Recent history has been humbling for nearly every corner of portfolio management. There are exceptions, of course. Several managed futures ETFs, for example, have been relatively stable in the recent market correction. But extreme stress has afflicted most corners of the financial markets, which in turn has unleashed unexpected challenges for many portfolio strategies.

The Financial Times highlights how recent events have raised new questions about standard asset allocation strategies.

For much of the past century, the building blocks of most investment portfolios have been a combination of riskier stocks and steadier, safer bonds. Like a see-saw, one typically rises if the other falls, smoothing returns and offering

a hedge.But over the past decade, this relationship has broken down. Bond yields have sagged as their prices have risen alongside equities, producing healthy gains but limiting how much protection bonds can offer in downturns. The recent market chaos unleashed by the coronavirus pandemic has underscored the problem, with bruising trading periods in which bonds and equities have dropped in unison.

Consider the classic 60/40 stock/bond portfolio mix, which is widely used as a simple benchmark for asset allocation strategies. Normally, this benchmark delivers solid results that are in line with the complimentary dance between equities and fixed-income. It is, in short, the building block for portfolio-based diversification. But this year has tested the strategy, pushing it to the extreme. As the FT notes:

A US 60-40 portfolio in the decade to 2020 produced its highest volatility-adjusted returns in over a century, according to investment bank Goldman Sachs. But in the first three months of this year, the 60-40 strategy suffered one of its worst performances since the 1960s, as the bond rally proved insufficient to offset the tumble in stocks.

Critics will note that a 60/40 portfolio is but one variation on asset allocation, and an overly simple one at that. That raises the question: Have more ambitious efforts at diversifying across asset classes delivered stronger results this year?

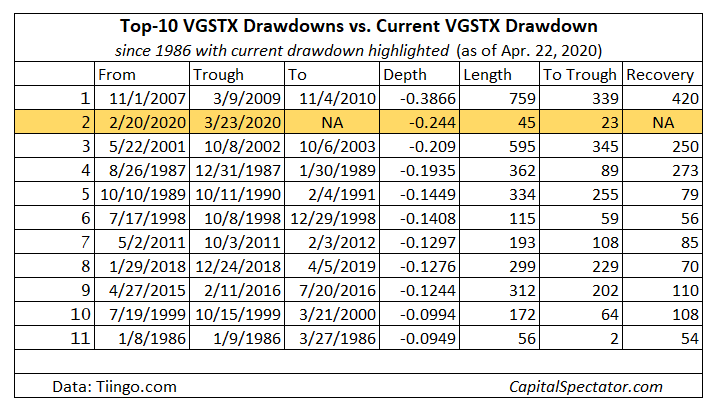

As a first step to investigating this question let’s review how a widely respected and long-running asset allocation fund has fared to date in 2020 and compare the results to previous corrections. For several reasons, Vanguard STAR (VGSTX) is a solid choice for a low-cost, multi-asset class fund with impressive long-run returns (the fund was launched in 1985). According to Morningstar.com, VGSTX has earned an annualized 6.7% total return for the trailing 15-year period through yesterday (Apr. 22) – a top-quartile performance vs. similar funds.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

But this year has proven to be a stress test in the extreme. Notably, VGSTX’s drawdown was unusually deep and swift, echoing the results in many corners of money management. The current slide represents the second-deepest drawdown since the fund’s inception.

As the performance chart below indicates, VGSTX has bounced back in recent weeks after suffering an unusually steep and rapid drawdown. Nonetheless, the fund’s current peak-to-trough slide remains in familiar terrain, albeit at the lower end of previous drawdowns.

But the jury’s still out on how this multi-asset class fund (and similar strategies) fares in the months ahead. By some accounts, recent events highlight the need for alternative methods to enhance portfolio design for what some say is a new world order of volatility.

Meanwhile, fixed-income – investment-grade corporate bonds in particular – are under new scrutiny after stumbling this year. Indeed, if the Federal Reserve didn’t step in recently and announce a program to support the corporate bond market, formerly “safe” havens in the credit space would be suffering with far deeper losses.

Perhaps Treasuries and cash are the only true safe havens. Or should gold and various tail-risk hedging strategies be added to the mix on a routine basis for “diversified” portfolios? That’s been the view of a small niche of portfolio managers, but the idea may go mainstream in the years ahead.

There are no simple answers, of course, but such questions are now front and center and investors reassess the definition of safety and diversification. Is a revolution in portfolio design lurking? Perhaps. Much depends on how VGSTX and its counterparts across the money management spectrum fare in the months ahead.

Meanwhile, old assumptions about what constitutes prudent portfolio design looks headed for a deeper level of scrutiny and suspicion.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: Most Corners of the Financial Markets Impacted by Extreme Stress - TradingGods.net

This is a question I’ve been asking since the GFC. It seems to me that during market crashes the correlation of all asset classes goes up and only returns to normal in a bull market. Has the use of leverage gone up over the last 50 years? What factor(s) is/are at play ?

Pingback: Weighing the Week Ahead: Should Investors Become Traders? | Dash of Insight

Pingback: Economic Calendar Is Packed This Week - TradingGods.net