● The Yellow Pad: Making Better Decisions in an Uncertain World

Robert E. Rubin

Review via The Wall Street Journal

These are uniquely uncertain times, says former Treasury Secretary Robert Rubin. From his office at the Council on Foreign Relations in Manhattan, where he serves as chairman emeritus, he rattles off a list of challenges facing the U.S.: friction with China and Russia, Iran’s pursuit of nuclear weapons, rising economic inequality and the “existential threat” of climate change. As for American politics, he describes it as “about as dysfunctional as it has ever been in my lifetime.”

Even more troubling, Mr. Rubin, 84, suggests that our collective ability to make sound decisions is getting worse.

Author Archives: James Picerno

US Q2 GDP Nowcasts Point To Pickup In Growth

The risk of recession remains elevated, according to several indicators, but the soft-landing scenario isn’t dead. Support for the relatively upbeat outlook includes estimates for second-quarter economic activity, based on current GDP nowcasts via data compiled by CapitalSpectator.com.

Macro Briefing: 19 May 2023

* House could vote on debt ceiling next week, says House Speaker McCarthy

* If the US defaults, it would be ugly. Here’s how it would unfold

* Two-thirds of North America could face blackouts in next few months

* Walmart Q1 sales beat expectations as firm lifts full-year outlook

* US Treasury yields rebound on upbeat economic, inflation outlook

* US jobless claims fell last week as bogus data muddle recent trend

* Philly Fed Mfg Index continues to indicate contraction for sector in May

* Existing home sales in US ease for a second month in April

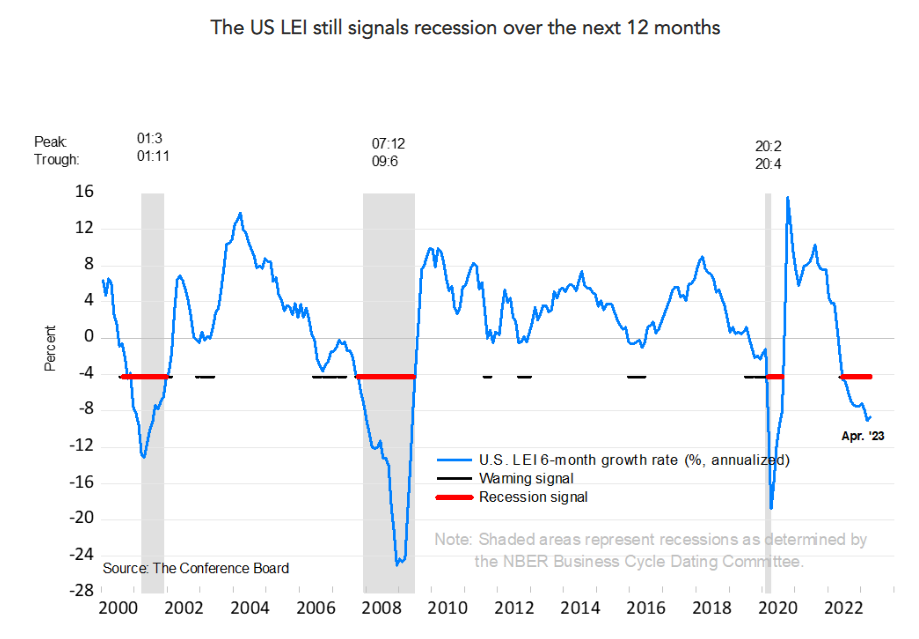

* US Leading Economic Index for April continues to forecast high recession risk:

Long Treasuries Top Bond Market Returns This Year

Last year’s famine has turned to feast in the bond market in 2023 as the riskiest slice of fixed income tops year-to-date results through yesterday’s close (May 17), based on a set of proxy ETFs.

