Rising worries about the global economy triggered a strong wave of fixed-income buying last week, propelling US bonds to the top of the performance ledger for the major asset classes, based on a set of exchange-traded funds.

Monthly Archives: August 2019

Macro Briefing | 19 August 2019

Hong Kong protests persist, defying HK police and Beijing: Vox

Trump tells supporters he doesn’t see a recession coming: CNBC

Trump isn’t quite ready to cut a trade deal with China: Bloomberg

Ten grey-swan risks that are stalking the global economy: MW

Has the post-war economic miracle run its course? NY Times

Fed caught between the rock (economy) and the hard place (Trump): WSJ

Warren Buffett’s latest contrarian play: buying bank stocks: NY Times

US consumer sentiment fell more than expected in August: CNBC

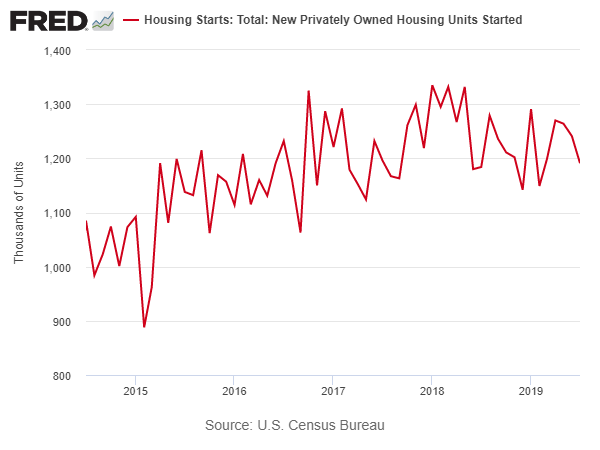

US housing starts fell for a third month in July: HousingWire

Book Bits | 17 August 2019

● Kochland: The Secret History of Koch Industries and Corporate Power in America

By Christopher Leonard

Review via The New Yorker

If there is any lingering uncertainty that the Koch brothers are the primary sponsors of climate-change doubt in the United States, it ought to be put to rest by the publication of “Kochland: The Secret History of Koch Industries and Corporate Power in America,” by the business reporter Christopher Leonard. This seven-hundred-and-four-page tome doesn’t break much new political ground, but it shows the extraordinary behind-the-scenes influence that Charles and David Koch have exerted to cripple government action on climate change.

Continue reading

The Bond Market’s All-In On Its Recession Forecast

Mounting recession worries of late have taken a bite out of stocks, but heightened fears that an economic contraction may be near has lit a fire of buying for US bonds. Long bonds in particular have soared recently, delivering stellar results, as shown by a set of exchange-traded funds representing the major slices of the US fixed income market.

Macro Briefing | 16 August 2019

Trump defends his economic policy as recession worries mount: Reuters

N. Korea launches missiles and rejects talks with S. Korea: BBC

Economists raise US Q2 GDP growth outlook to median +2.1%: CNBC

St Louis Fed President: inverted yield curve bearish only if it persists: CNBC

US jobless claims rose to 6-week high last week: MW

US homebuilder optimism strengthens in August: HousingWire

US manufacturing output fell in July following two months of growth: Reuters

Fed bank mfg surveys strenghen in August: CNBC

Retail sales in US increased 0.7% in July, a four-month high: MW

And Then There Were Two (Inverted Yield-Curve Recession Signals)

One of the crowd’s favorite yield curve pairings (the spread on 10-year less 3-month Treasuries) has been signaling elevated US recession risk since May. As of yesterday (Aug. 14), the 10-year/2-year spread has gone over to the dark side too. That alone doesn’t insure that economic output will slump in the near term, but it’s a clear message that the crowd has increased its collective bet that a US downturn is approaching.

Macro Briefing | 15 August 2019

China set to retaliate against new US tariffs: Bloomberg

Trump suggests ‘personal meeting’ with China’s Xi over Hong Kong crisis: CNBC

Warning signs suggest global economic slowdown is accelerating: WSJ

Chinese paramilitary exercise near Hong Kong — a ‘clear warning’: Reuters

US moves to block release of Iranian oil tanker in Gibraltar: CNN

Business inflation expectations steady at 2.0% in August: Atlanta Fed

US import prices rose in July but trend remains weak: Reuters

10yr-2yr Treasury yield curve inverts, issuing a new recession warning: BBG

It’s An Expansion, If You Can Keep It

President Trump’s decisions on the US-China trade war reflect a method to the madness, his supporters insist. To everyone else, it just appears to be madness. Regardless, Trump’s abrupt announcement on Tuesday that new tariffs on Chinese goods would be delayed inadvertently provided some clarity on the US economy.

Macro Briefing | 14 August 2019

Trump delays Chinese tariffs, igniting stock market rally: WSJ

China refuses port visits in Hong Kong for US warships: Bloomberg

Calm returns to Hong Kong airport after protests: CNN

Five of world’s major economies at risk of recession: CNN

German economy contracted in second quarter: BBC

China’s industrial production in July posts slowest growth since 2002: Reuters

US small business optimism ticked up in July, close to post-recession high: NFIB

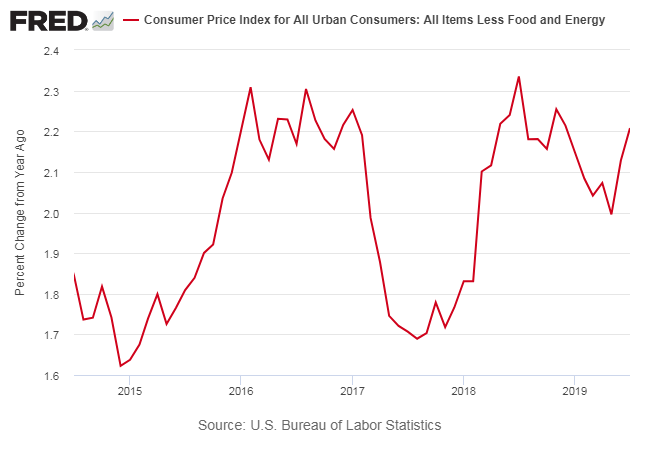

US core consumer inflation edged higher in July to +2.2% annual pace:

Bond Market Smells Recession. Will The Real Economy Follow?

Asset pricing is often mysterious as a source of figuring out exactly what Mr. Market is discounting, but in the case of bonds these days there’s no ambiguity about the crowd’s outlook. Recession is effectively a forgone conclusion, the yield curve is predicting. But while the real economy has slowed, growth remains strong enough to dispute the market’s forecast, at least for now. The question is when or if the hard data will align with market’s dark expectations?