The worst phase of the pandemic crisis in the US may be easing, but economic projections for the immediate future remain grim. Recent estimates for the upcoming second-quarter report for GDP tell the story—a tsunami of deeply negative projections. Amid the macro darkness, the Federal Reserve today, as part of a monetary statement, is scheduled to release its own set of revised economic projections.

Author Archives: James Picerno

Macro Briefing | 10 June 2020

White House adviser says new stimulus bill odds ‘are very, very high’: WSJ

OECD considers economic impact of a second coronavirus wave: Bloomberg

Worrisome Covid-19 trends in India, Brazil and South Africa: Vox

Consumer inflation in China slowed to 14-month low in May: Caixin

China’s industrial deflation continued to deepen in May: MW

What’s expected for today’s Federal Reserve meeting? CNBC

Pandemic threatens to upend business models for retail properties: NY Times

Small Business Optimism Index in the US rebounded moderately in May: NFIB

US job openings fell to a five-year low in April: CNBC

Is The Treasury Market Starting To Price In Reflation?

The clues are starting pile up that the deepest phase of the economic loss for the US coronavirus recession has passed. There’s still a long way to go to climb out of the hole, but data published to date suggest that the recovery process has started.

Macro Briefing | 9 June 2020

Politicians consider defunding police after George Floyd protests: NY Times

22 US states report rising cases of Covid-19 infections: CNN

Daily change in US Covid-19 deaths falls to new post-peak low: Reuters

North Korea cuts off communication with South Korea: CNN

India and China agree to peacefully settle border tensions: CNBC

Will strong US jobs report for May fuel a rise in Treasury yields? CNBC

Up to 25,000 US stores may close this year: Bloomberg

Longest US economic expansion on record officially ended in February: NBER

US stocks (S&P 500) closed on Monday with a fractional year-to-date gain: CNN

Real Estate Shares Surged Last Week

US and foreign property shares led returns in last week’s broad rise in global markets, based on a set of exchange traded funds tracking the major asset classes. over the trading week ended June 5.

Continue reading

Macro Briefing | 8 June 2020

Minneapolis City Council members favor ending police dept: Reuters

Some US states reporting a rise in virus cases, including California: WSJ

New Zealand says country is virus-free: BBC

Signs that the US economy is starting to recover: CNBC

Morgan Stanley bets on a steepening Treasury yield curve: Bloomberg

Was jobs surge in May a game-changer for markets and the economy? CNBC

Fed considers policy to actively peg certain rates at low levels: WSJ

Germany’s industrial output fell a record 17.9% in April: MW

US payrolls rose dramatically in May–biggest upside surprise in history: MW

US economic policy uncertainty falls to lowest level since early March: SLFed

Book Bits | 6 June 2020

● The End of Jobs: The Rise of On-Demand Workers and Agile Corporations

Jeff Wald

Summary via publisher (Post Hill Press)

The world has witnessed three step functions in technological change: mechanization, electrification, and computerization. These industrial revolutions led to massive increases in productivity and thus the need for fewer workers. With each of these technological breakthroughs, the power balance between companies and workers shifted heavily to companies. The abuses of that power by companies instigated employee unrest and sometimes even armed uprisings. Counterbalancing forces rose to constrain companies’ power, eventually prompting unions, regulation, and the social safety net to bring stability to the relationship.

Continue reading

Fat Tails Everywhere? Profiling Extreme Returns: Part II

It’s long been established that stock market returns aren’t normally distributed and that fat tails (extreme returns that are unexpected for a normal distribution) apply. This has implications, of course, for portfolio design and management. The first question: What are the choices for managing tail risk for equity exposures? There are many answers, each with a different set of pros and cons. Perhaps the first choice to consider: focus on longer-term results and look through the shorter-term noise. Is this a viable risk-management strategy? Let’s take a look at the data for insight.

Continue reading

Macro Briefing | 5 June 2020

Is the slow rise in US coronavirus cases since Memorial Day noise? CNBC

US exports and imports down sharply in April due to coronavirus: WSJ

Jobless rate expected to soar to 20% in today’s employment report: Reuters

US warship sailed through Taiwan Strait on Thursday: Reuters

Deflation risk warrants further ECB bond buying, central banker says: BBG

Germany factory orders plunged in April: AP

People with type A blood more likely to suffer severe Covid-19 symptoms: NYT

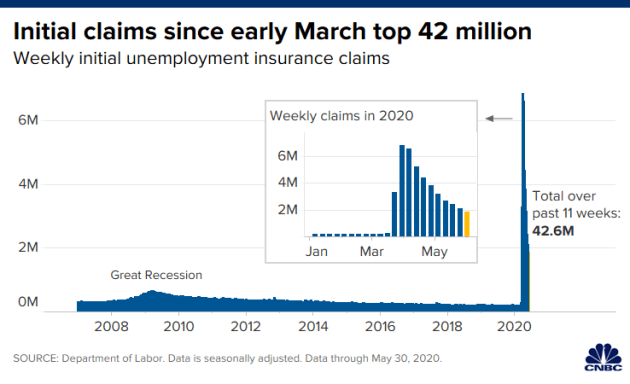

New filings for unemployment continued to surge in the US last week: CNBC

Is The Stock Market’s Optimism For Economic Recovery Valid?

The S&P 500 Index rose again on Wednesday (June 3), closing at a three-month high and paring the market’s drawdown to a relatively mild 7.8% decline — a shadow of the nearly 34% drawdown at the height of the correction on March 23. Fueling the market’s rebound is the view that the worst of the coronavirus recession has passed and the recovery is coming into view. Is this wishful thinking? Or is the crowd’s implied forecast valid? The future, as always, remains unknown, but let’s consider the pros and cons of Mr. Market’s outlook for some perspective.