* Ukraine war at risk of spilling across borders

* European leaders say Russian gas cutoff is economic ‘blackmail’

* Ukraine will cause ‘largest commodity shock’ since 1970s, World Bank warns

* Economists expect global growth to slow further via new Reuters poll

* Southern California imposes unprecedented water restrictions

* Yen at 20-year low vs. dollar as Bank of Japan stays committed to low rates

* Sweden’s central bank announces sudden policy U-turn and raises rates

* US pending home sales fell in March, marking five straight monthly declines:

Author Archives: James Picerno

US Growth Set For Sharp Slowdown In Tomorrow’s Q1 GDP Report

Tomorrow’s initial first-quarter estimate of US GDP from the government (scheduled for Thurs., Apr. 28) is expected to reveal a sharp deceleration in growth, based on a set of nowcasts compiled by CapitalSpectator.com.

Macro Briefing: 27 April 2022

* Russia cuts off natural gas supplies to Poland and Bulgaria

* Poland’s gov’t says its energy supplies are secure despite loss of Russian gas

* German consumer sentiment falls to record low in estimate for May

* Deutsche Bank economists raise severity of its US recession forecast

* Fed is now forced to keep raising interest rates, strategist advises

* World Bank expects largest commodity shock since the 1970s

* US home prices rose nearly 20% in year-over-year change through February

* New, single family home sales fell 8.6 percent in March

* US consumer confidence fell in April, based on consumers’ short-term outlook

* US durable goods orders rebounded in March:

Waiting For The US Economy To Cry “Uncle”

You can’t swing a cat without hitting a commentator discussing recession risk these days. And for good reason: there’s a growing list of potential threats to the economy. But forecasting a possible contraction in the future and monitoring events in real time are two different things and there’s always ambiguity about whether the two become one and the same. Hold that thought as we consider some of the evidence that while the potential for a new recession is lurking, the numbers published to date still indicate that the expansion is very much alive and kicking.

Macro Briefing: 26 April 2022

* Russia warns that nuclear war risks should not be underestimated

* Central banks need to aggressively fight inflation, says Man Group’s CEO

* Treasury real yields moving closer to zero after extended run in negative terrain

* The case for a possible return of the bond bull market

* US consumers’ discretionary spending fell in March, consultancy estimates

* Potential for more China lockdowns raises risk for global supply chains

* Twitter accepts Elon Musk’s $44 billion takeover offer

* Dallas Fed Mfg Index continues to indicate softer growth in April

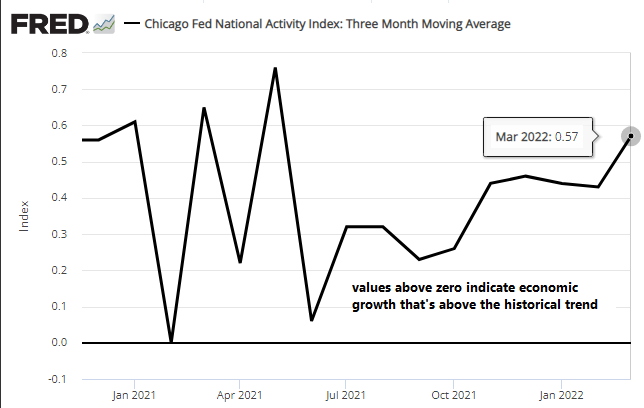

* US economy continued to grow at solid pace in March, Chicago Fed data shows:

Broad Sell-Off Continued To Weigh on Global Markets Last Week

Widespread selling in the major asset classes rolled on in last week’s trading through Friday’s close (Apr. 22), based on a set of ETFs. The upside outliers: US real estate investment trusts (REITs) and inflation-protected Treausuries.

Macro Briefing: 25 April 2022

* Macron reelected as France’s president, defeating far-right candidate

* US officials, after visiting Ukraine, pledge more military support

* Covid-19 outbreak continues to roil China

* Rising mortgage rates could create housing shortage, advises economist

* Bond market’s pricing in faster rise in inflationary pressures for years ahead

* US labor market hints at possible easing of inflation pressure

* A new energy crisis is in full swing

* German economic sentiment stabilizes in April, posting slightly higher reading

* A recession in Europe has started, according to Sentix survey data in April:

Book Bits: 23 April 2022

● Inflation: What It Is, Why It’s Bad,

and How to Fix It

Steve Forbes, et al.

Summary via publisher (Encounter Books)

Inflation: What It Is, Why It’s Bad, and How to Fix It explains what’s behind the worst inflationary storm in more than forty years—one that is dominating the headlines and shaking Americans by their pocketbooks. The cost-of-living explosion since the COVID pandemic has raised alarms about a possible return of a 1970’s-style “Great Inflation.” Some observers even fear a descent into the kind of raging hyperinflation that has torn apart so many nations. Is this true? If so, how should we prepare for the future?

Will The Strong Labor Market Prevent A US Recession?

Headwinds are building for the US economy, stoking forecasts that recession risk is rising. The labor market, however, remains resilient, suggesting that the economy will continue to expand for the near term.

Macro Briefing: 22 April 2022

* Powell says 1/2 percent rate hike in May is “on the table”

* Eurozone growth accelerates in April, PMI survey data shows

* Will French presidential election on Sunday roil US-led policy on Ukraine?

* Florida passes bill to end Disney’s special self-governing status

* China’s zero-covid strategy triggers capital flight from country’s financial markets

* Philly Fed Mfg Index eased in April but continues to reflect growth

* Jobless claims in US continue to hold near 50-year low

* US Leading Economic Index points to economic growth through 2022: