The widespread disruption from the coronavirus pandemic is obvious to everyone, but economic nowcasting and forecasting models are only just beginning to reflect the damage to what had been a moderately expanding US economy. Thanks to the lag in economic data, which can arrive as long as two to three months after the fact, formerly robust methodologies for tracking the US macro trend have become hopelessly out of date in recent weeks. But reality is quickly catching up with previously sunny estimates.

There’s still a long way to go before most economic models fully reflect the sharp and sudden deterioration in economic conditions, but the painful adjustment waits for no one. A bit of the shift is beginning to reveal itself in new estimates. The New York Fed’s second-quarter GDP nowcast, for example, has been revised down sharply in recent weeks, dropping like a stone from an upbeat +2.3% estimate for Q2 on Feb. 28 to a near-flat +0.1% for the Mar. 20 update. A touch of reality, although there’s surely more downside revisions to come as the model integrates upcoming numbers into its calculus.

The New York Fed’s Q1 Mar. 20 estimate has been revised down too, although the latest +1.5% (down from +2.1% on Feb. 28) is also vulnerable to further downgrades as new numbers are published.

The Atlanta Fed’s GDPNow model, by contrast, still looks ancient with its +3.1% nowcast for Q1 (as of Mar. 18). Recognizing the slow-motion revision that’s inherent in the model, the bank advised readers that the absurdly bullish estimate is the economic equivalent of a fairy tale. In red lettering to emphasize the point, the Atlanta Fed’s GDPNow page advises that the current nowcast “does not capture the impact of COVID-19 beyond its impact on GDP source data and relevant economic reports that have already been released. It does not anticipate the impact of COVID-19 on forthcoming economic reports beyond the standard internal dynamics of the model.”

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

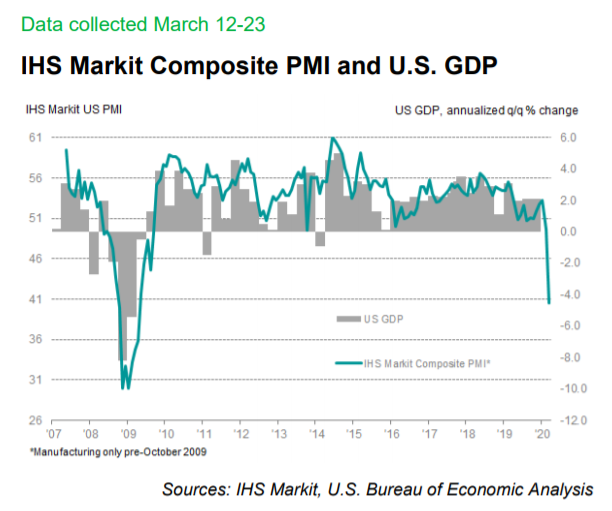

Other models that are more flexible and draw on data and estimates beyond formerly published hard economic reports have been quicker to reflect the rapid shift in macro conditions. Notably, the survey-based US Composite Output Index (a proxy for GDP) fell sharply in the initial estimate for March by indicating a deep contraction in economic activity. “US companies reported the steepest downturn since 2009 in March as measures to limit the COVID-19 outbreak hit businesses across the country,” says Chris Williamson, chief business economist at IHS

Markit, which published the report yesterday (Mar. 24).

The modeling published by TradingEconomics.com is also picking up on the sharp deterioration in the US macro trend. Combining econometric analytics with survey numbers, the web site’s US GDP forecasts have turned negative for each of the four quarters in 2020. For Q1 GDP, for instance, TradingEconomics is estimating a 5% decline in output.

Economists are reacting even faster, publishing far-darker estimates for the near-term outlook. At the lower realm of projections are recent updates from Morgan Stanley and Goldman Sachs. Fortune reports this week:

Morgan Stanley’s U.S. economists led by Ellen Zentner told clients in a report on Sunday that they now see American gross domestic product falling 30.1% in April-June. That will drive up unemployment to average 12.8% over the period, they said.

At Goldman Sachs, Jan Hatzius’s team said in a report that they now expect the world economy to contract about 1% this year, which would be a bigger decline than even that witnessed in 2009 amid the financial crisis. They were already projecting a 24% drop in U.S. output in the next quarter.

This month’s survey of economists via The Wall Street Journal is relatively optimistic by comparison with a -1.3% GDP decline for Q1 and a mere -0.1% downtick for Q2. But in a rapidly evolving climate for economic conditions, those estimates will surely suffer downside revisions by next month’s update.

Perhaps the only critical question left is how best to support the economy with government policy decision? It’s encouraging to see that the White House and Congress earlier today reach a deal for a huge $2 trillion relief bill. Meanwhile, the Federal Reserve has aggressively ramped up monetary support to keep the economy functioning, or at least prevent it from collapsing.

“We are now in QE infinity, again,” quips Peter Boockvar, chief investment officer at Bleakley Advisory Group, in a reference to the central bank’s latest announcement of buying securities with no formal limits.

Welcome to the “whatever it takes” era of supporting the financial system and the economy. It may end up as the boldest experiment in macroeconomic history. The only mystery: Will it work? It’s too soon to know at this point, but the mother of all stress tests is currently in progress—for the US and the global economy.

Meanwhile, whatever passed for reasonable forecasting efforts has been rendered inert. “The vast uncertainty surrounding the possible spread of disease (within the US and globally) and the duration of the near-economic standstill required to combat the virus make forecasting little different from guessing,” observes Harvard University economist Carmen Reinhart.

The closest parallel, she tells Bloomberg, is the Great Depression. “Today is reminiscent of the 1930s,” she says. “The slump in commodities, the crash in global trade and synchronization of recessions is more like then than any time.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: Widespread Disruption from Coronavirus - TradingGods.net

Pingback: Quantocracy's Daily Wrap for 03/25/2020 | Quantocracy