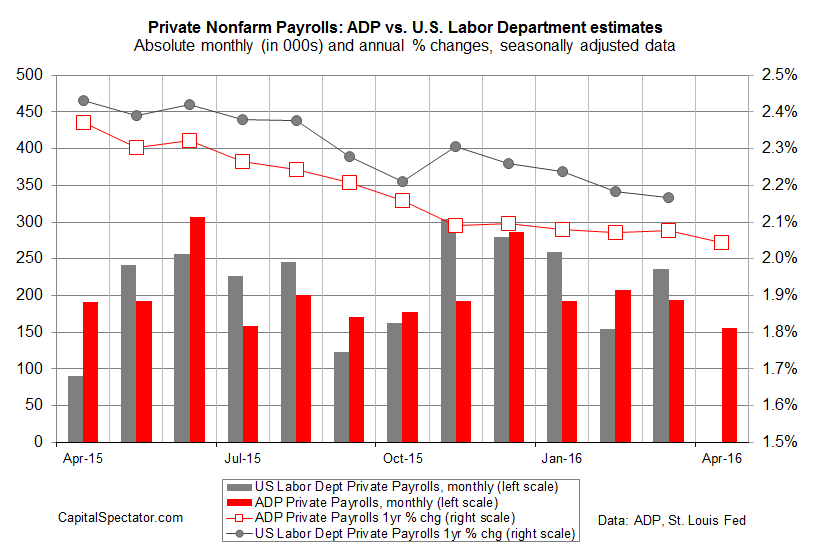

The year-over-year trend for the ADP data is still solidly positive. Is that a sign that the latest dip in the monthly gain is noise? Perhaps, although it’s worth noting that the annual growth rate in private payrolls has been inching lower for about a year. Today’s update leaves the year-over-year increase at 2.04%–a two-year low.

Deciding if today’s release is a one-off event or an early clue that the US macro trend is headed for more trouble in Q2 is a two-part data inquiry for the rest of the week, starting with tomorrow’s weekly update on jobless claims. Recent data paints a bullish profile for the labor market via new filings for unemployment benefits, which are holding close to multi-decade lows in recent weeks.

The main event for deciding what comes next is Friday’s official report on payrolls from Washington, due on May 6. Econoday.com’s consensus forecast at the moment projects a solid gain of 195,000 for private employment in April via the Labor Department’s reckoning.

If Friday’s figures turn out to be soft as well, the next hurdle is monitoring how or if the numbers impact US recession risk estimates–a topic that will be dissected, as usual, in this weekend’s update of the US Business Cycle Risk Report. In the Apr. 30 issue, macro momentum continued to look positive across a spectrum of benchmarks. That’s not likely to change due to one soft month for payrolls, although it’ll be interesting to see how the relatively reliable near-term projections of The Capital Spectator’s proprietary benchmarks fare. The estimates through May remain above the tipping points that historically have marked the onset of a new recession–but only by a thin margin. Will April’s numbers overall push the trend over to the dark side? Stay tuned.

This much is clear: a weak number on Friday will ramp up concern that the US economy’s expected Q2 snapback isn’t looking all that snappy.

Pingback: U.S. Employment Growth Slowed in April - TradingGods.net