Early estimates of GDP growth for the US in the fourth quarter point to another round of deceleration, based on the median for a set of projections compiled by The Capital Spectator. Although it’s still early in the quarter, leaving room for changes in the outlook based on incoming data, the preliminary numbers hint at the possibility that growth will continue to cool in the final three months of 2018.

Continue reading

Author Archives: James Picerno

Macro Briefing: 7 November 2018

Democrats take back the House; GOP holds Senate: MarketWatch

A Democratic House is eager to take on Trump: Politico

House Democrats will probably change US foreign policy: Reuters

How will the election results influence the stock market? CNBC

Global economic growth edged up at the start of Q4: IHS Markit

PMI data for Eurozone: growth slowed to lowest pace in over 2 years: IHS Markit

US job openings dipped in Sep but still near record high: CNBC

Profiling Factor ETF Correlations

Slicing and dicing the US equity market into factor buckets is, at its core, an effort to enhance return by engineering more control over risk management. A key part of this framework is recognizing that risk and return for the stock market overall is a byproduct of multiple factors, such as shares trading at low valuations or posting strong price momentum in the recent past. In turn, it’s reasonable to assume that a set of factor ETFs will exhibit relatively low correlations with one another, offering a degree of diversification otherwise unavailable via standard portfolio designs for capturing equity beta. To test that assumption, let’s review the return correlations for a broad set of factor ETFs in recent history.

Continue reading

Macro Briefing: 6 November 2018

Democrats appear to have an edge in today’s election: FiveThirtyEight

Facebook discloses possible election meddling by Russia: USA Today

Trump’s decision to deploy troops to border will cost $200M-$300M: CNN

Supreme Court refuses to hear appeal over net neutrality rules: The Hill

China’s VP: China is ready to resolve trade dispute with US: CNBC

Services PMI for US reflects “strong” business activity for Oct: IHS Markit

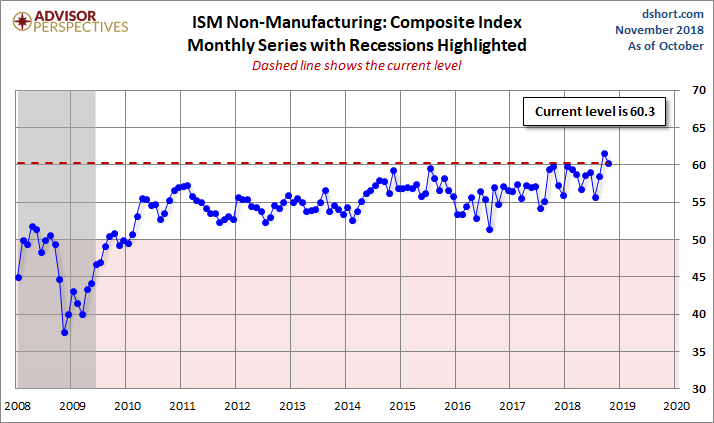

US ISM Non-Mfg Index for Oct reflects “strong growth”: CNBC

Stocks Rebounded As Commodities And US Bonds Fell Last Week

Led by equities in emerging markets, stocks around the world rebounded last week, based on a set of exchange-traded products that represent the major asset classes. The positive results for equities follows a wave of selling in the previous week for global stock markets. Meanwhile, last week’s big losers: broadly defined commodities and investment-grade bonds in the US.

Continue reading

Macro Briefing: 5 November 2018

Polls give Dems slight edge for House, GOP for Senate: RealClearPolitics

Is Trump’s focus on immigration over the economy hurting the GOP? Politico

What the Dems would do if they take back the House: Bloomberg

China Services PMI: growth slowed to 13-month low in October: CNBC

China’s Xi promises to lift imports and lower trade barriers: Reuters

US payrolls surged in Oct and y-o-y wage gains exceeded inflation: CNBC

US trade deficit with China sets new record in September: MarketWatch

Factory orders in US rose more than expected in September: Reuters

Traders expect volatile week for Treasuries as 10yr yld nears 7yr high: Bloomberg

Book Bits | 3 November 2018

● Keeping At It: The Quest for Sound Money and Good Government

By Paul Volcker with Christine Harper

Review via The Atlantic

Paul Volcker’s 6-foot-7-inch frame was draped over a chaise longue when I spoke with him recently in his Upper East Side apartment, in Manhattan. He is in his 91st year and very ill, and he tires easily. But his voice is still gruff, and his brain is still sharp.

We talked about his forthcoming memoir, Keeping at It: The Quest for Sound Money and Good Government—about why he wrote the book and the lessons he hopes to impart. Volcker is not a vain man, but he knows that his public life was consequential, and he wants posterity to get it right. He also does not mince words. In our conversation, he assailed the “greed and grasping” of the banks and corporate leadership, and the gross skewing of income distribution in America.

Continue reading

US Companies Accelerated Hiring In October

Private payrolls in the US surged 246,000 in October, according to this morning’s update from the Labor Department. The gain, which was well above the consensus forecast, marks a sharp rebound following September’s weak 121,000 rise.

Continue reading

Risk Premia Forecasts: Major Asset Classes | 2 November 2018

The projected risk premium for the Global Market Index (GMI) fell to an annualized 4.5% in October, down from 5.0% in the previous month’s outlook. This estimate for GMI (an unmanaged market-value-weighted portfolio that holds all the major asset classes) reflects the ex ante premium over the projected “risk-free” rate for the long run.

Continue reading

Macro Briefing: 2 November 2018

Trump says he had ‘good’ conversation with China’s Xi on trade: CNBC

US will give 8 nations waivers to buy Iranian oil: Bloomberg

US job growth expected to accelerate in today’s Oct report: Reuters

Cook Political Report lifts forecast of Dems’ edge in House race: WashEx

ISM Mfg Index fell to six-month low in Oct: MarketWatch

US Mfg PMI ticks up in Oct, signaling moderate growth: IHS Markit

US job cuts surge in Oct, mostly due to Verizon: 24/7 Wall St

Jobless claims in US fell last week, reaffirming strong labor market: CNBC

US construction spending flat in Sep after sharp rise: MarketWatch.

W. Texas Intermediate crude oil slumped to 7-mo low on Thursday: MarketWatch