The recent surge in US stock market volatility has rattled nerves and inspired some analysts to announce that a new bear market has arrived. The warning has resonated a bit deeper in some circles with the sight of the S&P 500 falling below its 200-day moving average earlier this month. The bearish view can’t be ruled out entirely, of course, but the latest stumble in stock prices looks like a temporary bout of anxiety rather than a start of an extended decline. Why? A key factor for this outlook is the economic trend, which continues to provide a bullish tailwind. Not surprisingly, an econometric test for bear-market signals in US stocks continues to show minimal signs of danger.

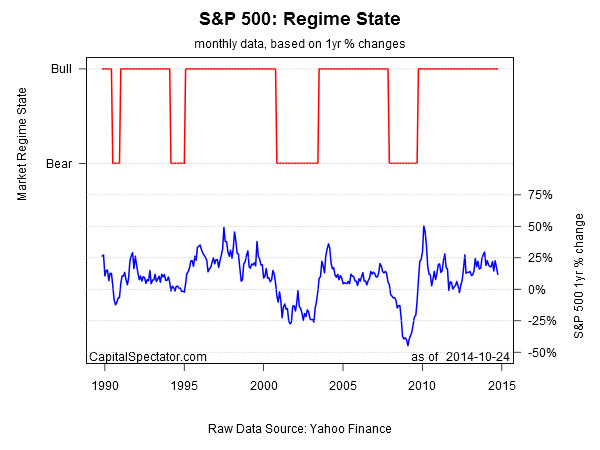

Analyzing the stock market with what’s known as a Hidden Markov Model (HMM) currently shows that the threat of a new bear market remains low. (For some background on HMM as applied at CapitalSpectator.com, see the posts here and here). Crunching the numbers on the S&P 500 in R with the depmixS4 package indicates a limited potential for a regime shift from a bull to bear market, based on one-year returns through Oct. 24. In the first chart below, the probability is shown to be virtually nil that a bear market was underway as of this past Friday, based on the current HMM signal.

A similarly upbeat profile emerges when we analyze the numbers through a binary prism that looks for bull and bear states. The current regime state is bullish.

The standard caveats apply, of course. As with any model, there are no guarantees that an HMM-based view of the market is flawless. But history suggests that looking at the market’s trend through a relatively objective, statistical lens offers an encouraging real-time record of spotting new bear markets, as I discussed here, for instance.

Even if you accept the latest analysis, don’t confuse today’s results as signals written in stone. When a bear-market environment does arrive—as it will at some point—the charts above will change quickly. The lesson, then, is to run the numbers regularly, and as part of a diversified regimen of monitoring risk across a wide spectrum of macro and market indicators.

As for the US stock market, the current profile continues to look relatively positive. That doesn’t mean that short-term volatility has been banished or that the market will soar in the weeks ahead. But for the moment, the case for assuming that equities have entered bear-market territory is premature.