* IMF warns of slowing growth and elevated recession risk

* France’s Macron’s comments on Taiwan bring sharp criticism in West

* Treasury Secretary says she’s “not anticipating a downturn” for US economy

* Fed officials divided over whether to hike rates again

* Fed rate hikes will end next month, predicts former Pimco chief economist

* EPA proposes rules that promote sales of electric vehicles

* Can AI beat the market? Don’t hold your breath

* US small business sentiment eased in March, holding below long-run average

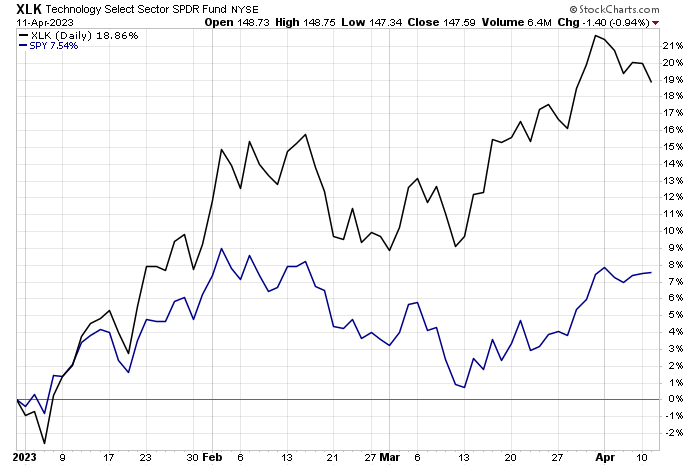

* Tech stocks (XLK) are sharply outperforming broad market (SPY) this year:

Author Archives: James Picerno

US GDP Growth Nowcast Edges Higher For Upcoming Q1 Report

Recession forecasts for the US continue to swirl, but the risk still looks low from the perspective of expectations for the first-quarter GDP report that’s scheduled for April 27, when the Bureau of Economic Analysis will publish it’s preliminary report.

Macro Briefing: 11 April 2023

* IMF predicts interest rates will fall to pre-Covid levels

* Analysts say corporate America is in an earnings recession

* Consumer inflation expectations rise for first time in months

* Consumers say credit is getting harder to come by, Fed survey shows

* Falling money supplies signal elevated recession risk for US, UK and Eurozone

* China consumer inflation slows to softest pace since September 2021

* Eurozone retail sales fell in February, reversing January’s gain

* Bitcoin rallies above $30k for first time since June

* Will bank lending slow after recent turmoil in the industry?

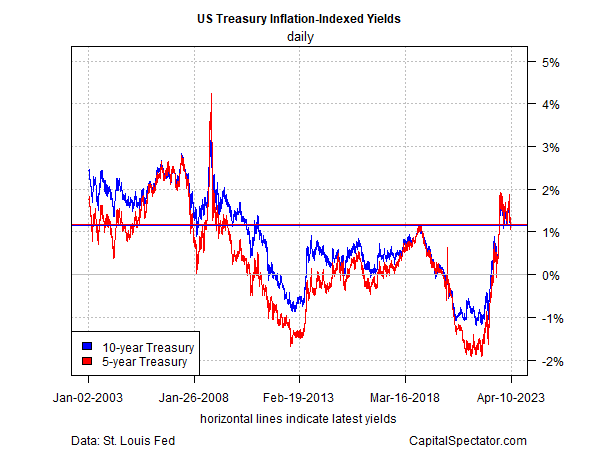

* US real Treasury yields hold above 1%–highest since 2010:

Corporate Bonds Ex-US Led Market Gainers Last Week

Bonds issued by companies outside the US rose for a fifth straight week, securing the strongest performance for the major asset classes, based on a set of ETFs in last week’s trading.

Macro Briefing: 10 April 2023

* US Navy challenges Beijing in South China Sea amid show of force near Taiwan

* End of rate-hiking cycle may be near

* US is building new factories at a furious pace

* Is the bond market over-estimating the risk of deep recession?

