The private workforce grew by a weak 89,000 in March, the US Labor Department reports. The gain, which fell far short of the 221,000 increase for February, is well below what the crowd was expecting. Economists were looking for a moderate increase of 170,000 in private-sector employment last month, according to Econoday.com’s consensus forecast. Meanwhile, the strong ADP Employment Report for March hinted at even faster growth at the close of the third quarter. Today’s update from Washington, however, presents a dramatically softer tone for the US labor market.

Some analysts advise against assuming the worst. “Even if payrolls are slowing down, I’m not sure that that means the labor market is weakening,” Stephen Stanley, chief economist at Amherst Pierpont Securities, tells Bloomberg. “To the extent that it is slowing down or going to slow down, it’s probably more a function of tight supply than weakening demand.”

“It was not a particularly good number, that’s for sure, but I think one of the things we have to do in fairness is take out the retail number,” JJ Kinahan, chief strategist at TD Ameritrade, adds via CNBC. “Let’s face it, retail stores are trying to figure out what is the proper balance between brick-and-mortar and online sales. If you do take that number out, it’s not quite as bad a jobs report.”

It’s also worth reminding that month-to-month employment numbers can be noisy and history suggests taking any one data point with a grain of salt. Recall that the May 2016 change in private employment fell to nearly zero (+17k), prompting worries at the time that the US economy was destined for a new recession. As it turned out, employment growth bounced back and the economy continued to grow at a moderate pace.

Revisions can be dramatic as well. It’s not unusual to see big gains or losses moderate, sometimes dramatically, in the second and third round of estimates for a given month.

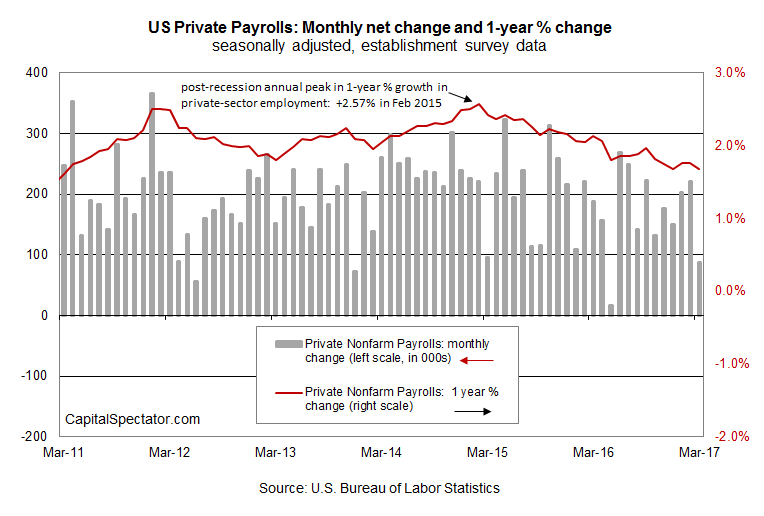

Keep in mind, however, that even if today’s monthly comparison is noise, the March data feeds into a trend that’s been in force for several years: decelerating year-over-year growth.

The annual rate of private-employment growth, which is a more reliable measure for business-cycle analysis, ticked lower in March, dipping to 1.67%. That’s the softest year-over-year advance since 2011. Taken at face value, that’s not terrible, but the numbers du jour suggest that the downside bias in the annual pace that’s been in force for the last two years remains intact.

By contrast, the ADP Employment Report for March suggests that growth is stabilizing and perhaps picking up in year-over-year terms. Note too that yesterday’s weekly update on jobless claims, which is considered a leading indicator for the labor market, is unequivocally bullish. New filings for unemployment benefits dropped by a hefty 25,000 to a seasonally adjusted 234,000, which is close to a multi-decade low.

In other words, it’s premature to conclude from today’s report alone that the labor market’s forward momentum has hit a wall. The senior economist at the Economic Policy Institute advises that last month’s disappointing jobs report is “likely a blip in an otherwise solid report.” She explains to Politico that the sharp slowdown is due “in part to seasonal adjustments not capturing the early March winter storms and a mild pullback after February’s strength and unusually mild weather.”

Perhaps, but that doesn’t change the fact that the annual trend has been slowing and continues to decelerate, based on the government’s numbers. Growth could pick up in the months ahead, of course, but the momentum for now suggests that slowing growth remains a risk factor. If so, the Federal Reserve’s plans to continue raising interest rates may be due for an attitude adjustment.

The key question is whether the upbeat ADP numbers paint a more-accurate profile of the labor market vs. the Labor Dept.’s worrisome estimates? No one knows at this point. Perhaps Monday’s broader profiles on the state of employment for March will provide deeper clarity via the Federal Reserve’s Labor Market Conditions Index and the Conference Board’s Employment Trends Index.

Meantime, there’s a higher level of doubt about what comes next in the wake of today’s release.

Pingback: Private Workforce Growth Slows - TradingGods.net