Index-based investing is often seen as a benchmark for active strategies, and rightly so. But what’s easy to overlook is the fact that indexing also represents an investment strategy, one with a particular set of pros and cons that can compliment active strategies.

Monthly Archives: October 2020

Macro Briefing: 9 October 2020

Stimulus talks in Washington stumble on: BBG

WHO reports record one-day rise in global coronavirus cases: Reuters

Louisiana coast braces for Hurricane Delta: AP

Economists expect slow recovery in US jobs, according to survey: WSJ

US budget deficit expands to record $3.1 trillion in FY 2020: AP

Wall St banks see record revenue for govt-backed mortgage debt trades: Reuters

UK economy grew 2.1% in August, less than expected: CNBC

China’s services economy grows at faster pace in September: Reuters

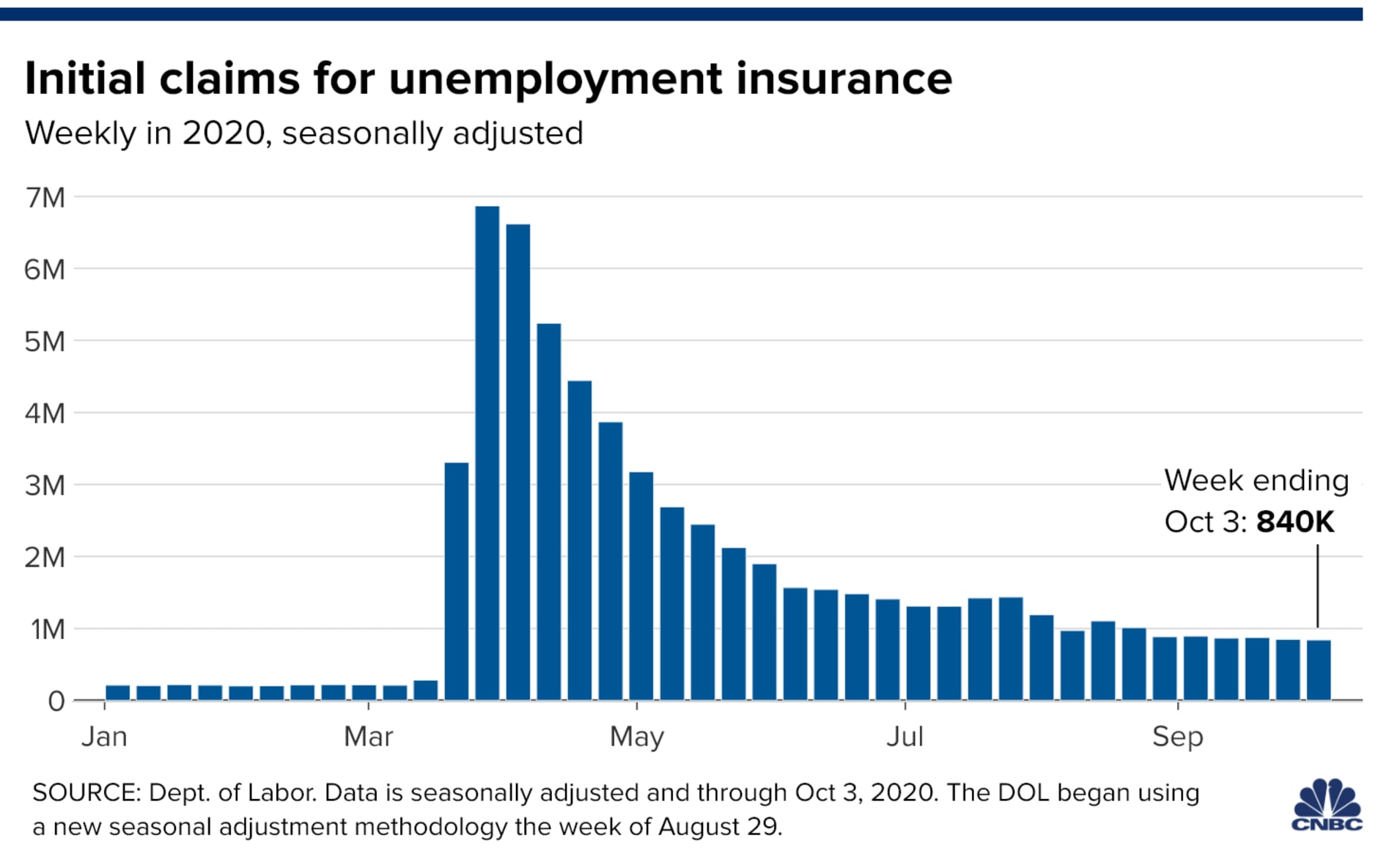

Are the jobless claims numbers accurate? FW

US jobless claims remain high, posing threat to economy: CNBC

Profiling Diversification Attributes With Principal Components

The holy grail of portfolio design is combining assets so that returns are relatively stable if not higher, risk is generally lower and the overall mix delivers stronger risk-adjusted performance that’s not otherwise available through owning the components separately. Diversification, as the saying goes, is the only free lunch in investing.