* Half-empty offices are a risk factor for banks

* Apple’s personal computer shipments fell 41% in the first quarter

* Tesla will open mega-factory in China to produce batteries

* Housing data suggests sector correction may be ending

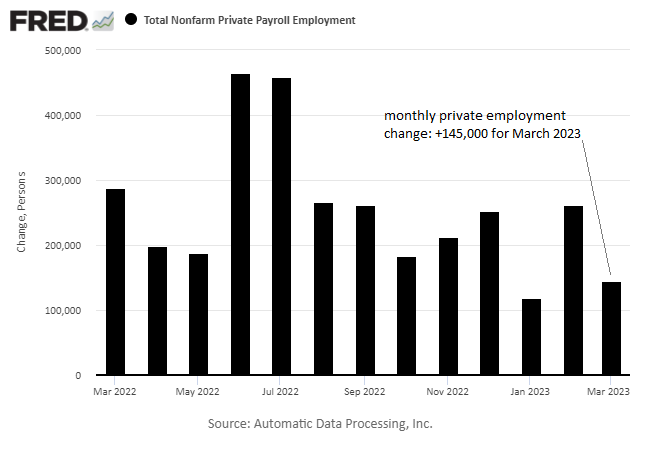

* Growth in US payrolls slows in March:

Book Bits: 8 April 2023

● The Spectacle of Expertise: Why Financial Analysts Perform in the Media

Alex Preda

Summary via publisher (Columbia U. Press)

Financial experts have become ubiquitous on television, radio, and social media. They provide investment advice, interpret market movements, and explain the implications of political events, wielding a great deal of power and influence through their media presence. How do these experts acquire their authority, and what makes displays of financial expertise persuasive to their audiences? Preda demonstrates that analysts and media professionals deploy expertise when they engage with audiences in ways that make it difficult to contest the claims conveyed in their talk.

Macro Briefing: 7 April 2023

* World economy set for weakest near-term growth since 1990, IMF chief predicts

* China’s Xi Jinping willing to speak to Ukraine’s Zelenskyy, says EU chief

* Brazilian President urges Ukraine to give up Crimea to Russia

* China’s economy recovering slower than expected, say Citi analysts

* Trailing US equity premium falls to lowest level since 2007

* US home prices starting to lag inflation, reversing trend in recent years

* Job cuts in US up 15% in March and surge 319% vs. year-ago level

* US jobless claims revised up, reflecting higher layoffs than initially reported

* Global economic growth accelerates in March, according to PMI survey data:

Research Review | 6 April 2023 | Artificial Intelligence and Finance

Multi-(Horizon) Factor Investing with AI

Ruslan Goyenko and Chengyu Zhang (McGill University)

April 2023

Can the backbone technology behind ChatGPT create and manage portfolios? We apply this tech-engine, adapted for finance applications, to multi-factor investing by a long-horizon investor who uses bigger that traditionally used data and takes into consideration long-term versus short-term volatility, liquidity and trading costs trade offs while maximizing expected portfolio returns. The answer is yes, as we are able to actively time factors’ premium realizations while dynamically re-balancing and diversifying between factors. Moreover, the long horizon perspective is critical, as it allows for more patient trading and re-balancing needs, more strategic factor timing, and a different set of fundamental signals to rely on.

Macro Briefing: 6 April 2023

* House Speaker McCarthy meets with Taiwan’s president, defying China

* Wall Street should worry about debt-ceiling risk, says House Speaker McCarthy

* France’s Macron begins talks with China’s Xi Jinping

* US-China tensions will cost world economy 2% of output, estimates IMF

* China service sector growth accelerates in March

* Norway is now Europe’s main supplier of fossil fuels

* US services sector growth eases more than expected in March

* US private hiring rose less than expected in March via ADP data:

Is The US Facing A Slow(er)-Moving Recession Threat? Part III

Assessing US recession risk isn’t getting any easier, but when it comes to cutting through the noise I continue to rely on combining models for the single-best tool in the toolkit. To paraphrase Churchill, this is usually the least-worst way to evaluate the odds that an NBER-defined downturn is near or has already started.