US jobless claims edged higher last week but remain at a middling level compared with the range over the past two years. This leading indicator continues to reflect a relatively upbeat outlook for the labor market. “After some noise earlier in the summer, initial jobless claims have settled into a tight range over the last several weeks,” says Nancy Vanden Houten, lead US economist at Oxford Economics. On a longer-term basis, claims layoffs remain near historically low levels.

Author Archives: James Picerno

10-Year US Treasury Yield ‘Fair Value’ Estimate: 12 September 2024

The premium for the US 10-year Treasury yield continued to fall in August relative to the “fair value” estimate based on a model developed by CapitalSpectator.com. The market rate remains moderately above the model’s estimate, but as expected in previous months (see the analysis from March, for instance) the unusually high premium is finally starting to normalize.

Macro Briefing: 12 September 2024

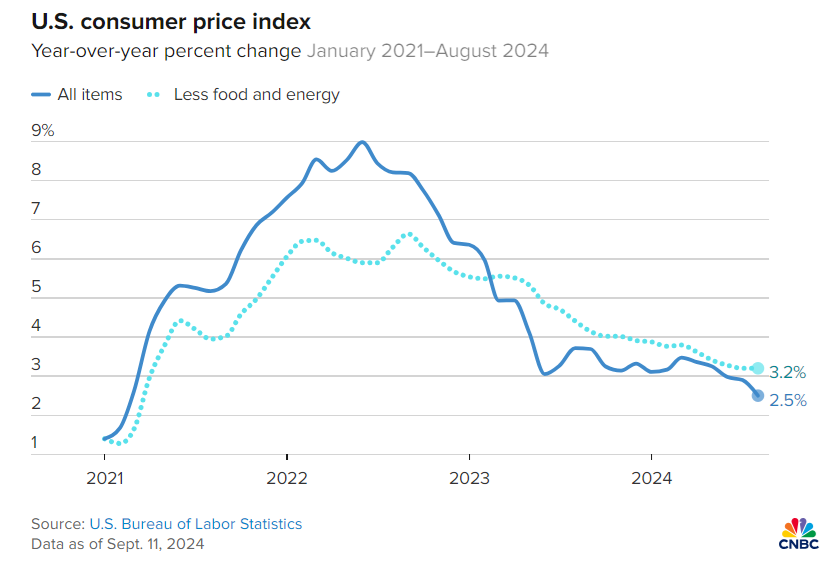

US consumer price inflation at the headline level eased to a 2.5% year-over-year pace in August, the slowest in 3-1/2 years. Core CPI, however, remained sticky at 3.2%, unchanged from the previous month. “This isn’t the CPI report the market wanted to see. With core inflation coming in higher than expected, the Fed’s path to a 50 basis point cut has become more complicated,” says Seema Shah, chief global strategist at Principal Asset Management. Sarah House, senior economist at Wells Fargo, advises: “Inflation continues to decelerate on tend, but we’re seeing it take longer for some of the impact of the pandemic to fully unwind.”

Utilities Stocks Are Now Top-Performing US Equity Sector In 2024

Market sentiment has recently shifted to prioritize defensive equity sectors. The attitude adjustment has lifted utilities shares, which are now outperforming the rest of the field as the top-performer, based on a set of sector ETFs through Tuesday’s close (Sep. 10).

Macro Briefing: 11 September 2024

US household income rebounded in 2023, posting the first annual increase since the pandemic, according to new data published by the Census Bureau. Inflation-adjusted median household income rose 4% to $80,610 in 2023 vs. $77,540 in the 2022. Despite the statistical improvement, “For many households, they still don’t feel it,” says Beth Ann Bovino, chief economist at US Bank, in a reference to the lingering effects of inflation that spiked in 2022 but has been sliding ever since. While income rose in 2023, so did the poverty rate, which increased for a second year after pandemic aid provided by the government expired. The share of Americans living in poverty (defined by the Census Bureau) rose to 12.9% last year, up from 12.4 percent in 2022.

US Core Consumer Inflation Trend Set To Hold Steady In August

Tomorrow’s update on US consumer inflation for August isn’t expected to derail expectations that the Federal Reserve will cut interest rates next week, but the disinflation trend of late looks set to stall. The estimate is based on CapitalSpectator.com’s ensemble model for the year-over-year change in core CPI.

Macro Briefing: 10 September 2024

The threat of a US government shutdown on Sep. 30 is in focus after House Republicans unveiled a spending plan that’s expected to be a non-starter with Democrats. Even if the GOP bill passes the House, it will likely fail in the Democratic-led Senate. The odds of that the House will approve the legislation, however, are looking shaky.

Consumer inflation expectations are “largely stable” in August, reports the New York Federal Reserve. The median one-year ahead inflation outlook is unchanged at 3.0%, according to the latest survey by the regional Fed bank.

US Stocks Continue To Top Global Markets In 2024

American shares suffered their deepest weekly decline in more than a year last week, but the setback wasn’t enough to dethrone US stocks as the world’s top-performing asset class in 2024. Based on a set of ETFs tracks the major asset classes through Friday’s close (Sep. 6), US equities are still leading the field by a wide margin.

Macro Briefing: 9 September 2024

US payrolls rebounded in August, but the 142,000 increase in new jobs was less than forecast. “The labor market is cooling at a measured pace,” notes Jeffrey Roach, chief economist at LPL Financial. “Businesses are still adding to payrolls but not as indiscriminately. The Fed will likely cut by 25 basis points and reserve the right to be more aggressive in the last two meetings of the year.” The unemployment rate dipped to 4.2% from 4.3% previously. Although that’s modest relative to the history, the recent increase has triggered recession warnings, according to some analysts. “The increased unemployment rate is in a range where we have historically been in recessions,” says economist Claudia Sahm. “But that’s a history, that’s a past. We’re not in a recession right now, but we do have a weakening labor market.”

Book Bits: 7 September 2024

● The Greatest of All Plagues: How Economic Inequality Shaped Political Thought from Plato to Marx

● The Greatest of All Plagues: How Economic Inequality Shaped Political Thought from Plato to Marx

David Lay Williams

Summary via publisher (Princeton U. Press)

Economic inequality is one of the most daunting challenges of our time, with public debate often turning to questions of whether it is an inevitable outcome of economic systems and what, if anything, can be done about it. But why, exactly, should inequality worry us? The Greatest of All Plagues demonstrates that this underlying question has been a central preoccupation of some of the most eminent political thinkers of the Western intellectual tradition.