Campbell R. Harvey, et al.

Interview with co-author (Sandy Rattray) via HedgeWeek

Rattray – who has co-authored a new book on strategic risk management along with Man Group strategy advisor Professor Campbell Harvey, and Otto Van Hemert, director of core strategies at quant-focused Man AHL – believes the upheaval of the past 12 months have rendered tail event predictions “nearly impossible.”

Their new book, titled Strategic Risk Management: Designing Portfolios and Managing Risk, explores how risk management should be incorporated into the core design of investment portfolios, and examines how portfolio balancing and balanced return streams can be achieved through volatility targeting of higher-risk asset classes, and which defensive strategies offer capital protection.

Author Archives: James Picerno

The ETF Portfolio Strategist: 7 May 2021

In this issue:

- Big miss for US payrolls today, but it spurs widespread rallies

- Across-the-board gains for the portfolio benchmarks

Will Treasury Term Premiums Signal Higher Inflation Risk?

There’s no shortage of indicators to monitor for deciding if the expected runup in inflation is a temporary affair or regime shift that signals a longer-term rise in pricing pressure. I recently considered several of the usual suspects, including core inflation and the Treasury market’s implied forecasts, for tracking this risk. But this only scratches the surface of possibilities. Considering options for what might be labeled alternative metrics, the Treasury term premium deserves to be on the short list.

Macro Briefing: 7 May 2021

* Germany opposes US-backed idea to waive patents on Covid-19 vaccines

* Vaccines show promising results against COVID variants

* India’s main opposition leader warns that India’s Covid wave threatens world

* Biden administration expected to maintain limits on US investments in China

* China’s economic growth accelerated in April–fastest to date in 2021 via PMI data

* China’s exports surged more than expected in April

* Fed warns of risk of ‘significant declines’ in asset prices as valuations climb

* Chinese rocket debris expected to hit Earth this weekend.

* US jobless claims fell below 500k last week–a new pandemic low:

US Economic Growth Expected To Accelerate In Q2

The US economic rebound picked up speed in the first quarter and even faster growth is expected for the April-through-June period, according to a set of GDP nowcasts.

Macro Briefing: 6 May 2021

* US supports plan to waive intellectual property rules for vaccines

* Treasury Dept. urges Congress to raise US debt level this summer

* World’s biggest pension fund rethinking ESG investing

* Epic rally in lumber prices adds average of $36,000 to cost of new homes

* Global economic growth accelerated to 11-year high in April via survey data

* US Services PMI reflects strongest growth on record (since 2009) in April

* US services growth slowed in April but still strong via ISM data

* Growth in US private payrolls accelerated in April–biggest gain in 7 months:

The ETF Portfolio Strategist: 5 May 2021

Commodities continue to benefit from ongoing worries about inflation and real-time reports of price hikes for basic materials.

Major Asset Classes | April 2021 | Risk Review

Today’s post rolls out the inaugural Risk Review column for the major asset classes, a monthly update that’s the companion piece to the monthly performance report and risk-premia estimates. Readers can use this trio for a quick summary of historical and expected return and how that compares with several measures of risk.

Macro Briefing: 5 May 2021

* Rates may need to rise to prevent overheating US economy, says Treasury Sec.

* Supply shortages, logistical logjams may force firms to raise prices

* Covid deaths in India may double in weeks ahead, forecasters warn

* Eurozone growth continued to strengthen in April via PMI survey data

* Birthrate in US declined to another record low in 2020

* US factory orders rebounded sharply in March

* US trade deficit surged to record in March

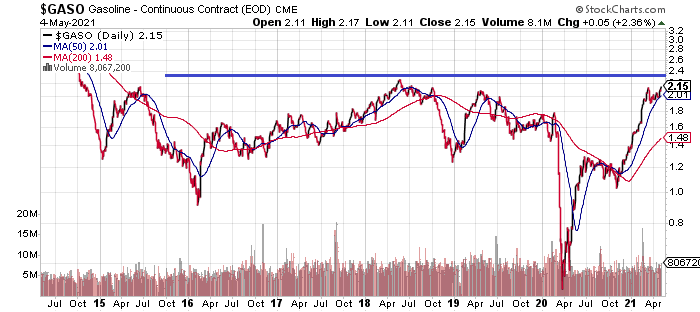

* US gasoline price approaching seven-year high:

Risk Premia Forecasts: Major Asset Classes | 4 May 2021

The expected risk premium for the Global Market Index (GMI) in the long run ticked higher again in April, rising to 5.9% annualized — modestly above the previous month’s estimate. The current expected return estimate — defined as performance above the “risk-free” rate — is still well below the previous realized performance peak for GMI, but today’s revision represents a solid bounce off the lows for recent projections.