Federal Reserve official are considering another interest-rate hike, according to yesterday’s release of minutes for the Jan. 31-Feb. 1 monetary policy meeting. The hawkish tone offers another reason to remain cautious on Treasuries. But while the outlook for bonds generally is challenged as interest drift higher, one corner of fixed-income has been immune: junk bonds.

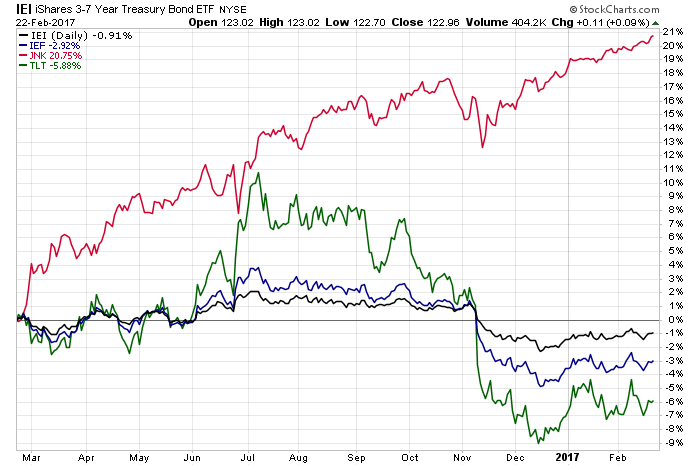

In sharp contrast with the slump in the prices for Treasuries, high-yield bonds remain in a powerful bull market. A review of four ETFs tells the story. Over the past 12 months, SPDR Bloomberg Barclays High Yield Bond (JNK) has surged more than 20%. Meanwhile, iShares 3-7 Year Treasury Bond (IEI) has eased 1% during that period and iShares 7-10 Year Treasury Bond (IEF) is off 3%. Long-term Treasuries have taken the biggest hit: iShares 20+ Year Treasury Bond (TLT) is down 6% vs. the year-earlier price.

The headwind for Treasuries is unambiguous: higher yields are taking a toll. The policy sensitive 2-year yield is currently 1.22% (as of Feb. 22 via daily data published by Treasury.gov) — close to the highest level since the recession ended. The benchmark 10-year yield has climbed recently, too, although the current 2.42% rate reflects a milder ascent compared with the 2-year yield’s dramatic pop.

The increase in bond yields (and the commensurate decline in bond prices) has weighed on fixed-income securities generally – with the glaring exception of junk bonds. The fuel powering the rally in high-yield securities is the ongoing compression in spreads for these bonds vs. Treasuries. The BofA Merrill Lynch US High Yield Option-Adjusted Spread (which compares junk yields to Treasury rates) has slipped to a mere 3.78% (as of Feb. 22), which is near the lowest level since the recession ended in mid-2009.

What accounts for the junk bond rally at a time when interest rates are trending higher? Part of the answer is bound up with the hybrid nature of the securities. Although technically a member of the fixed-income realm, high-yield bonds are often viewed as a quasi equity asset. The reasoning is that if economic conditions are favorable, junk bonds (and their issuers) will fare well. For Treasuries, which are free of default risk, a bullish macro trend can have the opposite effect due to the tendency of the Federal Reserve to raise interest rates as growth heats up.

“Junk bonds tend to act more like stocks in their market behavior than other bonds,” Morningstar explains. “This is because the strength of junk bonds is connected to the strength of the company that issues them.”

In a recession, when interest rates fall, junk bonds might also fall in value because the companies issuing them earn less and are unable to pay off their debts. A rise in company revenues is more important to the health of a junk bond than interest rates are. A strong economy means fewer defaults and more junk bonds that are successful.

Given the relatively upbeat outlook for the US economy, the recent performance of junk bonds comes as no surprise. Recession risk at the moment is virtually nil and economists expect that first-quarter GDP growth is on track to strengthen. Meanwhile, the crowd appears to be pricing in an even stronger growth rate down the road courtesy of bullish predictions linked to the Trump administration’s plans to cut taxes and regulations and roll out a massive infrastructure-spending program.

The caveat, of course, is that with junk bonds priced for perfection, any disappointments could come with a hefty price tag. Even if all goes as planned, a cautious stance may be warranted. The high-yield spread over Treasuries has almost never been lower during the past two decades, which implies that the potential for future gains in junk prices is limited.

The near-term future, however, still looks bright, or so one can argue based on analyzing junk funds through a momentum-based lens. Higher prices beget even higher prices… until the trend reverses. Alas, no one knows when the turning point will arrive.

Meantime, common sense prevails. If junk has been part of your asset allocation strategy and the weight is well above the target range, a round of rebalancing may be prudent.

But prudence is a tough sell in the risk-on Trump environment. The underlying bet is that yield spreads will continue to slide. The operative question: How low can they go? Perhaps a bit lower, although substantially stronger economic growth would almost certainly be required to squeeze the junk spread to the 3% range.

That brings us back to the dominant question for investors: How much confidence do you have in Trumponomics? Mixing politics and investing is generally a bad idea. But in the current climate, separating the two may be difficult, perhaps impossible.

Pingback: 02/23/17 – Thursday’s Interest-ing Reads | Compound Interest-ing!

Pingback: Weekend Reading: Errant Thinking | RIA

Pingback: A Bull Market For Junk Bonds As Interest Rates Rise - TradingGods.net

Pingback: Weekend Reading: Errant Thinking -

Pingback: Weekend Reading: Errant Thinking - Investing Matters

Pingback: Weekend Reading: Errant Thinking | Domainers Database

Pingback: Weekend Reading: Errant Thinking - BuzzFAQs

Pingback: Weekend reading: Warren Buffett’s latest annual letter – Frozen Pension