The value factor may not be dead, but it’s certainly on life support. The question is whether this popular but currently challenged risk premium for equity investors will revive any time soon, if ever? No one knows, at least no one without a reliable crystal ball. But perhaps we can find some clues on what’s coming by searching for likely smoking guns that are behind value’s demise (or current state of suspended animation, if you prefer).

A recent research report from J.P. Morgan does the heavy lifting on this front. The deep dive in this June 6 study outlines several “structural headwinds” that are on the short list for explaining value’s big fade in recent years. These headwinds also offer insight for handicapping the probability of a comeback.

For the uninitiated, the basic definition of a value strategy covers the waterfront as a generic label for favoring assets that have fallen on hard times. (Here’s a simple screen for ETFs, for instance.) The assumption is that out-of-favor pricing offers relatively high expected returns. Decades of research suggest as much, and there are many investors with the real-world results to support the idea – Warren Buffett in his glory days is perhaps the most persuasive example. The details can be messy, however, and so generalizing about strategy details and time periods for deciding when/if the strategy “works” can lead to trouble vis-à-vis real-world applications.

Is Recession Risk Rising? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

As for the future for value, perhaps by dissecting the perfect storm that blew the strategy off course in recent history offers a foundation for estimating the prospects for recovery… or determining that revival is unlikely.

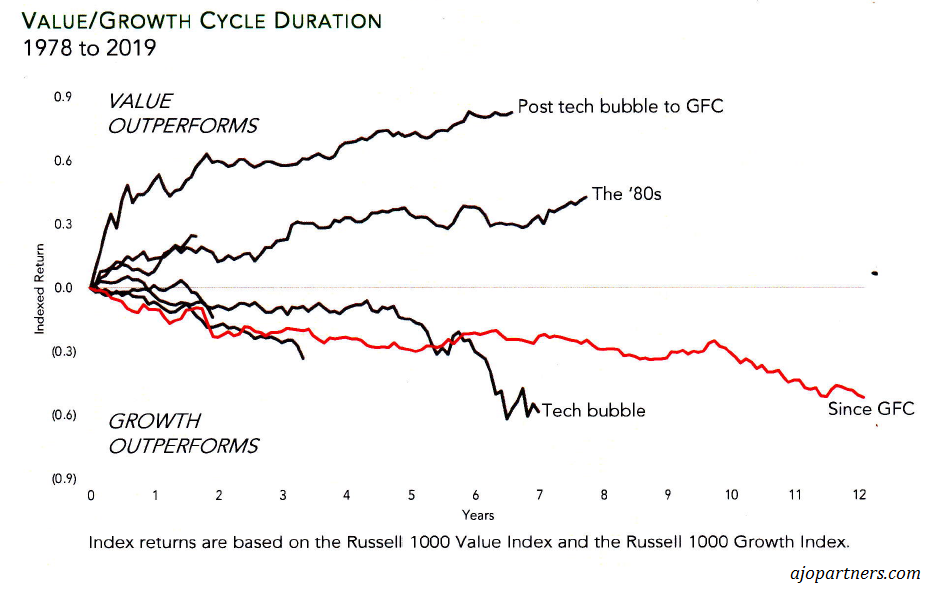

But first, let’s survey the damage. AJO Partners, a Philadelphia money management shop that favors an active approach to value strategies, offers a powerful visual summary of the hole that value has fallen into. By AJO’s reckoning, value’s run of underperformance is the longest over the last four decades, based on defining value as the Russell 1000 Value Index relative to Russell 1000 Growth. The current weakness has persisted since the Great Financial Crisis (GFC) of 2008, according to AJO. And while the current slump isn’t quite the deepest in value’s recent history, the loss of performance altitude, assuming it continues, will soon take the red ink crown for duration in recent history (since the late-1970s).

The case for optimism in the near term appears challenged, or at least it does from the perspective of the rear-view mirror. But value has stumbled before and subsequently found its mojo. Is this time different? No, predicts Cesar Orosco, a principal at AJO. In the latest of the firm’s semi-regular mailings to clients, the press and others on the company’s list, he wrote that AJO’s “conviction” on value’s capacity for resurrection “has not wavered. More than ever, we are convinced that a systematically applied, multi-pillared, value approach will provide the greatest rewards.”

Of course, that’s what you’d expect a value shop to say. But to be fair, history offers support for Orosco’s optimism. Does J.P. Morgan’s research (supplied via AJO) suggest otherwise this time?

