Whenever I update CapitalSpectator.com’s long-term return forecasts for the major asset classes I sometimes receive emails from readers asking for comparable estimates for shorter-term horizons. My standard response: there’s already a fair amount of noise in the long-run outlook and the noise rises for shorter time horizons.

Yearly Archives: 2022

Macro Briefing: 30 August 2022

* Violence rocks Iraq’s Green Zone amid violent protests

* Ukraine says new offensive in south is breaking through Russian defences

* France says Russia using energy supply as “a weapon of war”

* Pakistan’s planning minister says country’s floods will cost $10 billion

* US and China announce deal to avoid mass delistings of China stocks from US

* China bank scandal widens as hundreds are arrested

* Russia is raking in more money than ever from selling crude oil

* Global sea levels expected to rise nearly a foot due to Greenland ice losses

* Mortgage lender bankruptcies are rising

* Eurozone economic sentiment falls in August to 18-month low

* 3mo/10yr US Treasury yield stays positive — just barely:

Commodities Rose During Last Week’s Mostly Risk-Off Trading

A broad measure of commodities sidestepped the widespread losses found elsewhere for most of the major asset classes during the trading week through Friday, Aug. 26, based on a set of ETFs.

Macro Briefing: 29 August 2022

* Federal Reserve Chairman Powell says fighting inflation will bring ‘some pain’

* US gross domestic income suggests an economic stall vs. GDP recession

* Sen. Warren “very worried” that Fed rate hikes will “tip economy into recession”

* EU faces five to 10 terrible winters without cap on gas prices, says minister

* Economists cut growth outlook for China economy for full-year 2022 results

* US dollar reaches 20-year high amid expectations for more rate hikes

* German foreign minister says war in Ukraine “could last years”

* China push to become tech self-reliant remains an uphill battle

* Does Friday’s market rout point to a rough road ahead for stocks?

* US consumer spending growth slowed to a 7-month low in July:

Book Bits: 27 August 2022

● The Investing Oasis: Contrarian Treasures in the Capital Markets Desert

J. T. Mason

Summary via publisher (Wiley)

A guided journey revealing hidden values and buried treasures amidst the dangers facing DIY investors. A metaphorical journey through the hot, shifting sands of the capital markets ‘desert’ to awaken readers to the urgency of the “Behavior Gap”—a chronic gap of under-performance relative to the markets experienced by investors worldwide. This is a roadmap of portfolio management concepts and contrarian tactics that can turn misbehaviors, undue risks, and short-term gambles into longer-term strengths. Through 30 chapters and four tiers, the author progressively introduces more powerful tools & techniques used in the founding and successful management of the Oasis Growth Fund, a North American Hedge Fund.

It’s (Still) A Multi-Factor World For Predicting Returns

It’s tempting to assume that you can find a silver bullet for predicting returns. But along with unicorns and free money, reliable (or at least high-confidence) one-factor models for estimating ex ante performance are the stuff that dreams are made of.

Macro Briefing: 26 August 2022

* Markets are focused on today’s speech from Fed Chairman Powell @ 10am ET

* Putin orders increase in Russian military troops

* Russia halts a natural gas shipment to Asia over payment issues

* UK energy bills for households expected to rise 80% in October

* Midwest drought is causing more trouble for grain markets

* Will a housing recession lower house prices? Maybe not, says economist

* US consumers borrow at record levels to buy cars

* US Q2 GDP loss is softer than initially estimated

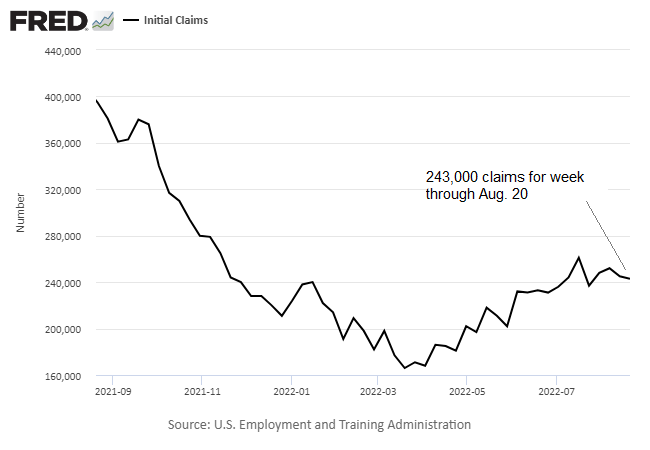

* US jobless claims fall for 2nd week, highlighting tight labor market:

Will Bullish Sentiment Return To Alternative Energy ETFs ?

In a year of upheaval, including worries about conventional energy supplies, the prospects for alternative energy sources should be front and center for investors. Or so one might think. But using a set of ETFs to gauge sentiment suggests the crowd is still lukewarm at best in embracing industries in the alternatives space vs. old-school fossil-fuels stocks.

Macro Briefing: 25 August 2022

* Biden announces student loan forgiveness plan

* California expected to ban sales of new gasoline cars starting in 2035

* China announces more stimulus to support economy

* German leading indicator forecasts continued weakness for economy

* Despite war in Ukraine, Russian goods continue to reach US

* Pending home sales fell again in July but economist says a bottom may be near

* US home prices fell in July–first monthly slide in three years

* New orders for US durable goods flat in July as core orders continue rising:

Rebound Expected For US Q3 GDP, Based On Median Outlook

After two quarters of contraction, US gross domestic product (GDP) is on track to recover in the third quarter, based on the median estimate for a set of nowcasts compiled by CapitalSpectator.com. But there’s a joker in the deck: the implied Q3 estimate based on the latest PMI survey data points to an accelerating slide in output that anticipates a deep recession.