The epic decline in US economic output in the second quarter was the deepest dive in GDP on record that surprised exactly no one. Economists and macro models have for months been projecting a massive decline as the nation’s economy shut down to combat Covid-19. Government figures released yesterday confirmed the worst fears, which clears the way to focus on the second half of the year.

By most accounts, the economic road is shaky at best for the next several quarters as the country continues to struggle with managing coronavirus. Unfortunately, the silver bullet that could solve everyone’s problem – a proven vaccine that’s widely distributed and widely used – remains elusive for the near-term.

Although the global pharmaceutical industry has made enormous progress at record speed in Covid-19 research this year, the news headlines that everyone wants to read aren’t likely to appear on the immediate horizon.

Barney Graham, deputy director of the National Institutes of Health’s Vaccine Research Center, says that substantial advances have been recorded in recent months for vaccine research. “We could get into a Phase 3 trial in six months instead of two years,” he predicts.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

But even six months, which is an optimistic estimate, is a long time with coronavirus continuing to ravage lives and taking a heavy toll on the economy. And let’s be honest: six months could turn into 12 months or two years. Even if a vaccine is developed and rolled out, it’s not obvious that the results will be 100% effective or that the US population will be eager, willing and able to take a shot or pop a pill for what effectively is a rush job for a drug development.

“This is a huge experiment and no one knows how it’s going to turn out,” observes James Le Duc, director of the University of Texas Medical Branch’s Galveston National Laboratory.

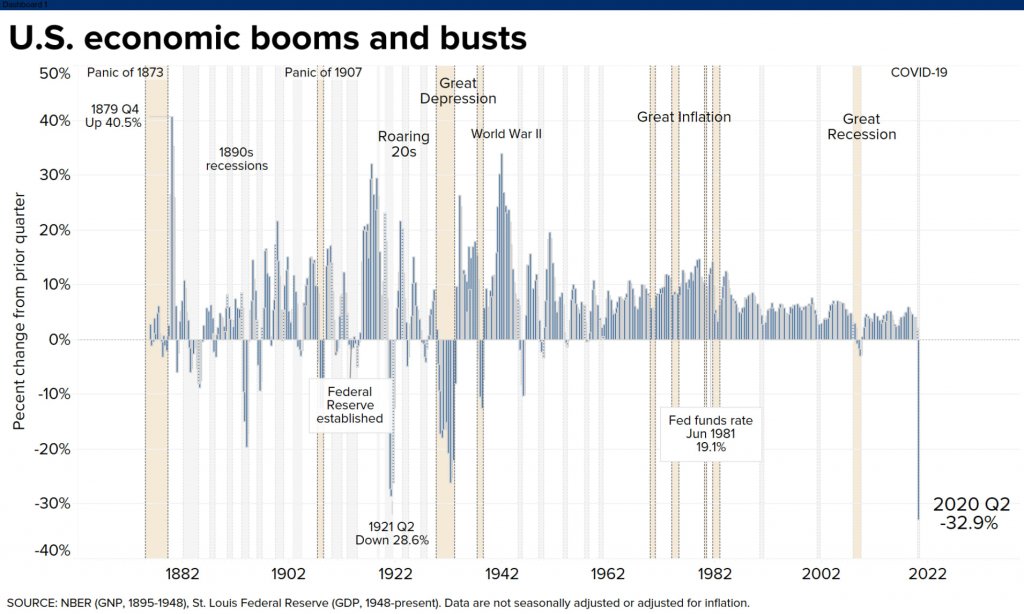

As for the realm of economics and what is known, US GDP plunged 32.9% on an annualized basis in Q2, the Bureau of Economic Analysis reports – the deepest quarterly decline on record.

“It’s a very deep and dark hole and we’re coming out of it, but it’ going to take a long time to get out,” predicts Mark Zandi, chief economist at Moody’s Analytics.

A bit of optimism could be found in last week flash estimate of the US Composite PMI data for July. This survey based read on economic activity — a GDP proxy — rebounded to a neutral print at the start of Q3. As the first non-negative profile since January, the news is encouraging. But this is only an early draft for the road ahead and, to state the obvious, the upbeat data is subject to change as conditions evolve.

