The world’s largest economy continues to post upbeat economic data as 2021 draws to a close, but there are hints that growth may suffer in the new year.

The latest risk factor is the political collapse of the Build Back Better Act (BBB), a $1.75 trillion economic and climate package. Earlier this week, Senator Joe Manchin – the key swing vote in the Senate – announced he wouldn’t support the bill, which effectively kills the legislation in the evenly divided chamber.

Goldman Sachs economist Jan Hatzius and his team subsequently advised in a research report that “a failure to pass BBB has negative growth implications.”

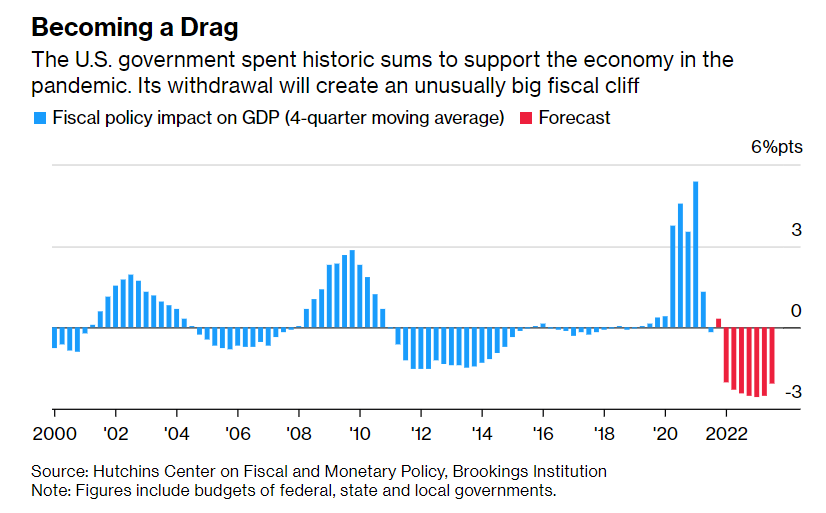

The timing couldn’t be worse as the nation enters another winter with a new coronavirus wave triggered by the Omicron variant and receding Federal government support. One estimate of fiscal policy’s influence on US GDP growth is projected to pull back sharply in 2022 after a dramatic run higher, as shown in the chart below.

Mark Zandi, chief economist for Moody’s Analytics, tweeted on Monday:

If BBB doesn’t become law, real GDP growth in 2022 will be lower by 0.5% and reaching full-employment next year will prove elusive… Without BBB, the economic recovery will be vulnerable to stalling out if we suffer another serious wave of the pandemic; an increasingly likely scenario with Omicron spreading rapidly. Detractors of BBB worry about inflation, but without it, the worry is more likely to be growth.

The good news: there’s a strong tailwind in Q4, which will help limit the damage in 2022’s Q1. The Atlanta Fed’s GDPNow model, for instance, is nowcasting US GDP growth at 7.2% annualized in the final three months of this year (as of Dec. 16). That’s up sharply from Q3’s modest 2.1% increase.

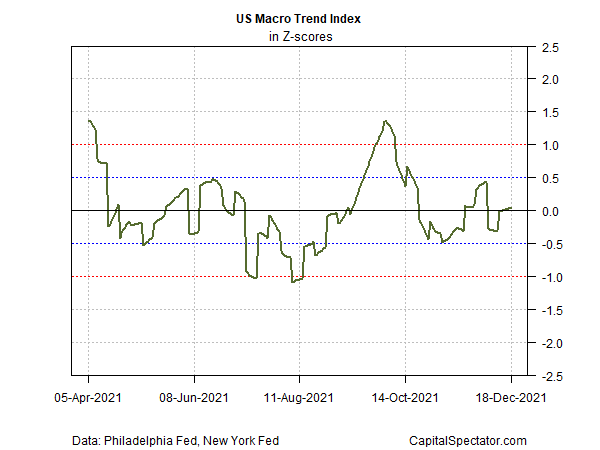

The Capital Spectator’s Macro Trend Index (MTI) indicates that recent US economic activity shows no sign of a negative bias in recent weeks. MTI tracks the fluctuation in the directional bias for US economic activity in real time and currently reflects data through Dec. 18. At the moment, the index reflects an equilibrium reading (index within the blue bands). Pairing that profile with an economy that’s still expanding suggests the near-term outlook remains skewed toward growth.

The key test will come after in January, after the holiday spending has faded and the blowback from the pullback in federal support and the spread of the Omicron variant starts to resonate.

An early sign of trouble will likely show up in MTI. If the index falls below the -0.5 mark, the slide will point to a markedly weaker trend in the immediate future. For the moment, steady as she goes.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report