Macro Briefing: 18 May 2023

* Biden says he’s “confident” US won’t default from debt-ceiling impasse

* G7 meeting in Tokyo will focus on Ukraine

* World’s largest semiconductor makers plan to expand in Japan

* China’s loans leave world’s poorest countries near brink of collapse

* Japan imports fall for first time in two years

* Global debt grew in first quarter to near-record high of $305 trillion

* Amazon Web Services announces plan for large investment in India

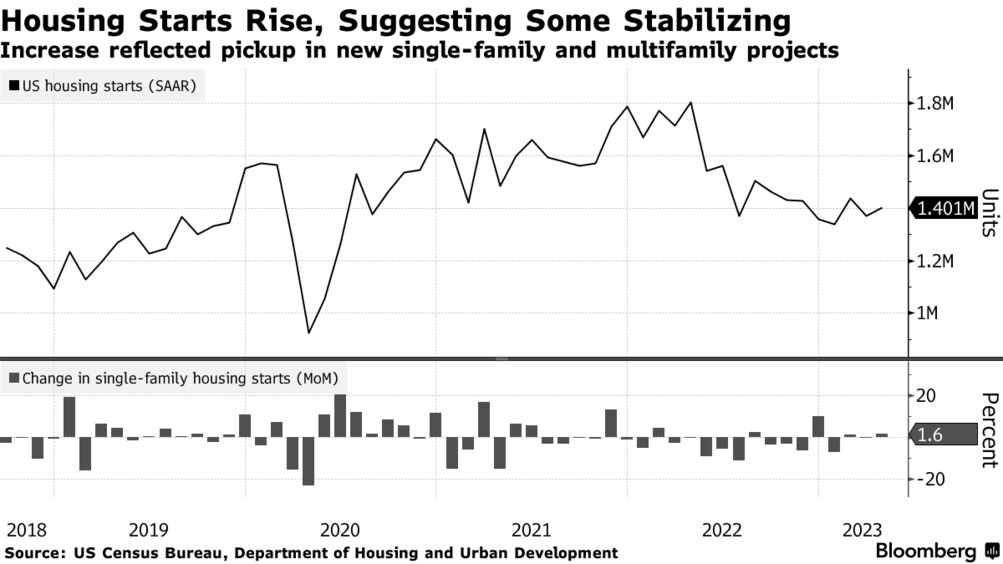

* US housing starts rise in April — gain suggests market is stabilizing:

Recession Forecasts Persist As US Economic Growth Muddles On

Warnings that the US economy is close to the tipping point for recession have endured for months, but the expansion keeps surprising on the upside. More of the same is likely for the immediate future, and perhaps longer.

Macro Briefing: 17 May 2023

* US debt-ceiling talks continue but agreement still not imminent

* House Speaker McCarthy hints at debt-ceiling deal by next week

* Russia oil exports rise to post-invasion high in April

* China’s demand for oil growing at faster-than-expected pace

* Home Depot blocks Amgen’s takeover bid of Horizon Therapeutics

* European Union gives green light to Microsoft buying Activision Blizzard

* US industrial output bounces back in April

* US retail sales rebound in April, first monthly gain since January:

Foreign Equities Allocation Is A Winning Strategy This Year

The dominance of the US stock market over its foreign counterparts has for years been taken as a sign of the new world order for global asset allocation that forever and always favors American shares. But this year offers a compelling counterpoint to reconsider the received wisdom.

Macro Briefing: 16 May 2023

* Biden and McCarthy set to meet today for more debt-ceiling talks

* Atlanta Fed President Raphael Bostic downplays rate-cut odds in 2023

* US household debt reaches new high in first quarter

* US will buy 3 million barrels of oil to refill emergency reserve stockpile

* China industrial output, retail sales rise less than forecast in April

* German economic sentiment falls in May, first negative print since December

* Argentina lifts interest rate to 97% to fight inflation

* NY Fed Manufacturing Index fell sharply in May:

All The Major Asset Classes Fell Last Week

Losses took a toll on markets around the world, with US stocks and bonds posting the smallest setbacks last week, based on a set of ETFs representing the major asset classes. Commodities and property shares ex-US, by contrast, took heavy blows in the trading week through Friday’s close (May 12).