“One of the enduring and puzzling features of this equity cycle has been Value’s lackluster performance,” the global quantitative strategy group at the bank wrote in “The Value Conundrum,” a June 6, 2019 report. The 20-page study offers a short course on what has gone wrong for value, along with perspective on what needs to go right for a revival.

At the core of the analysis is J.P. Morgan’s thesis that six “structural headwinds” account for the value’s troubles of late. Let’s briefly review each:

- Slower mean reversion This headwind “is working against the value trade in this cycle, especially for the short portfolio (i.e. most expensive stocks). Noting that mean reversion is the “key driver” for value, J.P. Morgan documents that reversal force has slowed considerably compared with past regimes for the strategy.

- Disruptive technologies are a drag on value “The convergence of tech, media and communications,” as a fundamental part of the economy, has created headwinds for value. “That trend has accelerated in the last 10-15 years through disruptive integration of the internet, automation, social media and artificial intelligence in consumer and business applications.” For so-called legacy market leaders that haven’t fully jumped on board this train, their market multiples have stagnated, ensuring the shares a role as “persistent members of the value portfolio.” The traditional avenue of escape (a rebound in market multiples) appears closed. Value stocks are suffering the double whammy of “poor fundamentals” and market share that’s “being eaten away by the disruptive growth companies.”

- Indexation and rise of stock correlation have led to value extinction The rise of indexing – roughly 60% of assets under management in the US, according to J.P. Morgan – has created a new class of investor that tends to buy and hold “irrespective of… differing fundamentals [for stocks]. It has lowered stock return dispersion, leaving fewer opportunities for price reversion.”

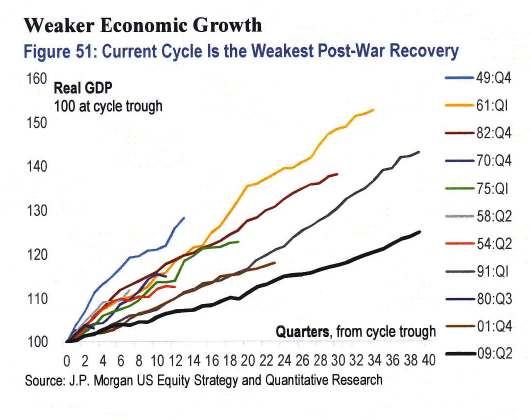

- The weakest post-War economic recovery and low real interest rate environment limit value effectiveness Real US economic growth in all post-World War Two recoveries “has exceeded 4% mid-cycle for at least several quarters.” Until now. Growth for the current cycle has averaged 1.8% and never rose to 4% — “one of the weakest in the last 70 years.” The slow-growth trend, combined with persistently low interest rates, has driven investors to favor bond proxies, such as low-volatility and high-quality equity strategies. In turn, that has kept valuations on those strategies “extremely high.”

- Prolonged easy monetary policy globally and access to cheap capital favors growth over value “As a result, long periods of cheap capital can divert interest from value (similar to 1990s).”

- Fundamental and risk characteristics of value have changed over time, some have deteriorated, others have improved As a result, “value stocks have become more risky—their beta and volatility profiles have increased…” One of the key reasons: “deteriorating pricing power…” On the bright side, the downside in the next recession could be limited for value stocks due for several reasons, including stable growth, lower leverage and higher buyback activity.

Could value bounce back? Yes, at least in theory. But J.P. Morgan reasons that a sustained recover needs the following conditions:

- Regulations that foster competition

- Saturation of passive and private equity products and stabilization of assets in activity equity strategies

- Less policy uncertainty, including “fewer disruptions from Trump”

- Faster global economic growth

- A return of something approximating a so-called normal business cycle: a “full-blown recession forcing premia to re-price”

Even without a clear return of all those conditions, value’s prospects aren’t entirely diminished. “We believe that short-lived and sharp value snapbacks are still very likely given extreme conditions.” J.P. Morgan points out, for instance, a wide gap – the “biggest market dislocation” – exists between value and low vol stocks.

Is any of this enough to revive the fallen star of value investing? Maybe, maybe not. But if you’re inclined to bet in the affirmative, and are willing to assume the risk of being wrong, recent conditions offer fertile terrain for a wager. If not now, when?

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: What Is Killing the Value Factor? - TradingGods.net

Pingback: This Week's Best Investing Reads 7/5/2019 | Stock Screener - The Acquirer's Multiple®