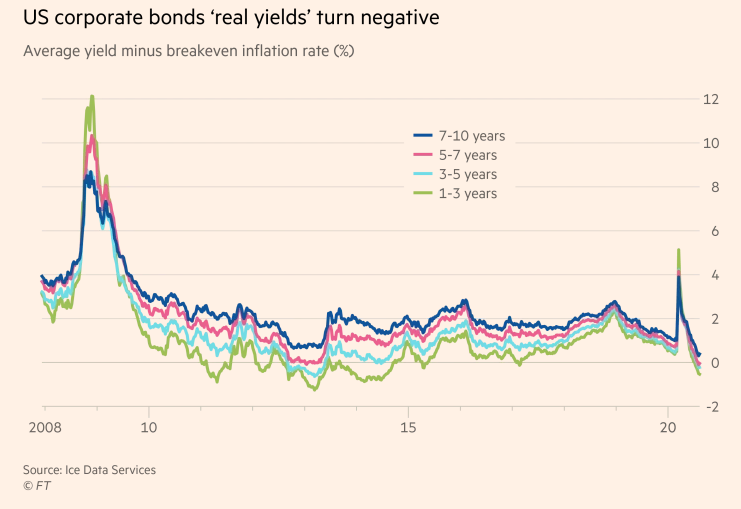

Has the bond market run out of road as portfolio-diversification tool? No one knows for sure, but for some analysts the writing’s on the wall and markets are facing regime shift. The key catalyst: the long-running decline in current yield, which has gone negative in some countries and may soon do so in US.

Author Archives: James Picerno

Macro Briefing | 4 September 2020

Justice Dept. reportedly set to file antitrust charges against Google: Reuters

Trump seeks to cut federal funding to ‘anarchist jurisdictions’: CNBC

US job growth expected to slow in today’s August update: Reuters

Growth in German factory orders continued to decelerate in July: MW

Global Composite PMI, a GDP proxy, rose to 17-month high in August: IHS Markit

US trade deficit in July expanded to biggest gap in 12 years: BC

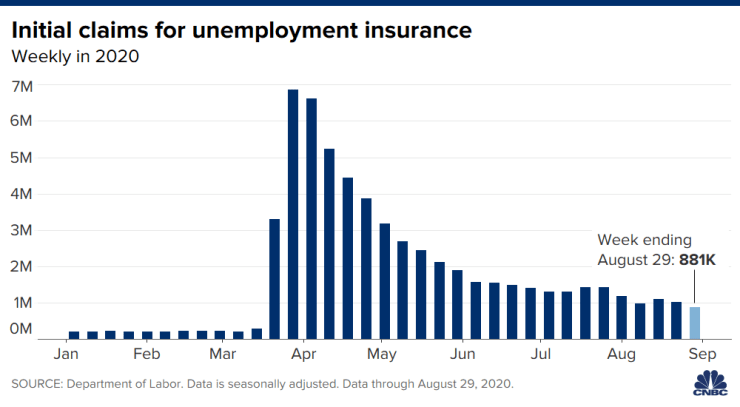

US jobless claims remain high but fell to lowest since pandemic started: CNBC

Growth And Momentum Equity Factors Pull Further Ahead

How has the US stock market performed so far this year? The answer, as always, depends on the definition of “the market.” If we’re slicing and dicing by factor buckets these days, the possibility of radically different answers has rarely been so stark.

Continue reading

Macro Briefing | 3 September 2020

Federal government tells states to prepare for coronavirus vaccine by Nov. 1: ABC

