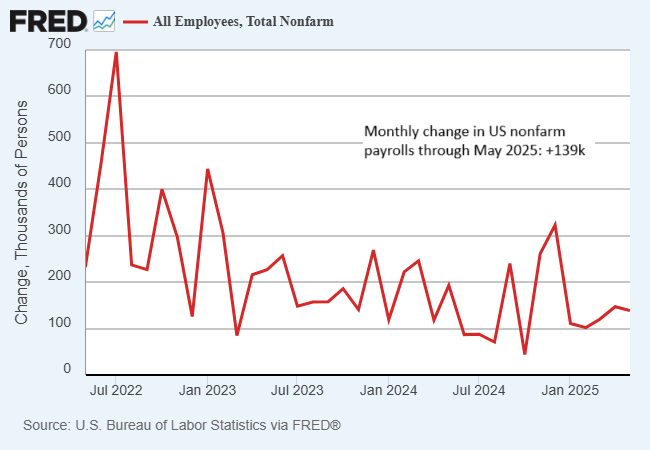

US payrolls rose more than expected in May. The economy added 139,000 jobs last month, the Labor Department reported. “Stronger than expected jobs growth and stable unemployment underlines the resilience of the US labor market in the face of recent shocks,” said Lindsay Rosner, head of multi-sector fixed income investing at Goldman Sachs Asset Management.

Deflation persists in China, based on consumer prices, which fell for a fourth consecutive month in May. The consumer price index fell 0.1% from a year earlier, according to data from the National Bureau of Statistics. Meanwhile, deflation for the country’s producer prices deepened, falling 3.3% from a year earlier in May.

China exports to the US fell 35% in May vs. the year-earlier level, according to customs data. “The acceleration of exports to other economies has helped China’s exports to remain relatively buoyant in the face of the trade war,” wrote Lynne Song of ING Economics said in a research note.

Boeing plans to deliver planes to China as tariff war eases. Deliveries to China of new aircraft stopped in April due to tariffs, but on May 12 the U.S. and China agreed to reduce most tariffs for 90 days.

The US Treasury is scheduled to sell $22 billion of 30-year government bonds on Thursday, an event that will be widely watched as investor appetite for long-term maturities has waned. “All the auctions will be viewed through the lens of a test of market sentiment,” said Jack McIntyre, portfolio manager at Brandywine Global Investment Management. “It feels like US Treasury 30 years are the most unloved bonds out there.”