The Federal Reserve’s Labor Market Conditions Index (LMCI) eased slightly in July, ticking down to 1.1 from 1.4 in the previous month. The slightly positive value equates with a labor market that’s expanding, but at a sluggish rate. Yet translating LMCI’s historical record into recession risk estimates via a probit model still indicates that the broad macro trend remains positive for the US. That’s also the message in the jobless claims data and a real-time estimate of business conditions via market numbers. We’ll have a more reliable estimate of recession risk through July with the monthly update of the Economic Trend & Momentum indices that’s scheduled for later this month. Meantime, the early clues suggest that macro risk is still low for the US. To be precise, the current numbers suggest that the NBER isn’t likely to declare July as the start of a new recession.

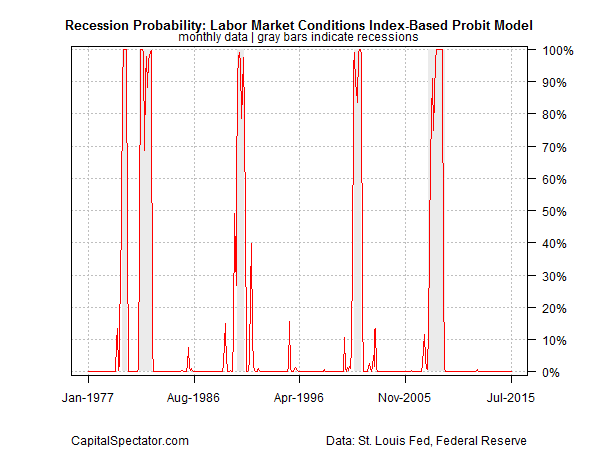

One hint that the expansion remained intact through last month can be seen in LMCI’s implied recession risk estimate, which is virtually nil—roughly 2%, as of July.

Estimating current macro conditions through the prism of jobless claims (based on monthly averages) tells a similar story, namely: business cycle risk remains low.

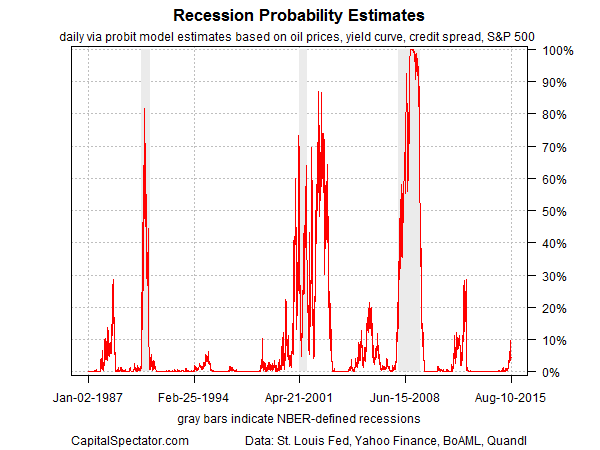

As a check on the signals generated by the labor market, let’s turn to a real-time approximation of economic conditions via a probit model that analyzes four data sets on a daily basis: the US stock market (S&P 500); the Treasury yield curve (10-year yield less the 3-month T-bill yield); the credit spread (BAA-rated bond yield less AAA yield); and spot crude oil prices (based on the US benchmark, West Texas Intermediate). The current estimate with this analysis also reflects a bias for growth. The probability is less than 10% that an NBER-defined recession has started for the US, according to this methodology as of Aug. 10.

Keep in mind that the estimates above are based on looking in the rear-view mirror. The future, on the other hand, is uncertain… as always. Meantime, don’t confuse this binary view on the business cycle with an estimate on the pace of growth. That’s a separate project entirely. Rather, the analytics above are designed for one purpose only: estimating the probability that the NBER—the official arbiter of US business cycle dates—will announce that a downturn started. Based on last month’s numbers, that’s still a long-shot proposition.

Pingback: test » U.S. Retail Sales Bounce Back In July