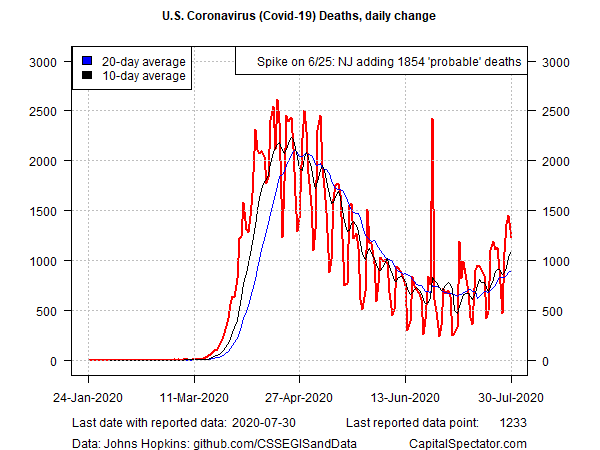

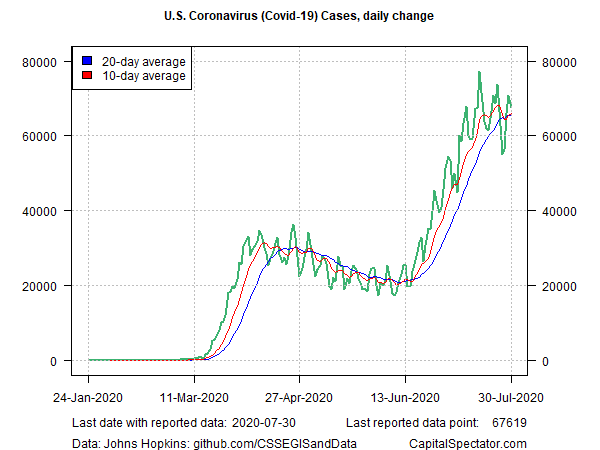

And evolve they will, for all the obvious reasons, starting with the war on the coronavirus—a war that the US appears to be losing at the moment. The trend for the daily change in US Covid-19 fatalities, after sliding for several months, has been rebounding lately, based on data aggregated and reported by Johns Hopkins University.

The raw material for the renewed upside bias in deaths is the rise in cases, which has reached record highs this month. The latest numbers suggest that the surge has peaked, but confirmation will take several weeks and so it’s best to reserve judgment for now.

Meantime, the economic outlook remains precarious. “We expect the economic reality of the virus to start catching up with businesses across the globe soon,” says Jan Lambregts, global head financial markets research at Rabobank.

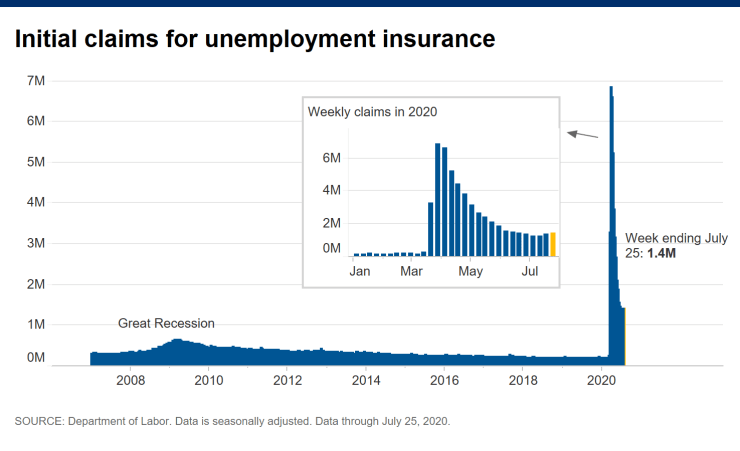

For the US, a critical indicator to watch is the weekly release of jobless claims. Alas, these numbers continue to paint a dark picture for the labor market, which necessarily casts a gloomy aura over the broader economic outlook.

Although yesterday’s GDP report dominated the economic headlines, the latest update on new filings for unemployment benefits remains worrisome, to say the least. Claims rose 1.434 million last week – another huge increase. Even worse, the pace picked up for a second week, suggesting that layoffs will remain at an elevated level for the near term.

We’re now 19 weeks into jobless claims surging by one-million-plus. That’s a sign that the headwinds in the labor market remain fierce – headwinds that are destined to take a toll on consumer spending, the critical factor that drives US economic activity.

The potential for positive developments in the weeks ahead shouldn’t be dismissed, either on the vaccine or economic fronts. But there’s also no way to sugar-coat the macro data to date — jobless claims, in particular. This leading indicator continues to flash a warning about the road ahead. The longer the claims figures are sky-high, the bigger the risk and the lower the odds that a meaningful economic recovery will take root in the near term.

The next best thing to fend off an even deeper economic crisis: extending government support for the expanding number of jobless workers. But here, too, the latest news is worrisome. Bloomberg this morning reports: “The Senate left Washington for the weekend after a fourth day of negotiations yielded little substantial progress on narrowing differences between Republicans and Democrats on a plan to bolster the coronavirus-ravaged U.S. economy.”

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: Epic Decline in US Economic Output for Q2 - TradingGods.net

Sweden data indicates the whole thing has very likely been blown way out of proportion. Sweden has had, as of end of Jul, 5743 deaths in a population of 10.3 mil. They have had no deaths for the last 3 days. Assuming the virus stops spreading when roughly 20% of the population has been exposed, yields an IFR of < .3%. Seasonal flu ranges from .1-2%, so covid-19 appears to be roughly twice as bad as the flu. This is bad, but no where near bad enough to have waged this war of economic destruction. So much has been lost by this media- and Fauci- driven driven over reaction. Fauci should be fired for malpractice. Even more so if it is eventually shown that inexpensive and broadly safe HCQ has a prophylactic benefit.

This whole mess appears to be far more political than reality-based, which shows the severe damage that corporate media has done to our society in their divide and conquer, salt-the-earth narratives. IMHO, we need to dismantle these media companies; they do far more harm than good.