Yes, but it’s a tentative “yes” and the answer has several qualifications and so it’s premature to celebrate what appears to be the end of the downturn.

Let’s start with the most conspicuous feature of this year’s economic downturn: it arrived like a bolt from the blue relative to previous recessions and so it’s not surprising that it’s fading just as quickly. But the start of the recovery is one thing. How it evolves is another matter entirely and for now there’s a huge amount of uncertainty on the latter point. Meanwhile, a quick review of recent history.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

As recently as late-February, the US economy continued to post moderate growth. But within a month, economic hell was unleashed. As the data releases subsequently confirmed, the deepest contraction since the Great Depression arrived—with record speed.

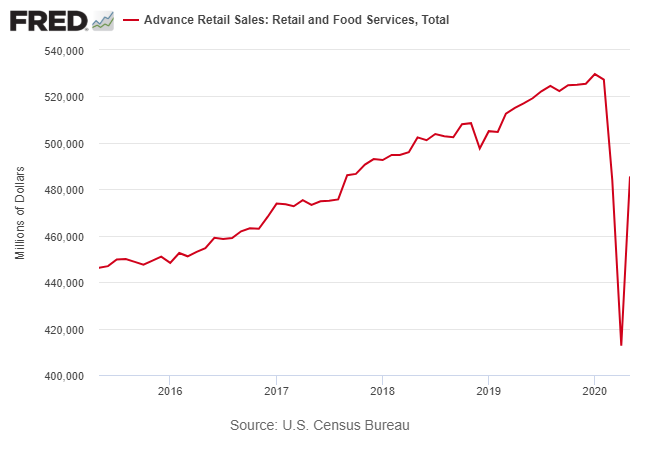

Unlike previous recessions, this year’s downturn was self-inflicted as a tool to fight the coronavirus. As the economy shut down, output collapsed. To some extent, as the shutdown eased, it was clear that economic activity would bounce back and that’s exactly what happened, as clearly shown in yesterday’s release of US retail spending in May.

Consumer spending surged nearly 18% last month – the biggest monthly gain on record by far. Good news, although the upward spike followed two straight months of record decline. The net result, even after the huge increase in May, the level of retail spending remains at the lowest in nearly three years.

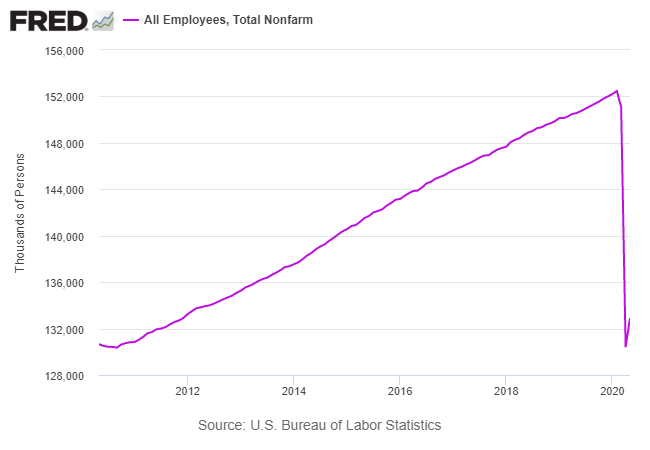

The snap-back effect is visible in other indicators, including payrolls, which increased by an astounding 2.5 million in May. Here, too, the gain is the biggest on record. But echoing the results in retail spending, the bounce in payrolls follows hefty losses. In fact, nonfarm payrolls, despite last month’s incredible rebound, remain near a decade low. In other words, virtually all the jobs created in the 2009-2020 expansion are still wiped out.

Other indicators show similar results, although with a wide range of degrees. Notably, the bounce-back for industrial production was surprisingly weak. After two months of extremely deep losses in output, the 1.4% increase in May is welcome but the gain only recovers a small fraction of the damage. As a result, the Federal Reserve’s Industrial Production Index in May is still near lowest level in a decade.

The main takeaway from the broad run of recent data: the recovery appears to be underway but recovering lost ground will take time, probably years. But it’s important to recognize that the economy is no longer contracting.

The future, as always, is unclear and so it remains to be seen how the June numbers compare. But there’s a reasonable case for expecting that the recovery will continue. Unevenly and in fits and starts, perhaps, but ongoing. But here’s the critical issue: the strength of the recovery will likely decelerate.