Macro Briefing: 8 October 2020

Regeneron asks for emergency approval for Covid-19 Therapy: BBG

US jobless claims expected to remain high in today’s update: WSJ

Hurricane Delta threatens threatens US Gulf Coast: CNN

Faltering stimulus talks in Washington threaten economy: CNBC

Investors eye healthcare sector as Biden lead in polls grows: Reuters

Low bond yields create challenges for baby boomers looking for safety: NYT

Fed minutes: officials worried about lack of fiscal support for economy: CNBC

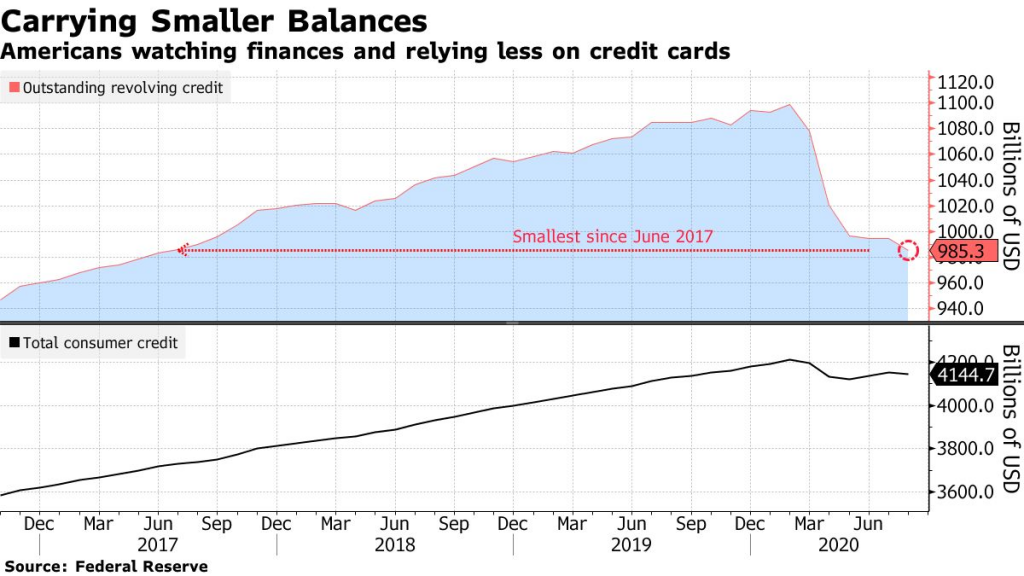

US consumer borrowing fell in Aug as credit-card balances continue to slide: BBG

The ETF Portfolio Strategist: 7 October 2020

Resilience Revived? Election/political risk in various forms has been squeezing the US equity market in recent weeks, but the correction appears, once again, to be a temporary diversion.

US Q3 GDP Expected To Rise Sharply As Q4 Outlook Dims

The US economy is still on track to post a strong rebound in the upcoming third-quarter GDP report, but Q4’s prospects appear to be fading, according to recent nowcasts compiled by CapitalSpectator.com and analysis by economists.

Macro Briefing: 7 October 2020

Trump ends stimulus talks between GOP and Dems until after election: WSJ

After rejecting stimulus talks, Trump appears to reverse course: CNBC

End of pre-election stimulus talks threatens more economic pain for US: BBG

Fed’s Powell recommends more stimulus to aid economic recovery: CNBC

Covid-19 continues to spread among Trump’s inner circle: BBC

US lawmakers focus on reforms for Big Tech: Reuters

Iran warns that fighting in Caucus could trigger regional war: Reuters

Another former Soviet republic (Kyrgyzstan) succumbs to political chaos: BBC

German industrial output slipped in Aug after 3 monthly gains: MW

Venezuela, once a major oil producer, grinds to a halt for crude output: NYT

US traded deficit at 14-year high in August: AP

US job openings retreat for the first time in four months in Aug: BBG

Latest Rise In 10-Year Yield Stirs Reflation Forecasts… Again

It doesn’t take much to set reflation expectations on fire these days. With US interest rates near zero (or negative in some parts of the world), a mild uptick in yields inspires a new round of forecasts that a sustained run of higher inflation has finally started.

Macro Briefing: 6 October 2020

Trump returns to White House with cautious prognosis: WSJ

CDC’s new coronavirus guidance: it can spread on airborne particles: CNBC

US Sec. of State, meeting with Asian allies, criticizes China’s ‘malign activity’: IBT

Two-track recovery unfolding as US economy struggles with coronavirus: WSJ

House antitrust report suggests breaking up Big Tech: Reuters

Global economic recovery slowed in Sep but remains “solid”: IHSM

German factory orders continued to recover in August: MW

PMI survey: US economy continued to rebound in September: IHSM

US services sector expands for fourth month in a row in Sep: MW

Most Asset Classes Rebounded Last Week While Commodities Fell

Global markets recovered lost ground last week, although a measure of broadly defined commodities continued to fall, based on a set of exchange traded funds through Oct. 2.