Today’s retail sales report for September offers more evidence that consumer spending is plodding along at a sluggish pace. The appetite for consumption has clearly downshifted in recent months, but it’s not obvious that spending is falling off a cliff into a recessionary hole when we look at the annual comparison.

Headline retail sales increased 0.1% in September vs. the previous month, which is in line with expectations. That’s a tepid rate and it marks the second straight month of slower growth. But reasoning from monthly comparisons is a dangerous proposition. A more reliable measure is the year-over-year trend, and by this standard growth picked up a bit.

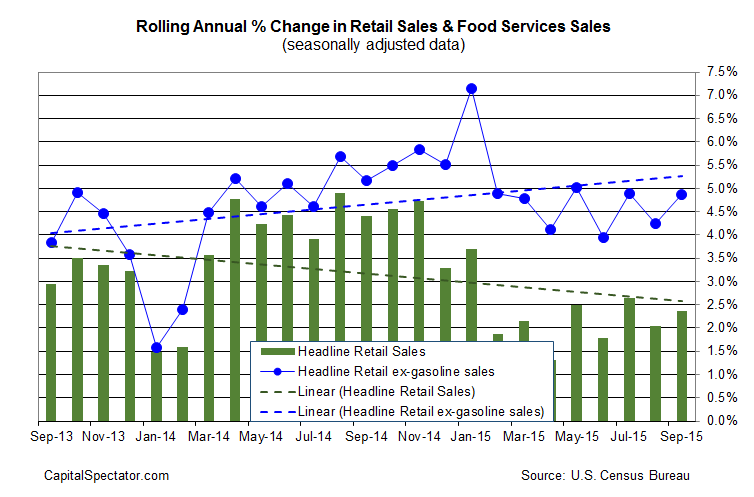

Headline retail spending advanced 2.4% in September vs. the year-earlier level—a moderate improvement over August’s 2.0% rise. Meanwhile, stripping out gasoline sales continues to paint a considerably brighter profile of the trend. Retail sales ex-gas jumped 4.9% last month vs. a year ago. That’s a decent improvement over the 4.3% year-over-year gain in sales ex-gas in August.

The message is that flat to declining expenditures on gasoline sales is still weighing on the headline trend. Why? Energy prices are relatively low compared with recent history, a change that’s taking a bite out of the dollar value of sales at the pump. Spending on gasoline slumped 3.2% last month and dropped nearly 20% compared with a year ago.

But retail spending otherwise is relatively steady on a year-over-year basis, albeit at a lesser pace of growth compared with last year’s strongest gains. If you’re looking for signs that consumer spending is fading fast, retail sales ex-gas isn’t helping your case. Consumption by this yardstick continues to rise on an annual basis at a pace that’s close the highest level since February. Yes, that’s a slower rate of growth vs. last year, but for the moment it appears to be stable. That’s not great news if you’re trying to drum up a case for projecting stronger US economic growth, but it’s not a smoking gun for arguing that last month was the start of a recession.

The key question that today’s numbers promote: Is the US on a sustainable path of slower growth? If the answer is “yes”, there are several macro implications to consider. One is that the Fed can leave rates lower for longer. Two, the business cycle’s historically sharp changes—strong growth followed by deep recessions followed by strong recoveries—may no longer be a valid template, at least for the foreseeable future. Instead, we may be looking at sluggish growth that lasts longer. That’s disappointing, but it’s not the raw material for expecting a deep recession either.

“Consumption has been a strong pillar of growth over the summer, but this pillar is probably more fragile than previously expected,” Thomas Costerg, a senior US economist at Standard Chartered Bank, tells Bloomberg. “Consumers would like to see more wage growth before spending a bit more freely.”

As for the immediate future, one thing seems to be clear after looking at today’s update: The case for tightening monetary policy is weak, advises Paul Ashworth, chief US economist at Capital Economics, via Reuters. “The softness of September’s figures supports our view that the Fed probably isn’t going to hike interest rates until early next year.”

Pingback: Retail Sales Report Indicates Sluggish Consumer Spending

Pingback: 3 Numbers: U.S. Jobless Claims Edge Up, Sentiment, Fed Surveys

Pingback: Industrial Output Fell Last Month