US GDP growth eased in the first quarter, according to this morning’s report from the Bureau of Economic Analysis. The slowdown, which marks the weakest gain in a year, was widely expected, although the annualized 2.3% rate was modestly above Econoday.com’s 2.0% consensus forecast.

A key headwind in today’s quarterly release: softer consumer spending in the first quarter. Personal consumption expenditures rose just 1.1% in Q1, the smallest gain in five years and sharply below the 4.0% increase in the previous quarter.

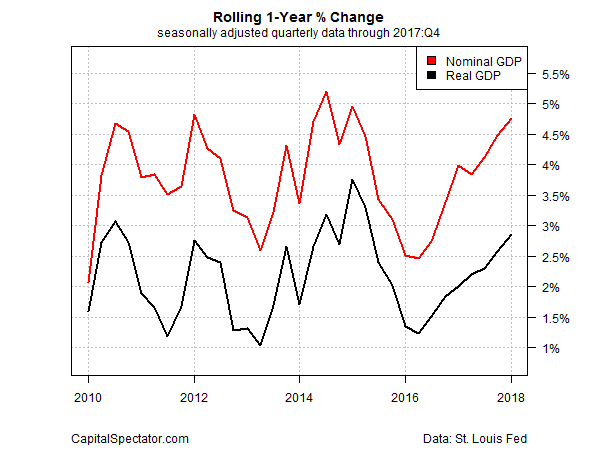

Despite weaker GDP growth in Q1, the year-over-year change continued to accelerate, albeit modestly. For the seventh quarter in a row, the annual rate of economic output in real terms picked up speed, edging up to 2.9% — the fastest increase in nearly three years. Nominal GDP growth also picked up in Q1, advancing 4.8% vs. the year-earlier level – the strongest annual gain since 2015’s first quarter.

It’s unclear if the deceleration in the quarterly GDP change is a sign of things to come, but the firmer year-over-year trend offers a reason for thinking positively. By minimizing the short-term noise that can infect quarterly comparisons, the annual numbers are arguably more reliable for measuring the broad macro trend.

“The labor market is seemingly still getting better, wages are finally starting to increase and you’re getting a tax cut on top of all that,” notes Jacob Oubina, senior U.S. economist at RBC Capital Markets.

Meanwhile, Now-casting.com’s Q2 estimate for GDP growth was revised up today to just below 4%, which suggests that there’s still a reasonable case for expecting a second-quarter rebound.

“The first quarter has been persistently weak in recent years,” says David Sloan, senior economist at Continuum Economics. “We expect a rebound. Tax cuts will support consumer spending and business investment,” although “trade is certainly a risk.”

Pingback: US GDP Growth Slowed in First Quarter - TradingGods.net

Pingback: Is A New Bear Market Lurking For The US Stock Market? – Investing.com – Tradersville

Pingback: April Employment Growth Picks Up After A Weak Gain In March | Growth Investing Research

Pingback: James Picerno - Softer Inflation Data For April Doesn’t Change Fed’s Policy Outlook - Wealth365 Summit - Online Financial Conference