This morning’s US economic updates on housing construction and industrial output—the final batch of numbers ahead of this afternoon’s monetary announcement from the Federal Reserve—delivered a mixed bag of macro news, albeit with a moderately positive spin. The main takeaway: industrial production is still contracting at the headline level but manufacturing is expanding at a faster rate. On the housing front, new residential construction continues to trend higher. Overall, the numbers offer support for expecting moderate economic growth in the near-term future.

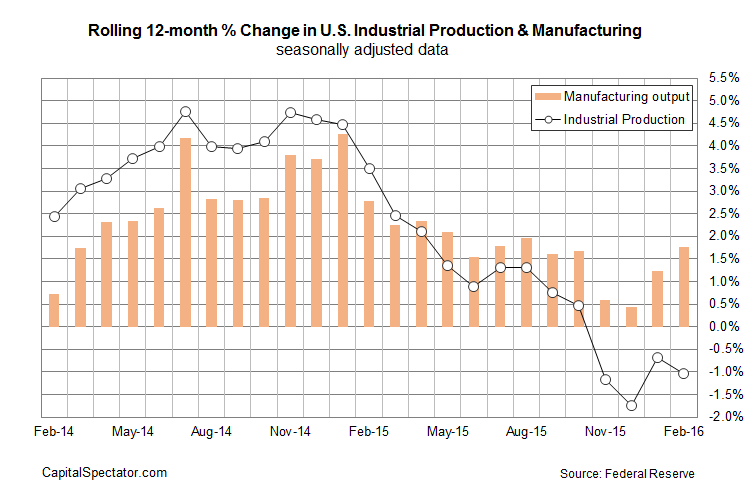

Let’s take a look at the details, starting with today’s report on industrial activity for February. The headline index remains in negative territory, according to the Federal Reserve. Output contracted 0.5% last month, the fourth monthly decline in the last five months. Yet the manufacturing slice of industrial activity increased for the second month in a row, hinting at the possibility that worst has passed for this sector.

Looking past the short-term noise reveals a tale of two trends. In year-over-year terms industrial output declined 1.0% through February—the fourth straight run of red ink for the annual comparison. But manufacturing’s growth rate is accelerating, rising 1.8% in February vs. the year-earlier level—the strongest year-over-year gain since last summer.

“It does seem that after a recent spell of weakness, manufacturing seems to have found a base,” 4cast Inc.’s senior economist, David Sloan, tells Bloomberg. “This strengthens the tentative perception that manufacturing is making a firmer step in the first quarter, which is encouraging.”

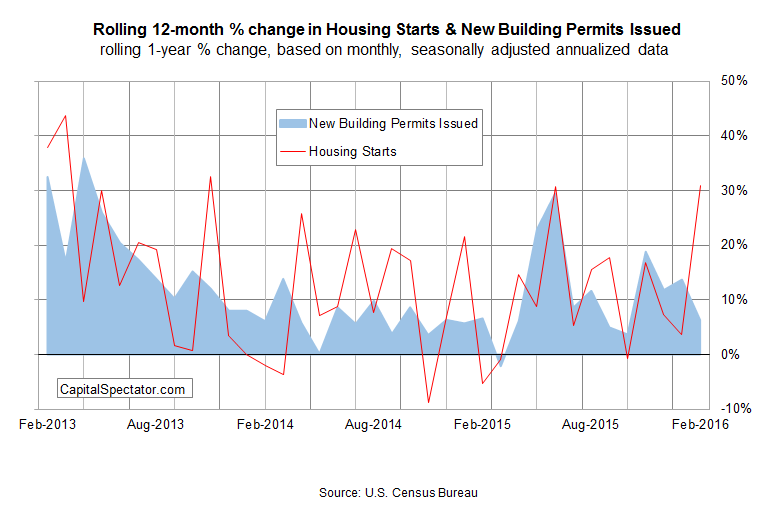

Moving on to housing starts, new residential construction increased to 1.178 million units (seasonally adjusted), which marks a five-month high. Even more striking is the sharply higher year-over-year gain for starts, which surged to a nearly 31% increase last month vs. the level from a year ago.

“We see a resilient labor market as supportive of a continued slow and steady housing recovery and low housing inventory should continue to bolster residential construction ahead,” Bricklin Dwyer, an economist with BNP Paribas, advises via AP.

Maybe so, although let’s note that newly issued building permits—widely seen as a leading indicator for starts—eased last month to 1.167 million, the lowest since last September. Nonetheless, permits continue to rise on an annual basis, albeit at a modest pace. The latest housing numbers in the aggregate suggest that new construction activity has a positive tailwind as we head into the spring.

That’s also the message in yesterday’s upbeat report on survey data for the home building industry. “Confidence levels are hovering above the 50-point mid-range, indicating that the single-family market continues to make slow but steady progress,” says the chairman of the National Association of Home Builders (NAHB). “Solid job growth, low mortgage rates and improving mortgage availability will help keep the housing market on a gradual upward trajectory in the coming months.”

The bottom line: there’s an upside edge in today’s numbers, particularly when we focus on the annual trend. The headline data for industrial activity remains weak, but this is mostly due to softness in mining and utilities. By contrast, the firmer trend in the cyclical manufacturing sector implies that industrial output overall will rebound in the months to come. In other words, the red ink in the headline industrial index may not be the ominous signal for the business cycle that it appears to be.

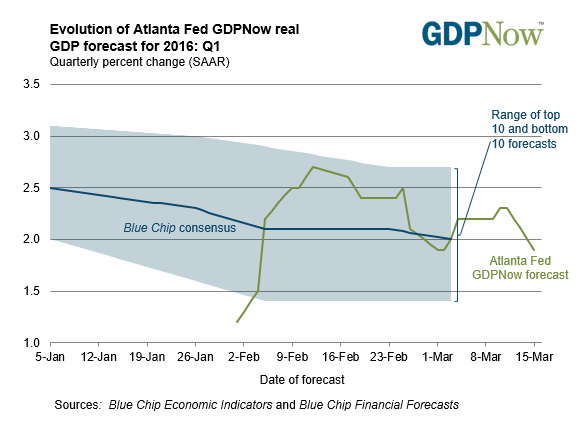

Nonetheless, the near-term outlook for the macro trend is still modest. Note that yesterday’s revised estimate for first-quarter GDP growth via the Atlanta Fed ticked lower to a mild 1.9% rise (seasonally adjusted annual rate). That’s enough to keep the economy out of the cyclical ditch, but the case is still weak for seeing a robust pace of growth.

Pingback: US Economic Updates Mixed News

Pingback: US Equity and Economic Review: We Continue to Grind Slower, Edition | Forex News|Real Time Forex Trading News