The expected risk premium for the Global Market Index (GMI) was unchanged in September, holding steady at an annualized 5.0% — matching the estimate in the previous month. The performance forecast for GMI (an unmanaged market-value-weighted portfolio that holds all the major asset classes) reflects the premium over the projection for the “risk-free” rate for the long run.

Continue reading

Author Archives: James Picerno

Macro Briefing: 2 October 2018

Key differences in Trump’s replacement for Nafta: CNBC

Trump appears set for protracted economic war with China: Bloomberg

US Navy reports ‘unsafe’ encounter with a Chinese warship: CNN

US air strikes in Somalia target militants: Reuters

McConnell: Senate to vote on Kavanaugh’s nomination this week: The Hill

US construction spending up 0.1% in Aug, led by public sector: MW

ISM Mfg Index for US slipped in Sep after 14-year high the month before: CNBC

US Mfg PMI rose to 4-month high in Sep: IHS Markit

WTI crude oil jumps to four-year high: MW

Major Asset Classes | September 2018 | Performance Review

Broadly defined commodities led the performance horse race in September for the major asset classes. The return marked the first monthly advance for commodities since May, which was also the last time that raw materials writ large led the field.

Continue reading

Macro Briefing: 1 October 2018

US and Canada reach agreement on Nafta trade deal: LA Times

New questions arise over FBI investigation of Kavanaugh: CNN

Iran launches missile attack on militants in eastern Syria: CNN

Hurricane Rosa threatens Phoenix: Newsweek

Death toll surges in Indonesia from earthquake and tsunami: CBS

Sec. of Defense Mattis cancels trip to China amid rising tensions: CNN

Trump administration sues California over its net neutrality law: TechCrunch

Brent oil jumps to 4-year high ahead of Iran sanctions: Reuters

Two-thirds of business economists see US recession by late-2020: Bloomberg

The mini recession of 2015-2016 explains a lot: NY Times

Consumer sentiment reading for US in Sep revised down to still-strong level: CNBC

Chicago PMI dips to five-month low in Sep: MW

US consumer spending posted smallest gain in six months in Aug: MW

Book Bits | 29 September 2018

● AI Superpowers: China, Silicon Valley, and the New World Order

By Kai-Fu Lee

Q&A with author via Recode

Former Google China president Kai-Fu Lee is betting heavily on artificial intelligence; his investment firm Sinovation Ventures has invested more than $600 million in computer vision, machine learning and other forms of automation. And he’s confident that soon this technology will dramatically change the job landscape.

“If we look at what AI cannot do, there are really two main things,” Lee said on the latest episode of Recode Decode, hosted by Kara Swisher. “One is creative jobs. Jobs like scientists, storytellers, artists and so on. And the other are the compassionate people who really have created a human-to-human connection, trust.”

And what about the jobs that require low creativity and compassion?

“All those jobs will be taken by AI,” he said.

Continue reading

Market Outlook Sees Treasury Yields Continuing To Trend Higher

The prospect of more interest-rate increases in the absence of rising inflation, based on the Federal Reserve’s latest forecast, strikes some as unnecessarily risky for the economy. But for good or ill, the central bank remains on track to lift rates further and the Treasury market (still) expects no less after the 25-basis-point increase from earlier in the week that pushed the Fed funds target rate to a 2.0%-2.25% range, the highest in more than a decade.

Continue reading

Macro Briefing: 28 September 2018

Senate committee may vote on Kavanaugh today: Politico

American Bar Assoc. recommends delaying Kavanaugh vote: CNN

Italy defies EU by raising deficit target: Bloomberg

Israeli PM describes secret Iranian nuclear site: Reuters

WTO cuts global trade forecast, warning trade war threatens growth: Bloomberg

Pending Homes Sales Index falls for eighth month: HousingWire

Fed Chairman Powell: US not facing high odds of recession in next 2 years: Reuters

Wholesale inventories revised down for July: CNBC

KC Fed Mfg Index ticked lower in Sep, but still showing “solid” gain: KC Fed

Jobless claims in US rise more than expected: CNBC

US merchandise trade deficit widened to biggest gap in 6-months: Bloomberg

Revised Q2 US GDP growth: 4.2%, unchange from previous estimate: MW

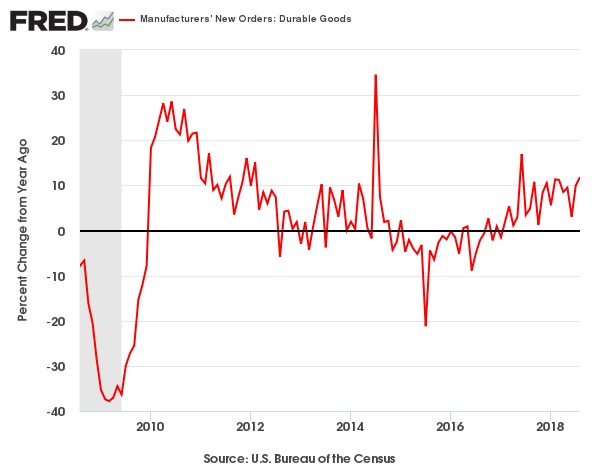

US durable goods orders accelerate to 11.8% y-o-y, highest in over a year:

Mideast, US Still Lead Regional Equity Markets Returns This Year

Stock markets in the Middle East and Gulf are holding on to a small performance edge over the US equity market so far in 2018, based on a set of exchange-traded funds.

Continue reading

Macro Briefing: 27 September 2018

Federal Reserve raises interest rates for 3rd time in 2018: CNN

Trump criticizes Fed’s rate hike: CNBC

Fed estimates of US GDP growth for 2018 and 2019 tick higher: Fed

Fed chief sees more rate hikes ahead thanks to strong economy: Bloomberg

Kavanaugh hearing set for today amid doubts and new allegations: The Hill

Reports of higher spending plans by Italy’s gov’t weigh on euro: CNBC

Ford’s CEO says Trump’s China tariffs will cost company $1 billion: USA Today

MSCI considers raising weight for Chinese stocks in global benchmarks: Reuters

New US home sales up 12.7% in August vs. year-earlier level: MarketWatch

Fed Set To Hike Rates Today As Inflation Expectations Rebound

The Federal Reserve is on track to lift interest rates at today’s policy announcement scheduled for 2:00 pm Eastern, according to Econoday.com’s consensus forecast. The projected hike coincides with rising inflation expectations in recent weeks, based on the yield spread for nominal less inflation-indexed Treasuries.

Continue reading