Today’s updates on US economic activity—housing starts and jobless claims–offer a fresh round of encouragement for expecting moderate growth in the near term. The numbers are a net positive for monetary hawks who argue that the Federal Reserve should announce a rate hike today. The counterpoint is that economic growth has been sluggish lately, raising concerns that it’s still too early to start tightening policy. Nonetheless, the data du jour provide some support for the view that the US economy is still on a path of moderate growth.

Continue reading

Author Archives: James Picerno

Rationalizing The Case For A Rate Hike With Models

The Federal Reserve may or may not raise interest rates today—the mystery will be solved when today’s policy announcement hits the streets at 2:00 pm eastern. Meanwhile, what’s the case for squeezing liquidity, if only slightly? US economic growth, after all, has been sluggish lately, which inspires Goldman Sachs CEO Lloyd Blankfein (among others) to recommend that the central bank delay the first hike in over a decade. The economic data “is not compelling to raise interest rates right now,” he says. An open-and-shut case? Not quite, which explains the recent obsession with analyzing/forecasting the Fed’s decision that’s finally upon us. So, how might the monetary mavens rationalize raising rates today? By focusing on the specific data points that support a hike. Although Blankfein suggests otherwise, there are some indicators that suggest that tighter policy is appropriate. To be precise, certain models are a hawk’s best friend for arguing that it’s time to pull the trigger.

Continue reading

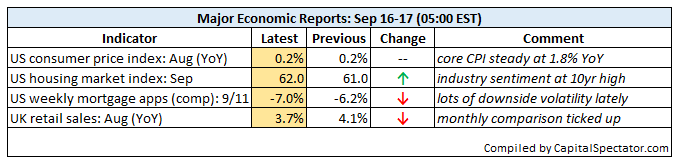

Initial Guidance | 17 September 2015

● Key issues to monitor for today’s Fed announcement | LA Times

● Goldman Sachs chief says data doesn’t support Fed rate hike | Telegraph

● Weaker export growth for Japan in August | MarketWatch

● No change in interest rates for Swiss central bank | Reuters

A Rate Hike Amid Modest Growth Expectations?

The Atlanta’s Fed’s GDPNow model raised its outlook for US economic growth in the third quarter to 1.5% in yesterday’s update (Sep 15). That’s still a sluggish pace, but it beats a kick in the head. Alas, it still falls short of a clear signal for raising interest rates, which is potentially on the agenda at the Fed’s policy meeting, which concludes with tomorrow’s statement and press conference.

Continue reading

US Housing Starts: August 2015 Preview

Housing starts are expected to slide lower to 1.179 million units (seasonally adjusted annual rate) in tomorrow’s update for August, according to The Capital Spectator’s average point forecast for several econometric estimates. The projection represents a modest decline from the previous month’s level of residential construction activity.

Continue reading

US 2-Year Treasury Yield Rises To New 4-Year High

The Treasury market’s 2-year yield yesterday (Sep. 15) broke the ceiling, rising nine basis points to a new four-year high of 0.82%, based on Treasury.gov’s daily data. After repeatedly testing but never breaking above the low-0.70% range this year, this key yield—reportedly the most sensitive spot on the curve for rate expectations—pushed above the old barrier on Tuesday. The timing of the increase–ahead of tomorrow’s policy announcement from the Federal Reserve–looks like a decisive bet that the central bank will begin raising rates when it issues a public statement on Thursday.

Continue reading

Initial Guidance | 16 September 2015

Softer Growth In Retail Sales & Weak Industrial Activity In US Raise Concerns For Macro Risk Outlook

US retail sales ticked higher in August, rising 0.2%–below several consensus forecasts but still a decent if unimpressive gain. Industrial output in the US in August, on the other hand, was clearly disappointing, suffering a 0.4% slide vs. the previous month—the weakest performance in three months. On a year-over-year basis, industrial activity also weakened, with growth dipping close to its lowest pace since the US recession ended in 2009. Does this add up to a clear signal that a new recession for the US is now fate? Some are tempted to make that call, but I’m not there yet, as I’ll explain.

Continue reading

Rising Global Recession Fears

Last week’s forecast of “rapidly rising risk” of a global recession from Citigroup’s chief global economist, William Buiter, is attracting attention, which isn’t surprising at a time of stumbling financial and commodity markets. “The most likely scenario (40% probability), in our view, for the next few years is that global real GDP growth at market exchange rates will decline steadily from here on and reach or fall below 2% around the middle of 2016,” he wrote. “Growth is likely to bottom out in 2017 and start recovering again from late 2017 or early 2018.”

Continue reading