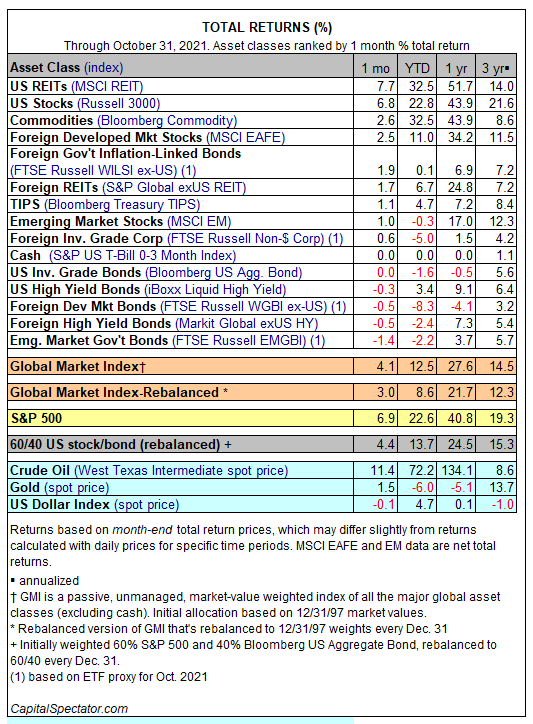

US real estate investment trusts (REITs) and stocks posted the strongest returns for the major asset classes in October — by wide margins.

US REITs surged 7.7% last month, reversing September’s sharp decline. The recovery puts American property shares in the lead for 2021 with a 23.5% total return, albeit just fractionally ahead of commodities.

US stocks were a close second in October. American equities rose 6.8%, based on the Russell 3000 Index. Year to date, US shares are up a strong 22.8%.

Foreign bonds were the losers in October. The deepest setback was in emerging-markets government bonds, which fell 1.4% — the worst performer for the major asset classes last month.

US bonds, by contrast, were essentially flat in October.

The Global Market Index (GMI) rebounded last month. This unmanaged benchmark (maintained by CapitalSpectator.com), which holds all the major asset classes (except cash) in market-value weights, rallied 4.1%. The advance marks the strongest monthly gain in 11 months for the index. Year to date, GMI is up by a robust 12.5%.

Comparing GMI to US stocks and bonds still shows a strong middling performance over the trailing one-year period. GMI earned roughly 63% of the gain posted by US stocks over the past 12 months. US bonds, by contrast, continue to tread water for the trailing 12-month window.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: Strongest Returns Posted by US Real Estate Investment Trusts and Stocks - TradingGods.net

Pingback: Long-Run Risk Premium Forecast Rebounded in October - TradingGods.net

Pingback: Prospects for an Extended Rally Could be Short Lived if Interest Rates Rise - TradingGods.net

Pingback: US Bonds Spared from Losses Last Week - TradingGods.net