The assault of the US Capitol on Wednesday failed, allowing Congress to certify Joe Biden’s election victory after a harrowing day in Washington. But the challenges for the US economy endure.

A new warning sign emerged in yesterday’s December report on private employment, according to the ADP Employment Report. For the first time since April, when the economy was crashing due to the pandemic, US companies cut payrolls. Total US nonfarm private employment fell 123,000 last month. The decline surprised economists: a 130,000 increase was expected, according to Econoday.com’s consensus point forecast.

The setback is hardly surprising in the wake of persistently high jobless claims. Although the number of new filings for unemployment benefits have pulled back from the extremes during March and April, the roughly 800,000-per-week increase has been persistent in recent months — pace that exceeds the worst points in previous recessions, week after week. Unfortunately, today’s update is expected to fall in line with this worrisome trend.

The blowback is starting to spill over into payrolls, as the ADP report shows. “As the impact of the pandemic on the labor market intensifies, December posted the first decline since April 2020,” says Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “The job losses [in December] were primarily concentrated in retail and leisure and hospitality.”

Ian Shepherdson, chief economist at Pantheon Macroeconomics, agrees, explaining that the main source of the weakness is the ongoing blowback for traditional retailers and other firms in the services sector. “The underlying story here is the impact on the services sector from the patchwork of anti-Covid measures imposed across the country in the fourth quarter, alongside people choosing to reduce their social interactions in the face of soaring infections,” he advises in a research note.

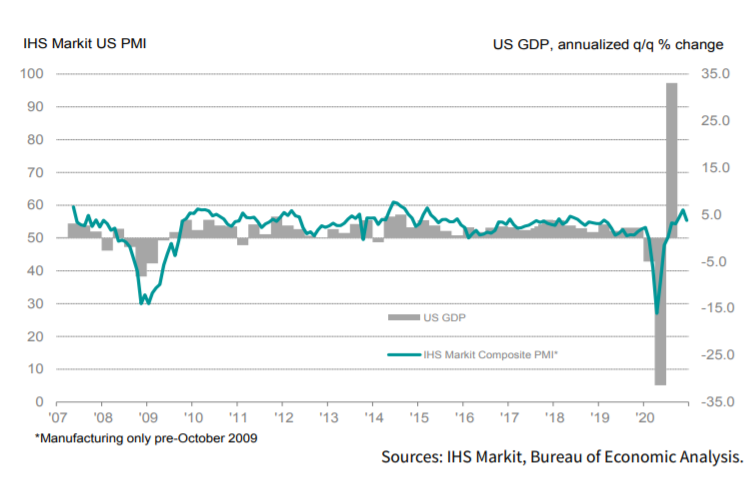

For now, the upcoming fourth-quarter GDP report remains on track to post a solid increase, at least by historical standards. Output is projected to rise 4.1% (seasonally adjusted annual rate), based on the median nowcast via a set of estimates compiled by CapitalSpectator.com. That’s up fractionally from the previous estimate published a month ago. The steady forecast is encouraging, but the decline in payrolls last month suggests that the Q4 GDP estimate is vulnerable to downgrades ahead of the official release on Jan. 28 from the Bureau of Economic Analysis.

There are also signs that December’s broad economic trend slowed, based on yesterday release of the IHS Markit Composite PMI Output Index, a survey-based GDP proxy. The index slipped to 55.3 in December, a three-month low. Although that’s still comfortably above the neutral 50 mark, the softer print is worrisome in the current environment.

“While the survey data remained sufficiently resilient to indicate that GDP continued to expand at a relatively robust rate in the fourth quarter, the near-term outlook has deteriorated,” says Chris Williamson, an economist at IHS Markit. “Business expectations for the coming year fell considerably compared to November, as some postelection exuberance waned and companies grew more anxious about the ongoing impact of the pandemic.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: Economic Rebound Expected to Persist - TradingGods.net