After a stellar first half in 2022, the energy sector stumbled, inspiring some analysts to forecast that the bull run was over. But that view is looking premature as Big Oil shares rally anew.

Yearly Archives: 2022

Macro Briefing: 26 October 2022

* The energy future the West wants is magical thinking

* Natural gas and electricity prices in Europe plunge from summer peaks

* Health insurance inflation, a key CPI input, is expected to drop sharply

* Microsoft reports profit slide amid slowdown in personal computing industry

* Hydropower, world’s biggest source of clean energy, is evaporating fast

* Atlanta Fed Mfg Index continues to report weak conditions in October

* US consumer confidence eases in October after gaining for two months

* US home prices decelerate at rapid rate in August:

US Economy Is Set To Rebound In Thursday’s Q3 GDP Report

Economic activity for the US for the third quarter is on track to recover in this week’s initial estimate from the government, based on the median for a set of estimates compiled by CapitalSpectator.com. The rebound is set to fade in Q4, however, according to early projections and so any celebrations over this week’s results may be short-lived.

Macro Briefing: 25 October 2022

* UK economic, financial turmoil await Rishi Sunak, the incoming prime minister

* World in ‘global energy crisis’, says head of the International Energy Agency

* Fed’s rate hikes will pause when inflation halves, economist predict

* Recession is price to pay for taming inflation, says JP Morgan president

* China’s yuan falls to 15-year low against the US dollar on Tuesday

* China probably won’t bail out its ailing property sector, says economist

* US economic activity contracted in October via PMI survey data

* Chicago Fed Nat’l Activity Index indicates “steady” US growth in September:

Global Markets Stage Broad Rebound In Last Week’s Trading

Offering a reprieve from bear-market conditions that have pummeled markets for much of 2022, traders bid up prices for most of the major asset classes for the week through Friday, Oct. 21, based on a set of ETFs.

Macro Briefing: 24 October 2022

* Rishi Sunak is set to become Britain’s new prime minister

* Global tension on track to rise as Xi secures third term to lead China

* US rebuts Russia’s claim that Ukraine may use dirty bomb and blame Moscow

* The two Koreas exchange warning shots along disputed sea boundary

* China releases delayed Q3 GDP data, which shows modest rebound in output

* Eurozone economic contraction deepens in October via PMI survey data

* UK economic downturn accelerates in October, PMI survey data shows

* Illegal border crossings into US set to reach record high

* Federal Reserve on track for another 75-basis-points rate hike in November

* US Treasury real yields remain near 13-year highs:

Book Bits: 22 October 2022

● MegaThreats: Ten Dangerous Trends That Imperil Our Future, And How to Survive Them

Nouriel Roubini

Review via Financial Times

At least there were only four horsemen of the apocalypse. But reflecting today’s rampant inflation, Nouriel Roubini now identifies 10 so-called megathreats, spanning various economic, financial, political, technological and environmental disasters. “Sound policies might partially or fully avert one or more of them, but collectively, calamity seems near certain,” Roubini jauntily concludes. “Expect many dark days, my friends.”

Readers of a nervous disposition may want to file this book in the bin before they turn a page. Those braced for an ice bath of pessimism may profit from its gloomy insights about the state of the world. Roubini’s warnings may be alarmingly scary, but they are also disturbingly plausible. One only prays that policymakers have better solutions than the author unearths.

Fed Pivot Watch: 21 October 2022

There are no shortage of risks weighing on markets and economies these days, but perhaps the first question that’s on every investor’s mind: When will the Fed pivot? Everyone has a view, but no one has a clue, which is why monitoring the ebb and flow of key indicators is the first stop on the road to guesstimating when the tide will turn. As the data below suggests, however, a pause in Federal Reserve rate hikes – much less a rate cut – still looks like a low probability event for the immediate future.

Macro Briefing: 21 October 2022

* UK Prime Minister Liz Truss quits but political and economic turmoil will persist

* High inflation is raising political risk for governments in Europe

* 10-year US Treasury yield on track for 12th straight weekly increase

* US home sales continue to fall, dropping for eighth straight month in September

* Philly Fed Manufacturing Index continued to signal sector weakness in October

* US jobless claims fell last week, indicating tight labor market persists

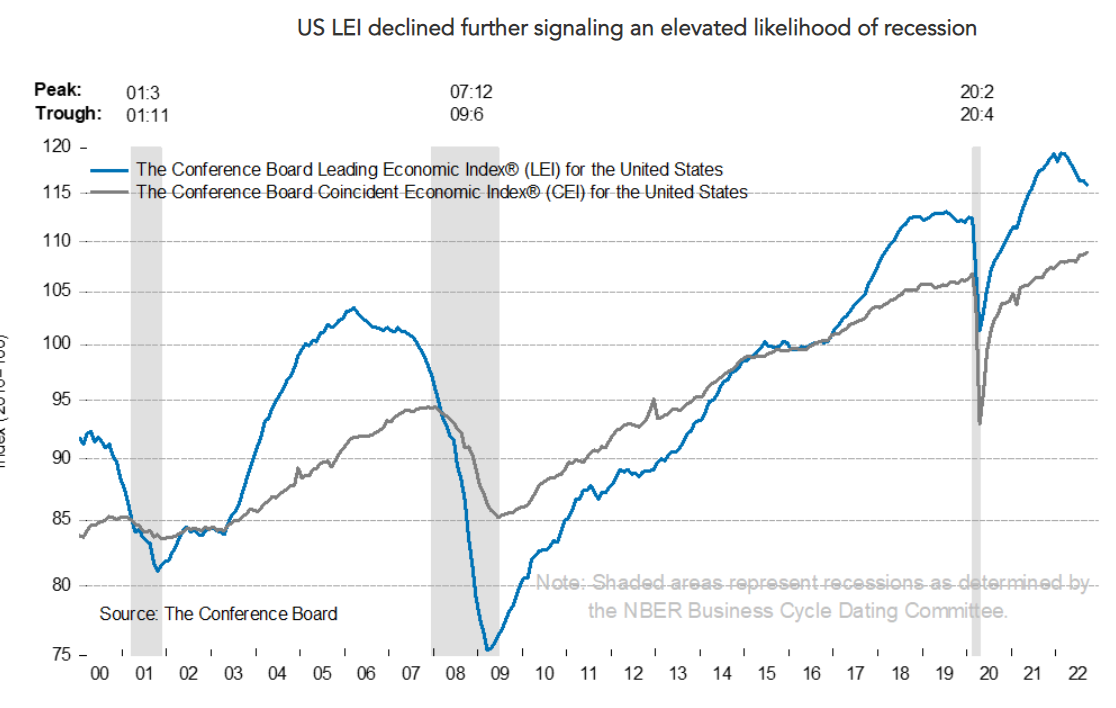

* Leading Economic Index fell again in September, reflecting rising recession risk:

Will The Stumbling Housing Market Drive The US Into Recession?

There’s no mystery why the housing sector is stumbling. Surging mortgage rates are taking a toll: a 30-year fixed rate, for example, is close to 7%, a 20-year high. The question is whether this key slice of the US economy will overwhelm the positive support from a so-far resilient labor market and strong consumer spending?