The outlook for first-quarter US growth has been cut to the bone, according to the current estimate of the Atlanta Fed’s GDPNow data. But if the “wisdom” of the crowd is accurate this time, it’s only a temporary stumble. Most economists continue to expect a robust Q2 snapback. The Wall Street Journal’s survey data sees second-quarter GDP rising at a brisk 3.1% pace after a sharp deceleration in growth for Q1. The early clues on Q2 via April releases, however, offer a mixed batch of numbers. There’s a long way to go for digesting this month’s economic reports, but at the moment the data doesn’t look especially compelling for anticipating a strong kickoff to Q2. That could change, of course, but for the moment we’re off to a mixed start in the messy business of revising expectations for the current quarter.

April’s profile is still limited to a handful of data sets and so we should be cautious when interpreting the available numbers for this month. The available figures for Q2 currently include weekly initial jobless claims, Markit’s survey data for the manufacturing sector, and several regional manufacturing indexes via Federal Reserve banks. Let’s’ start with new filings for unemployment benefits.

New jobless claims ticked higher in yesterday’s update, but the trend still looks encouraging. State unemployment benefits rose 1,000 to a seasonally adjusted 295,000 for the week through April 18, the Labor Department reports. That’s the highest since late-February, although the year-over-year trend paints a considerably brighter outlook. Claims fell nearly 11% last week vs. the year-earlier level. That’s a healthy sign for anticipating that growth will prevail in the labor market in the near-term future.

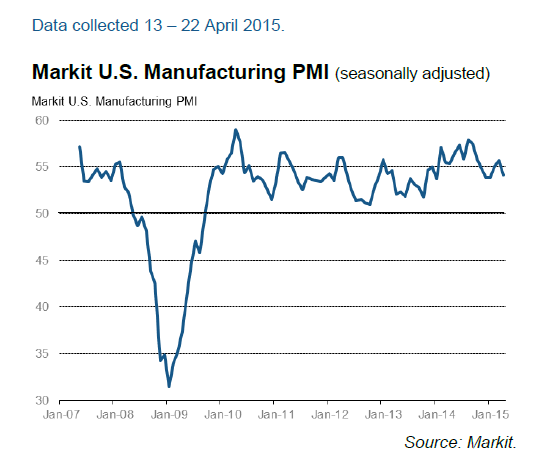

The current view from the perspective of the cyclically sensitive manufacturing sector, however, paints a mixed picture. Markit’s purchasing managers index dipped to a four-month low in April. “Although still comfortably above the 50.0 no-change value, the latest index reading signals the least marked improvement in overall business conditions since January,” the press release noted.

A lesser pace of expansion is also reflected in the current lineup of April updates via the regional manufacturing surveys published so far by Federal Reserve banks. Three of the five indexes for this month are available and two of three have slipped into mildly negative territory for April. The New York Fed’s Empire State index’s reading for this month posted its first monthly contraction this year. Meanwhile, the Kansas City Fed’s headline benchmark for manufacturing suffered its second straight monthly decline. Bucking the trend is the Philly Fed index, which enjoyed a moderately better-than-expected rise, reaching a four-month high this month.

Overall, the numbers for April so far suggest a modest level of growth. The outlook for a strong rebound in growth in Q2, in other words, is still debatable until or if the incoming numbers in the days and weeks tell us otherwise. The next chance for an attitude adjustment with new data for April: Monday’s release of the US PMI services data and the Dallas Fed’s report on its regional manufacturing index.

Pingback: 04/24/15 - Friday Interest-ing Reads -Compound Interest Rocks

Great work as always – thanks for your post!

Just wanted to comment that manufacturing appears to be the main area of the economy currently not in a good trend. I track key indicators on my site in a Easy Trends Dashboard, and right now Industrial Production and Factory Orders (nondefense capex minus aircraft) are the only categories not in a positive trend. They’re both manufacturing heavy. As such, it’s way too early to say anything about the early reports from April, in my humble opinion. The only non-manufacturing one you quoted (weekly jobless claims) was in good shape. We should see good things from many other areas as well. Let’s hope anyway.

Again thanks for the great work!