* Fed official says central bank can’t risk being late with rate cuts

* Japan’s GDP rises more than expected in Q2

* China industrial growth slows to four-month low in July

* Cisco will cut 7% of its global workforce

* US headline consumer inflation dips under 3% for first time since 2021:

Author Archives: James Picerno

Africa Stocks May Be Close To Overtaking US Equities In 2024

Betting against the US stock market has been a losing trade in relative terms in recent years and from a top-down down perspective it’s not obvious that’s about to change. But carving up the global market into regional slices highlights a rally in Africa stocks that may be set to give US shares a run for their money, based on a set of ETFs.

Macro Briefing: 14 August 2024

* US regulator considers breaking up Google

* The unraveling of “carry trades” isn’t over, strategists predict

* US consumers fell behind on debt payments as pandemic-era wealth fades

* World’s largest sovereign wealth fund reports robust 1H tech-driven profits

* Home Depot downgrades earnings outlook as consumers turn cautious

* US wholesale inflation’s monthly changed ticked lower in July:

Slower Growth Expected For US Q3 GDP Report

Early assessments of third-quarter economic activity for the US point to slowdown vs. Q2, based on the median nowcast for a estimates compiled by CapitalSpectator.com. The downshift is prominent, but the estimate still points to low recession risk.

Macro Briefing: 13 August 2024

* Iran retaliation against Israel could come this week, says White House

* Majority of Americans wrongly think US is in recession

* Investor demand for bonds rebounds as recession fear rises

* Fund managers raise cash holdings in August, BofA survey reports

* German economic sentiment falls sharply in August

* Big Tech’s electricity use higher than some demand in some countries

* GM cuts staff in China as it rethinks its strategy for the country

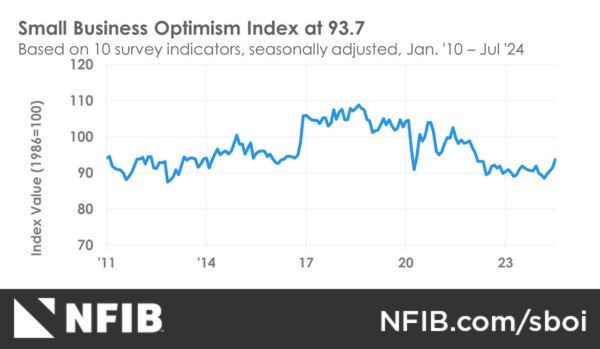

* Small business optimism rises for fourth straight month in July:

Despite Recent Market Volatility, Most Markets Are Still Up In 2024

It’s been a rough ride in recent weeks, but trend data still leaves room for debate on the prospects for maintaining bullish bets. Using a set of ETFs shows that most of the major asset classes in 2024 through Friday’s close (Aug. 9) are posting gains.

Macro Briefing: 12 August 2024

* US sends more forces to Middle East, reacting to “escalating regional tensions”

* Is the recent surge of market volatility over? Not yet, predict analysts

* Increasingly price-sensitive consumers will help lower inflation rate

* Nouriel Roubini–“Dr. Doom”–doesn’t expect a hard landing for US anytime soon

* US inflation likely held stead in July, RBC predicts

* Despite market volatility, US large caps (SPY) still lead small caps (IJR) this year:

Book Bits: 10 August 2024

● Making Sense of Chaos: A Better Economics for a Better World

● Making Sense of Chaos: A Better Economics for a Better World

J. Doyne Farmer

Summary via publisher (Yale U. Press)

We live in an age of increasing complexity—an era of accelerating technology and global interconnection that holds more promise, and more peril, than any other time in human history. The fossil fuels that have powered global wealth creation now threaten to destroy the world they helped build. Automation and digitization promise prosperity for some, unemployment for others. Financial crises fuel growing inequality, polarization, and the retreat of democracy. At heart, all these problems are rooted in the economy, yet the guidance provided by economic models has often failed. Using big data and ever more powerful computers, we are now able for the first time to apply complex systems science to economic activity, building realistic models of the global economy. The resulting simulations and the emergent behavior we observe form the cornerstone of the science of complexity economics, allowing us to test ideas and make significantly better economic predictions—to better address the hard problems facing the world.

Research Review | 9 August 2024 | Crisis Risk

The CNN Fear and Greed Index as a Predictor of Us Equity Index Returns

Hugh Farrell and Fergal A. O’Connor (University College Cork)

July 2024

We assess whether the CNN “Fear and Greed” Index can be used to predict returns on equity indices and gold using hand-collected data. We find that the Fear and Greed Index Granger causes returns on the S&P 500, Nasdaq Composite and Russell 3000 in the first sample period (2011-2020), but not gold returns. Analysis from 2021–2024 indicates the Fear and Greed index Granger causes S&P 500 and Russell 3000 returns, but the relationship is weaker. No significant relationship is found between the VIX and stock indices, indicating that the Fear and Greed Index is a better predictor of equity returns.

Macro Briefing: 9 August 2024

* JP Morgan lifts US recession odds to moderate 35% for this year

* US mortgage rates fall to lowest level in over a year

* US government will offer loan to S. Korean firm build solar plant in Georgia

* China inflation picks up, but remains low–just 0.5% vs. year-ago level

* US jobless claims fall more than expected, offering upbeat labor market news: