● The Mismeasure of Progress: Economic Growth and Its Critics

Stephen J. Macekura

Summary via publisher (Chicago U. Press)

Few ideas in the past century have had wider financial, political, and governmental impact than that of economic growth. The common belief that endless economic growth, as measured by Gross Domestic Product, is not only possible but actually essential for the flourishing of civilization remains a powerful policy goal and aspiration for many. In The Mismeasure of Progress, Stephen J. Macekura exposes a historical road not taken, illuminating the stories of the activists, intellectuals, and other leaders who long argued that GDP growth was not all it was cracked up to be.

Author Archives: James Picerno

The ETF Portfolio Strategist: 6 Nov 2020

Risk Assets Bounce Back: Sometimes a week makes all the difference. While the world was obsessed over the US election (Joe Biden appears headed for the White House based on the latest vote counts), global markets rebounded after last week’s across-the-board sell-off. Every component of our standard lineup of the major asset classes posted a gain.

Will Rising Coronavirus Risk Derail The US Economic Recovery?

The rear-view mirror continues to show that the US economy is clawing back losses from the coronavirus gut punch in the spring. But the rebound is increasingly threatened by the re-acceleration of Covid-19 cases, fatalities and hospitalizations.

Macro Briefing: 6 November 2020

Vote counting pushes Biden closer to winning the White House: Reuters

Federal judge blocks Trump campaign’s request to stop Philly vote count: Reuters

George vote counting gives Biden the lead in the state for the first time: BBG

Control of the Senate still unclear: depends Georgia runoff election in Jan: Politico

Tests of nasal spray that blocks coronavirus looks promising: NYT

Fed leaves rates near zero–warns of more coronavirus fallout for economy: CNN

October job cuts in US dropped to lowest number in seven months: CGC

US jobless claims fell again but remain unusually high: CNBC

Growth And Momentum Equity Factors Continue To Lead

The US election is over (or nearly over), but there’s no sign yet that the end is near for the leadership of growth and momentum risk factors in the US equity market.

Macro Briefing: 5 November 2020

Biden edges closer to winning Electoral College vote: Reuters

Trump campaign challenges vote count in key states with lawsuits: BBC

New US coronavirus rise to record 103,000 for Nov. 4: MW

Senate Leader McConnell calls for new economic relief bill: WSJ

Wall Street embraces the prospect of divided government: NYT

UK economy at risk of new recession due to coronavirus and Brexit: CNN

Global growth rebounded to fastest pace in over 2 years in October: IHSM

US Composite PMI, a GDP proxy, rose at highest rate in 29 months in Oct: IHSM

US Services PMI ticked lower in Oct but continues to post moderate growth: ISM

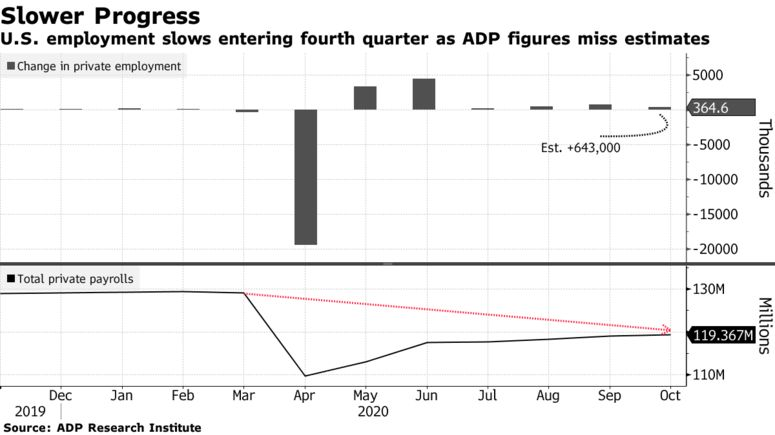

US private employment growth slowed in October, ADP data shows: BBG

Now We Know: Trump’s 2016 Win Was No Fluke

The outcome of the US presidential election remains unclear the morning after the Nov. 3 election, but the results so far have cleared up one misconception: Donald Trump’s victory in 2016 wasn’t a quirky outlier. Regardless of who wins the White House in the hours (or days) ahead, it’s obvious in the numbers posted so far that nearly half of voters who cast ballots prefer Trump.

Macro Briefing: 4 November 2020

US presidential election still too close to call the morning after: AP

Still-evolving results in 3 key states will determine next president: Politico

Biden’s ‘Blue Wall’ path to presidency looks shaky at best: NYT

Biden campaign prepared to fight Trump in court: AP

A concession by one side or the other may end up as the only solution: NYT

Republicans appear to hold on to control of US Senate: Reuters

China blocks $34 billion IPO of Ant Group: WSJ

US officially leaves the Paris climate agreement: BBC

US factory orders rose strongly in September: Reuters

Biden has slight lead in Electoral College but final results may take days: NYT

Risk Premia Forecasts: Major Asset Classes | 3 November 2020

The expected risk premium for the Global Market Index (GMI) edged down to an annualized 4.7% in October, modestly below the previous month’s estimate. The projection is a long-run forecast for performance over the “risk-free” rate, according to a risk-based model (details below).

Macro Briefing: 3 November 2020

Biden favored in election modeling as US begins voting: FiveThirtyEight

One outlier pollster predicts a clear Trump victory: NYT

Portfolio changes based on election results are risky: CNBC

Economists don’t expect Fed to increase asset purchases through 2021: BBG

US Treasury cuts estimates for borrowing through end of 2020: WSJ

US construction spending rose less than expected in Sep: Reuters

Global manufacturing output rose at 2-1/2 year high in October: IHSM

China Mfg PMI rises in Oct to highest level since 2011: IHSM

Eurozone manufacturing output continued to strengthen in October: IHSM

US Mfg PMI rose in Oct to highest level since Jan 2019: IHSM

US ISM Mfg Index: manufacturing posted strong pickup in growth in Oct: ISM