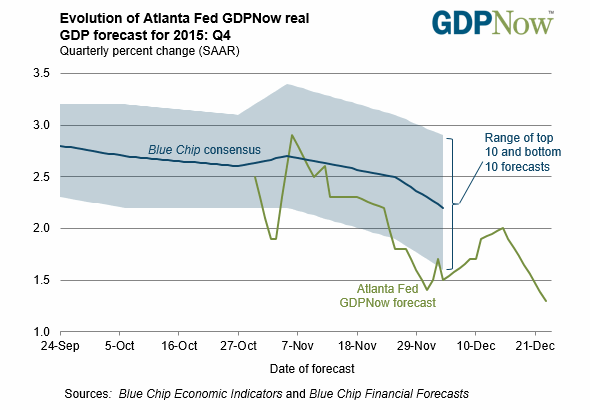

Yesterday’s upbeat data for US personal income and spending delivered some holiday cheer, but the gains didn’t help the Atlanta Fed’s fourth-quarter GDP estimate. The fed bank’s widely followed GDPNow forecast for Q4 growth tumbled to a weak 1.3% (seasonally adjusted annual rate) in yesterday’s revision (Dec.23), down from the previous 1.9% projection. The update is a reminder that US economic growth appears on track to end 2015 with a whimper.

If the new forecast holds, growth in the final three months of this year will continue to decelerate, slipping well below the already sluggish 2.0% pace in Q3:2015 and Q2’s strong 3.9% increase.

The Atlanta Fed’s weaker revision follows The Capital Spectator’s soft Q4 GDP estimate of 1.5%, which as of this past Monday (Dec. 21) was below the GDPNow model’s forecast. It’ll be interesting (for all the wrong reasons) to see if other forecasters lower their estimates in the days to come.

By some accounts, however, the current macro trend still looks upbeat. “The economy is not too cold, and not too hot, it is just right, Chris Rupkey, chief economist at MUFG Union Bank, tells Reuters. “The Fed can stay the course [for slow increases in interest rates] … no need to depart from a gradual pace given what we know currently about the economy.”

The latest GDPNow estimate begs to differ. Nonetheless, it’s still not obvious that US recession risk has jumped into the danger zone. This week’s November update of the Chicago Fed National Activity Index, for instance, signals that last month wasn’t the start of an NBER-defined recession in the US. Ditto for The Capital Spectator’s Dec. 18 profile of US business-cycle risk.

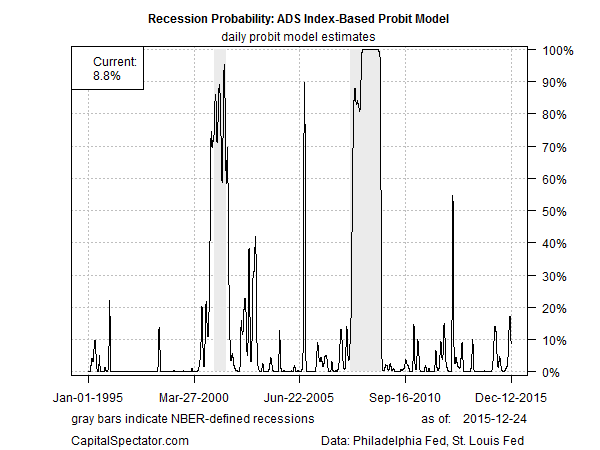

The higher-frequency ADS Index that’s published by the Philadelphia Fed also points to an economy that will sidestep recession, based on the latest economic data. This benchmark remains in the -0.40 range, which is still comfortably above the -0.80 mark that’s considered a tipping point, based on analysis by the San Francisco Fed. Translating the latest ADS Index values into recession-risk probabilities via a probit model, in connection with NBER’s business-cycle-signal data, still points to a low likelihood—roughly 9%–that the US economy has slipped over to the dark side.

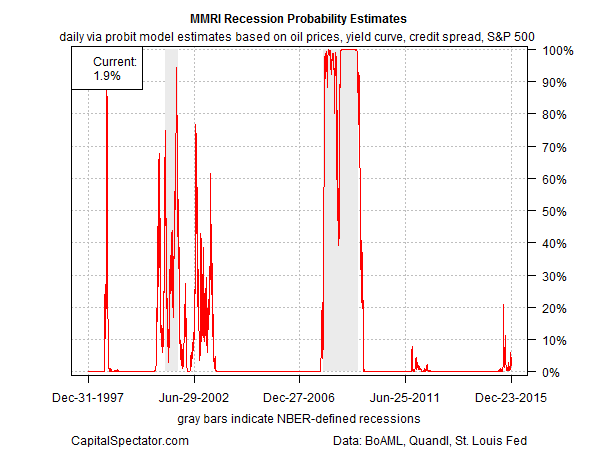

A markets-based estimate of business-cycle risk–Macro Markets Risk Index–is also signaling a low probability that an NBER-defined recession has started. Crunching the data on four markets—US equities, oil prices, the high-yield credit spread, and the Treasury yield curve—implies that that recession risk is under 2%, based on numbers through yesterday (Dec. 23).

Nonetheless, the Atlanta Fed’s weak GDP forecast for Q4 raises the possibility that the hard economic numbers will be skewed to the downside in the next round of updates. The US may not be destined for a formal recession, but that doesn’t preclude the possibility (likelihood?) of slow growth. As such, the crucial question is obvious as the year draws to a close: How weak will Q4 GDP growth be when the final numbers for the quarter are published? Lower than generally assumed at the moment, based on the latest GDPNow data.

Pingback: Atlanta Fed’s Q4 GDP Growth Estimate For U.S. Tumbles To 1.3% | Biedex Magazine - Financieel nieuws - Forex - commodities - beurzen - Trading Signalen

Pingback: US Jobless Claims (Still) Point To A Strong Labor Market | Breaking News Today

Pingback: US Jobless Claims (Still) Point To A Strong Labor Market – My Blog