Germany says Russia opposition leader poisoned with a nerve agent: BBC

Pressure grows for Germany to abandon gas pipeline from Russia: Reuters

Economists manage expectations down for global economic outlook: Politico

China’s services sector posted “another solid increase” in August: IHS Markit

US economic rebound softened in August, Fed’s Beige Book reports: MW

Factory orders in US rose more than expected in July: Reuters

US federal debt set to reach 98% of economy in fiscal year 2020: NYT

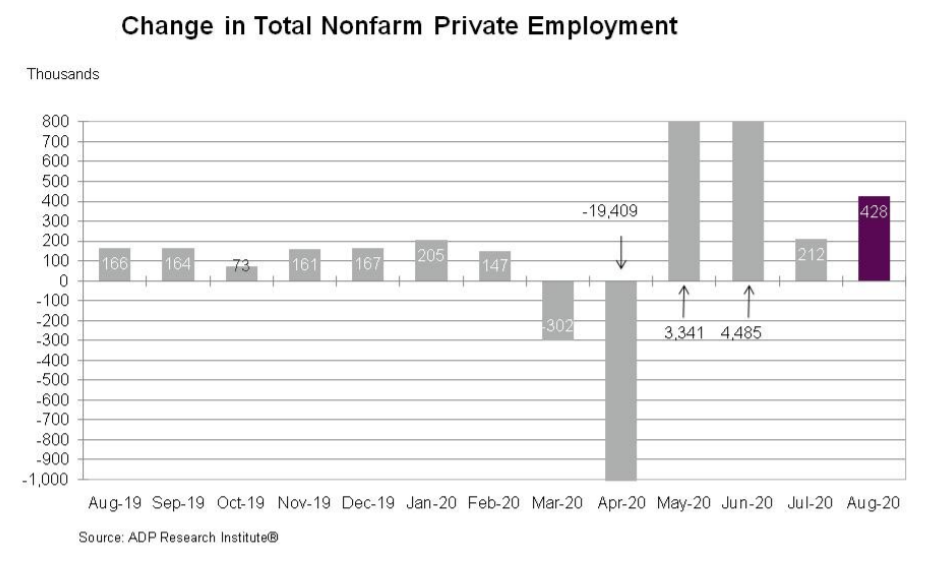

US private payrolls rose in September but far below expected gain: CNBC

The ETF Portfolio Strategist: Volatility On Holiday

One day volatility will return to the financial markets. When that day arrives (and why) is anyone’s guess. Meantime, vol remains in remission across the major asset classes, based on a set of proxy ETFs.

Risk Premia Forecasts: Major Asset Classes | 2 September 2020

The risk premia estimate for the Global Market Index (GMI) rose to 5.0% in August, 20 basis point above the previous month’s estimate. This long-run forecast, which can be varies modestly from month to month, reflects an outlook for performance over the “risk-free” rate, according to a risk-based model (details below).

Macro Briefing | 2 September 2020

Health experts see risk of new wave of Covid-19 infections this winter: CNBC

Trump makes controversial visit to Kenosha: Reuters

US-Russia military clashes around the world are rising: NYT

Treasury Secretary: US economy needs more gov’t stimulus: BBG

Fed’s Brainard: central bank should do more to support economy: MW

Australia in recession for first time in decades: WSJ

Global mfg growth picked up in Aug, rising to 21-month high: IHS Markit

China manufacturing PMI rose to 9-year high in August: CNBC

Home prices rise 5.5% in July, well ahead of 1.0% CPI inflation: CoreLogic

US construction spending rose in July–first monthly gain since February: Reuters

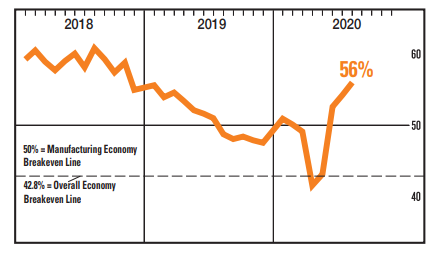

US manufacturing activity rebounded in Aug to strongest pace since late-2018: ISM

Major Asset Classes | August 2020 | Performance Review

August was another risk-on month. Except for investment-grade bonds in the US and foreign-government fixed income in developed markets, across-the-board gains dominated the major asset classes higher last month.

Continue reading

Macro Briefing | 1 September 2020

Trumps risks stoking racial tensions with trip to Kenosha today: AP

US announces new economic support for Taiwan to counter China: Reuters

China’s mfg sector continued to recover in Aug, PMI survey data shows: CNBC

China’s exports are surging despite Trump’s tariffs: NYT

China’s economic growth in 2020 expected to slow to just 2%: BBG

Eurozone mfg sector held on to a modest recovery in Aug: IHS Markit

India’s economy contracted at a record pace in Q2: CNN

US corporate bond real yields go negative for short maturities: FT

US Stocks Led Broad-Based Gains In Major Asset Classes Last Week

American shares led a global rally for the trading week ended Aug. 28, based on a set of exchange-traded funds. With the exception of investment-grade bonds in the US, risk-on sentiment lifted every corner of the major asset classes.