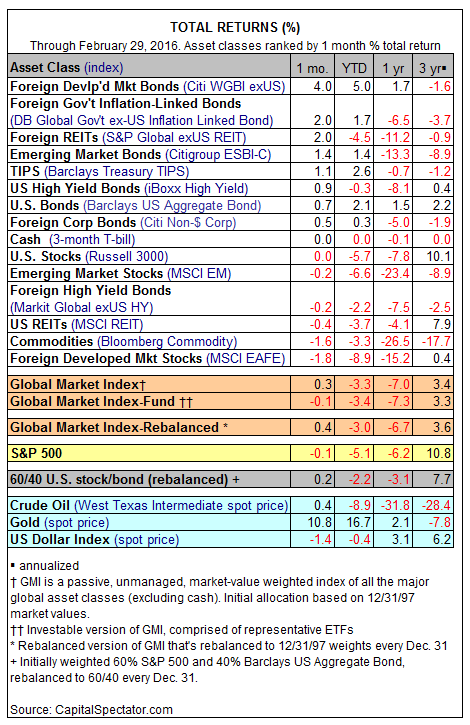

The demand for safe assets dominated asset flows in February. The main beneficiary of the risk-off trade last month: foreign government bonds in developed markets. Citigroup’s World Gov’t Bond Index ex-US surged 4.0% in February (unhedged US dollar total return). The gain also pushed this slice of the fixed-income market into first place for the trailing one-year period with a 1.7% increase.

Bonds generally were in high demand last month. The only corner of fixed income that didn’t deliver a gain in February: foreign junk.

As for equities, all the broad categories lost ground last month. In fact, February’s biggest loser among the major asset classes: foreign developed-market equities (MSCI EAFE), which retreated 1.8%.

In a sign of the times, there are only two markets with positive returns for the trailing one-year period: US investment grade bonds (Barclays Aggregate) and Citi’s measure of foreign developed-market government bonds. In other words, multi-asset class portfolios remain under pressure in a world that’s reluctant to bid up prices of risky assets.

Yet last month managed to offer a modest reprieve for the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. Thanks to GMI’s bond holdings, the index increased 0.3% in February. Gravity, however, still prevails for the trailing 12-month, paring GMI by 7.0% vs. the year-earlier level.

Looking ahead, GMI’s long-term risk annualized premia forecast is still positive—2.9% in last month’s update. But here too there’s been a sharp reduction in expectations in recent history and there may be more downgrades to come.

The chief headwind at the moment is the sluggish outlook for the global economy. “The global recovery continues, but it remains uneven and falls short of our ambition for strong, sustainable and balanced growth,” the G20 communique from this past weekend advised. Until the crowd has more confidence that the macro trend is stabilizing if not improving, the near-term prospects for risky assets will remain under pressure.

Pingback: Demand for Safe Assets Dominates in February

Pingback: 03/01/16 – Tuesday’s Interest-ing Reads | Compound Interest-ing!