The answer relies heavily, perhaps completely, on political calculations. In other words, trying to forecast how the tortured path ahead evolves is only a bit easier than trying to grab fish in a barrel.

Author Archives: James Picerno

Macro Briefing: 18 April 2023

* House Speaker McCarthy outlines plan for vote on debt limit and spending cuts

* Hedging interest-rate risk is rare in the banking industry, study finds

* China’s economic growth picks up speed in the first quarter

* Fund managers most underweight stocks since 2009, survey finds

* AI will impact “every product of every company”, predicts Google CEO

* It’s (still) premature to predict US dollar’s demise as world’s reserve currency

* US homebuilder sentiment edges up in April but remains below neutral 50 mark

* NY Fed Mfg Index rebounds in April, marking growth for first time in 5 months:

Stocks In Developed Markets Ex-US Rally For Fourth Straight Week

Is the long-running drought in relative returns for foreign stocks vs. American shares starting to fade? It’s getting easier to consider the possibility as developed-markets equities ex-US continue to rise.

Macro Briefing: 17 April 2023

* US and its allies grapple with how to reduce economic ties with China

* GOP House Speaker McCarthy set to recommend spending cuts on Wall Street

* Democratic senators favor forcing House vote on debt limit increase

* Banks may further tighten lending standards, says Treasury Sec. Yellen

* ECB to lift deposit rate to 3.75% peak in July, survey predicts

* ECB chief says she has ‘huge confidence’ that US won’t default on its debt

* Google reportedly developing AI-powered search engine to fend off rivals

* Big banks report surging revenue and profits for the first quarter

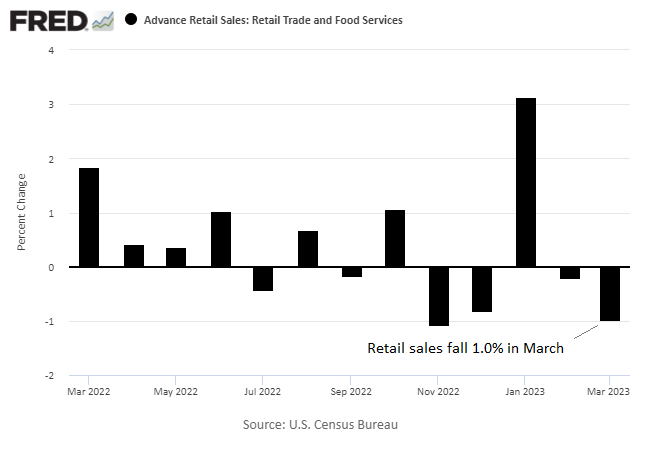

* US retail spending slump deepens in March:

Book Bits: 15 April 2023

● The Octopus in the Parking Garage: A Call for Climate Resilience

Rob Verchick

Summary via publisher (Columbia U. Press)

One morning in Miami Beach, an unexpected guest showed up in a luxury condominium complex’s parking garage: an octopus. The image quickly went viral. But the octopus—and the combination of infrastructure quirks and climate impacts that left it stranded—is more than a funny meme. It’s a potent symbol of the disruptions that a changing climate has already brought to our doorsteps and the ways we will have to adjust. Rob Verchick examines how we can manage the risks that we can no longer avoid, laying out our options as we face climate breakdown. Although reducing carbon dioxide emissions is essential, we need to adapt to address the damage we have already caused. Verchick explores what resilience looks like on the ground, from early humans on the savannas to today’s shop owners and city planners.

10-Year US Treasury Yield ‘Fair Value’ Estimate: 14 April 2023

The 10-year Treasury rate continues to trade well above CapitalSpectator.com’s fair-value estimate, but the days of a large premium look numbered. As evidence mounts that inflation continues to ease, money supply remains sharply negative on a rolling one-year basis and the economy faces stronger headwinds, the odds are rising that the yawning gap between the current 10-year yield and our fair-value estimate will narrow.

Macro Briefing: 14 April 2023

* S&P 500 earnings for Q1 fell nearly 7%, according to estimates by FactSet

* Banks are now losing money on mortgages after sharp rise in interest rates

* China oil imports surge to highest level in nearly 3 years

* Senate Leader Schumer seeks regulations on artificial intelligence technology

* US jobless claims rose for first time in three weeks

* US wholesale prices fell in March, another sign of easing inflationary pressure:

US Consumer Inflation Trend Continues To Ease Through March

The Consumer Price Index eased more than expected in March, providing fresh evidence that pricing pressure has peaked and inflation remains on track to decelerate further in the months ahead. The core reading of CPI posted a firmer reading, but this looks like an outlier when viewed in context with a range of alternative inflation metrics.

Macro Briefing: 13 April 2023

* Rate hikes still needed, says San Francisco Fed President Mary Daly

* Fed expects a recession later this year, according minutes for March meeting

* US-Saudi oil pact breaking down as Russia influence in OPEC rises

* UK economy stagnates in February via GDP data

* China’s exports unexpectedly surge in March

* All but biggest banks face tough quarter for earnings reports

* Threat of war a factor for Buffett’s sale of shares in chipmaker giant TSMC

* US headline consumer inflation eases in March, but core trend ticks up:

Profiling Volatility Regimes For The US 10-Year Treasury Yield

Last month we looked at how stock market volatility ebbs and flows through time. Let’s pick up this thread and do the same for the bond market, based on the 10-year US Treasury yield.