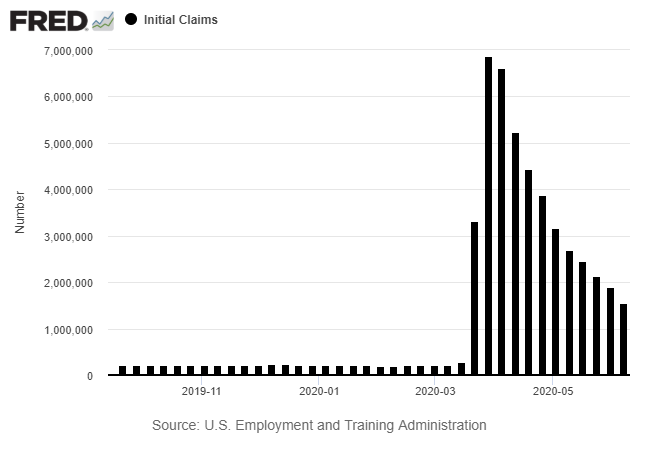

Consider payrolls. Although the massive bounce-back in May is encouraging, the ongoing surge in newly unemployed workers is a reminder that the recovery faces hurdles. Although the weekly increase in jobless claims has lessened for 11 straight weeks, the level of increase is still tragically high – new filings for unemployment benefits rose 1.5 million in the week through June 6. That’s still far too high to inspire confidence that we’re on the cusp of an unusually strong and persistent economic rebound.

True, a 1.5 million rise is much better than the nearly 6.9 million that filed at the end of March. Yet it’s also clear that the labor market continues to bleed by a hefty degree.

The good news is that the economy is beginning to put people back to work, but there’s a long road ahead. Until there’s deeper clarity on the outlook for how the coronavirus will evolve in the months (years?) ahead, there’s still a huge amount of uncertainty for estimating the strength of the economic recovery.

Nonetheless, let’s recognize that we passed a key milestone, or so it appears, namely: growth has resumed. The obvious caveat is that the revival of growth coincides with an economy that’s been heavily battered and the recovery road is littered with many pitfalls. Although we’ll likely see growth continue (mostly) on several key fronts in the months ahead, there will be setbacks and for the foreseeable future the healing will likely be disappointing at times in terms of what’s needed to fully repair the damage.

The main risk factor is the coronavirus. The key question: When will an effective vaccine arrive that’s widely distributed? If you’re optimistic, the end of the year, but that timetable is hardly a high-probability estimate.

Meanwhile, the possibility of a second wave in the fall and winter lurks. How might a resurgence in infections and deaths affect the recovery? Unclear, although it’s safe to assume that it won’t help, although it’s open for debate just how much of an economic setback a second wave would unleash.

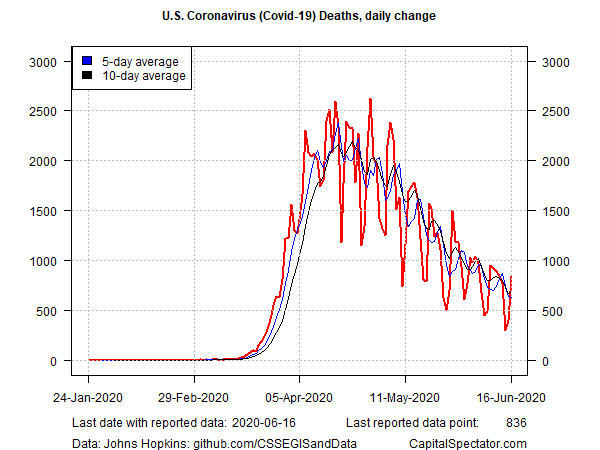

For now, a key metric for the coronavirus looks encouraging for the US – the daily change in Covid-19 fatalities. As the chart below shows (based on data collected by Johns Hopkins University), the trend in deaths peaked in early May and has been trending down ever since.

But some models of the disease project a rebound in infections – the dreaded second wave – starting in September. For example, the Institute for Health Metrics and Evaluation (IHME) at the University of Washington forecasts that infections will bottom out in late-summer and trend higher for the rest of the year. That’s not written in stone, of course, but it’s a possibility and so the economic recovery may be vulnerable.

For now, the numbers look encouraging – encouraging in the sense that the economic collapse has ended and the green shoots of recovery have emerged. How this plays out is still a guessing game, but we have a recovery, albeit a recovery that’s started at the bottom of a very deep hole. Keep in mind that the rebound from the Great Recession of 2008-2009 was slow and uneven. Will it be different this time? Maybe, although the risks don’t appear skewed in support of an upbeat outlook on this front. But for the moment it seems a recovery is underway. Whether it “feels” like a recovery in the months ahead remains an open question. But like every thousand-mile journey, this one has started with a first step.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: Is the Economic Downturn Over? - TradingGods.net